Gotrade News - Visa is scheduled to release its financial report this Thursday (Jan 29) after the market closes. This is a crucial moment for investors to watch, especially as the stock price is currently seeing a notable correction.

This report serves as a key test for the payments giant to prove its business resilience. Market expectations remain high, even though the short-term price trend looks a bit bearish.

Key Takeaways:

-

Revenue is projected to hit double-digit growth, reaching approximately $10.7 billion.

-

Visa’s stock is down 8.3% over the last month despite solid fundamentals.

-

Analyst price targets sit at $398, suggesting significant upside potential.

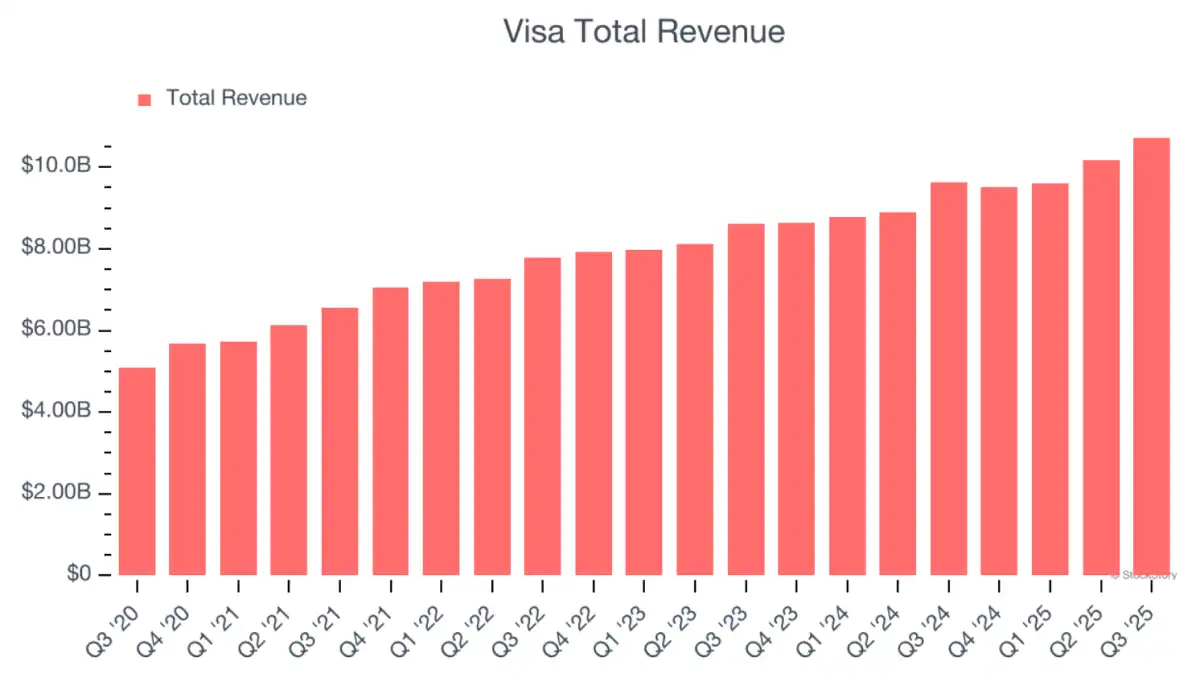

Wall Street predicts Visa’s revenue will land at $10.69 billion for the quarter. That figure represents a solid 12.4% growth compared to the same period last year.

Earnings per share (EPS) are also projected to see positive momentum. Analysts are forecasting a 14.2% jump to $3.14 per share.

According to Zacks data, the consensus EPS estimate has remained steady over the last 30 days. This indicates that analysts are standing firm on their confidence in the company’s operational performance heading into the print.

However, Visa's price action shows an interesting anomaly for investors. The stock has slipped 8.3% in the past month, while its competitors have mostly traded flat.

Earnings reports from the broader consumer finance sector offer mixed signals for comparison. Synchrony Financial missed estimates, while Capital One managed to top revenue expectations.

Investors are now waiting for confirmation on total payment volume, which is predicted to reach $3.8 trillion. International transaction volume is also expected to climb by 11.8% year-over-year.

Based on a report from Stock Story, Visa rarely misses Wall Street revenue estimates. The company has beaten top-line expectations by an average of 1.3% over the last two years.

The average analyst price target currently stands at $398.01. This offers a compelling upside potential compared to the current market price hovering around $325.

The current dip could be an interesting entry point before the earnings numbers hit. Grab Visa shares starting from just $1 on Gotrade.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

Stock Story, Visa (V) Q4 Earnings Report Preview: What To Look For. Accessed on January 28, 2026

-

Zacks, Ahead of Visa (V) Q1 Earnings: Get Ready With Wall Street Estimates for Key Metrics. Accessed on January 28, 2026

-

Featured Image: Shutterstock