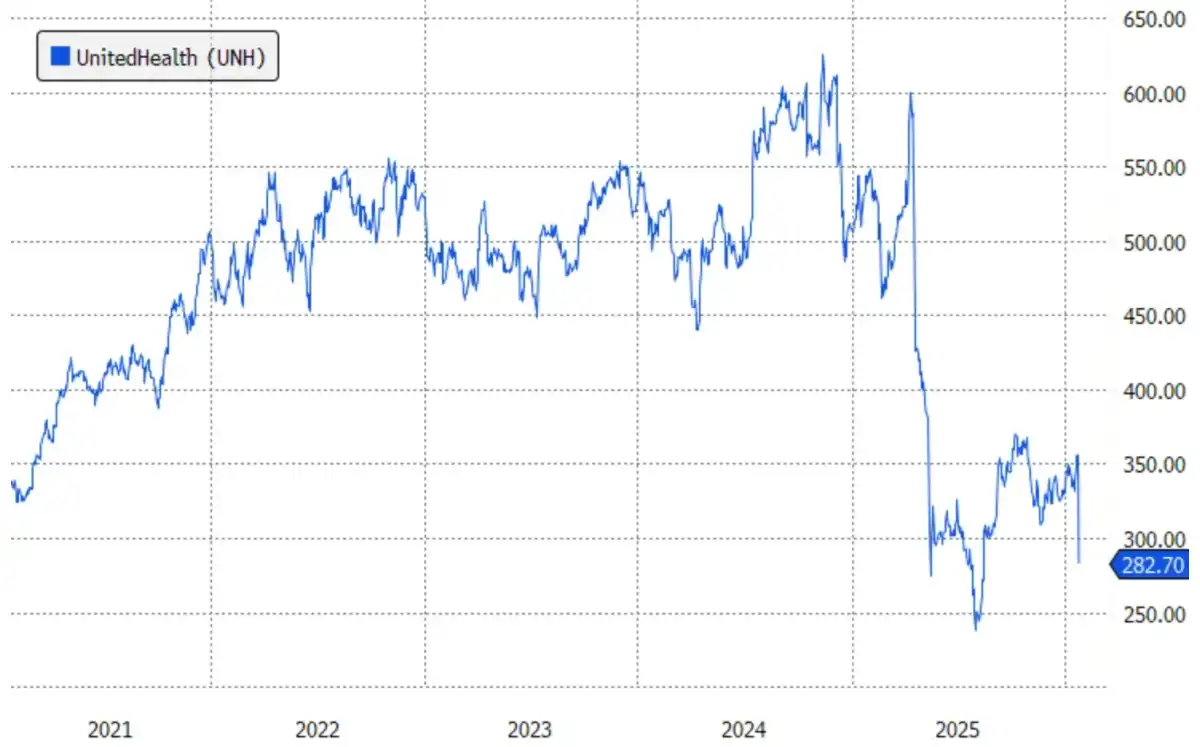

Gotrade News - UnitedHealth shares took a massive dive, plummeting nearly 20 percent on Tuesday (Jan 27). This sharp selloff was triggered by a double whammy: tighter Medicare Advantage regulations and a disappointing outlook that caught investors off guard.

This is a wake-up call for the market, as the insurance giant is now projecting an annual revenue decline for the first time in decades. The negative sentiment didn't stop there—it quickly spilled over to other insurers and broader healthcare ETFs.

Key Takeaways:

-

UnitedHealth forecasts a revenue drop in 2026, its first since 1989.

-

Stagnant Medicare Advantage payment rates are squeezing profitability for major insurers.

-

The volatility dragged down peers like Humana and CVS Health, shaking the sector.

While the quarterly earnings report showed a decent $2.11 per share—matching expectations—the real shocker came from the forward guidance. Management expects 2026 revenue to dip about 2 percent to $439 billion.

They’re calling this a "planned right-sizing" to streamline operations for the long haul. But if this plays out, it marks UnitedHealth’s first annual revenue contraction since 1989.

The core issue fueling this selloff is Medicare Advantage, the private alternative to the government's health program. Regulators just proposed keeping payment rates flat for next year, missing Wall Street’s hopes for a hike by a mile.

Insurers have long relied on these rate increases to juice their profits. Now, UnitedHealth expects its Medicare Advantage membership to shrink by up to 1.4 million people in 2026.

The fallout was immediate for competitors in the same boat. Humana crashed over 20 percent, while CVS Health and Cigna also saw their stocks take a beating.

This pressure hit healthcare ETFs hard, especially those heavy on insurers. The iShares U.S. Healthcare Providers ETF (IHF) tumbled roughly 10 percent, dragged down by its exposure to these big names.

However, the broader sector showed some resilience. The Health Care Select Sector SPDR Fund (XLV) only slipped 1.7 percent, thanks to its diversified mix of pharma and medical device companies cushioning the blow.

Even big players like Berkshire Hathaway are feeling the heat, forcing a rethink of their positions. A stock once seen as a safe "compounder" is now facing the harsh reality of slower growth and tighter rules.

For investors, this underscores why putting all your eggs in one basket is risky. Betting on a single insurer right now is a lot more volatile than holding a diversified slice of the healthcare sector.

Don’t let one insurer’s drop wreck your portfolio. Get instant diversification and shield yourself from single-stock risk with the Health Care Select Sector SPDR Fund (XLV), covering stable pharma and medical giants. Secure your position in the healthcare sector today.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

etf, UnitedHealth Rout Sends Shockwaves Through Health Care ETFs. Accessed on January 28, 2026

-

Featured Image: Shutterstock