John Armitage, salah satu pendiri Egerton Capital, adalah veteran di dunia hedge fund Eropa yang dikenal dengan strategi Fundamental Bottom-Up. Armitage tidak sekadar mengikuti tren pasar, ia fokus membedah fundamental perusahaan untuk menemukan bisnis dengan pertumbuhan arus kas yang kuat dan valuasi yang masuk akal.

Dalam laporan terbarunya, terlihat jelas bahwa Armitage sedang menaruh keyakinan besar pada ketahanan raksasa teknologi dan sektor pembayaran digital.

Microsoft (MSFT) dan Amazon (AMZN) menjadi dua pilar utama portofolionya, diikuti oleh Visa (V), yang menandakan strateginya mengamankan aset di perusahaan-perusahaan "penguasa pasar" dengan moat (keunggulan kompetitif) yang lebar.

Data Snapshot

- Portfolio Value (Valuasi Portofolio): ~$9.48 Billion (Estimasi Total Aset yang Dilaporkan)

- Top 5 Assets (Aset Terbanyak):

- Microsoft Corp (MSFT) — 9.89%

- Amazon.com Inc (AMZN) — 9.39%

- Visa Inc (V) — 8.58%

- Progressive Corp (PGR) — 6.74%

- Ferguson Enterprises Inc (FERG) — 6.16%

- Top Sector (Sektor Dominan): Technology & Financial Services

Portofolio

Data diupdate pada 10 Desember 2025, diambil dari Valuesider

| Ticker | Stock | % of Portfolio | Shares* | Reported Price* | % difference Current Price | Value |

|---|---|---|---|---|---|---|

| AMZN | AMAZONCOM INC | 9.39% | 4,053,249 | $219.57 | 🟢 4.48% $229.41 | $889,971,883 |

| APH | AMPHENOL CORP-CL A | 4.99% | 3,823,422 | $123.75 | 🟢 12.21% $138.86 | $473,148,473 |

| ARMK | ARAMARK | 1.30% | 3,204,201 | $38.40 | 🔴 1.85% $37.69 | $123,041,318 |

| ACGL | ARCH CAPITAL GROUP LTD | 3.36% | 3,507,882 | $90.73 | 🟢 3.13% $93.57 | $318,270,134 |

| BSX | BOSTON SCIENTIFIC CORP | 5.47% | 5,312,504 | $97.63 | 🔴 6.00% $91.77 | $518,659,766 |

| CP | CANADIAN PACIFIC KANSAS CITY | 1.59% | 2,026,311 | $74.49 | - | $150,939,906 |

| COF | CAPITAL ONE FINANCIAL CORP | 4.66% | 2,077,839 | $212.58 | 🟢 12.67% $239.51 | $441,707,015 |

| CRS | CARPENTER TECHNOLOGY | 3.56% | 1,374,333 | $245.54 | 🟢 30.41% $320.22 | $337,453,725 |

| CME | CME GROUP INC | 3.38% | 1,184,788 | $270.19 | 🟢 0.64% $271.91 | $320,117,870 |

| CRH | CRH PLC | 5.39% | 4,260,846 | $119.90 | 🟢 5.81% $126.87 | $510,875,435 |

| ERJ | EMBRAER SA-SPON ADR | 1.35% | 2,117,012 | $60.45 | - | $127,973,375 |

| FERG | FERGUSON ENTERPRISES INC | 6.16% | 2,600,224 | $224.58 | - | $583,958,306 |

| FCNCA | FIRST CITIZENS BCSHS -CL A | 0.89% | 47,384 | $1,789.16 | 🟢 16.51% $2,084.56 | $84,777,557 |

| FLUT | FLUTTER ENTERTAINMENT PLC-DI | 3.78% | 1,412,018 | $254.00 | 🔴 13.50% $219.72 | $358,652,572 |

| IBKR | INTERACTIVE BROKERS GRO-CL A | 4.54% | 6,254,134 | $68.81 | 🔴 3.94% $66.10 | $430,346,961 |

| ICE | INTERCONTINENTAL EXCHANGE IN | 1.84% | 1,036,199 | $168.48 | - | $174,578,808 |

| LAMR | LAMAR ADVERTISING CO-A NEW | 0.93% | 723,857 | $122.42 | - | $88,614,574 |

| MA | MASTERCARD INC - A | 2.76% | 460,155 | $568.81 | 🔴 0.94% $563.46 | $261,740,766 |

| META | META PLATFORMS INC-CLASS A | 4.19% | 541,167 | $734.38 | 🔴 11.35% $651.00 | $397,422,221 |

| MSFT | MICROSOFT CORP | 9.89% | 1,810,788 | $517.95 | 🔴 6.66% $483.47 | $937,897,645 |

| PGR | PROGRESSIVE CORP | 6.74% | 2,588,638 | $246.95 | 🔴 6.87% $229.99 | $639,264,154 |

| STX | SEAGATE TECHNOLOGY HOLDINGS | 3.97% | 1,592,983 | $236.06 | - | $376,039,567 |

| TRU | TRANSUNION | 1.29% | 1,465,050 | $83.78 | 🟢 2.47% $85.85 | $122,741,889 |

| V | VISA INC-CLASS A SHARES | 8.58% | 2,383,373 | $341.38 | 🟢 1.36% $346.02 | $813,635,875 |

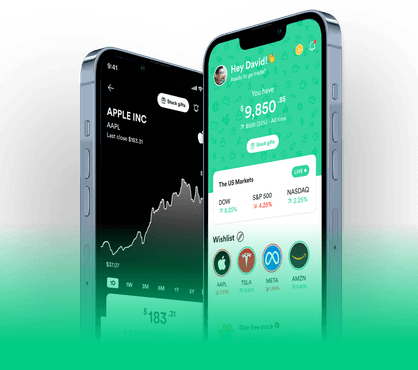

Sekarang giliran kamu! Beli saham-saham pilihan The Insider ini langsung dari HP kamu hanya di Gotrade!

Data diupdate pada 10 Desember 2025, diambil dari Valuesider