Jakarta, Gotrade News - Global crude oil prices just posted their first drop in six days after US President Donald Trump signaled a delay in military action against Iran.

This correction is a crucial moment for you to reassess the energy market's direction, especially after oil prices rallied by 11 percent over the past week.

Key Takeaways

-

Brent crude dropped 3.4 percent, trading below US$65 per barrel.

-

The pause on US military action against Iran triggered the sell-off.

-

A sharp rise in US crude inventories is adding extra pressure on prices.

Brent crude took a dive, falling as much as 3.4 percent to trade under the US$65 mark, while West Texas Intermediate (WTI) hovered around US$60. This drop happened right after Trump mentioned he’d received assurances that Iran would stop the violence against protesters, dialing down the urgency for an immediate US military response.

This news eased market fears regarding disruptions to Iranian production or key shipping lanes in the region. However, the situation on the ground remains pretty fluid and high-risk.

Geopolitics Still in the Driver’s Seat

Aviation authorities temporarily closed the airspace around Tehran, and the US has reportedly redeployed personnel to Qatar and other bases in the area. This signals that while the strike is on hold, military readiness is still on high alert.

According to Robert Rennie, head of commodity research at Westpac Banking Corp, Brent’s strength—fueled by geopolitical tension—is likely to continue for now. He predicts prices could test the US$75 level if tensions flare up again, but also warned of a potential price collapse once the "all-clear" is sounded.

Beyond Iran, the market is also keeping an eye on communications between Trump and Venezuelan Vice President Delcy Rodriguez regarding oil topics. In an interview with Thomson Reuters Corporation, Trump mentioned it would be better for Venezuela to stay in OPEC, though no official discussions with Caracas have taken place yet.

US Stockpiles Are Piling Up

Aside from war talk, fundamental data is showing a supply buildup. US government data showed nationwide crude stockpiles rose by 3.4 million barrels last week—the biggest jump since early November.

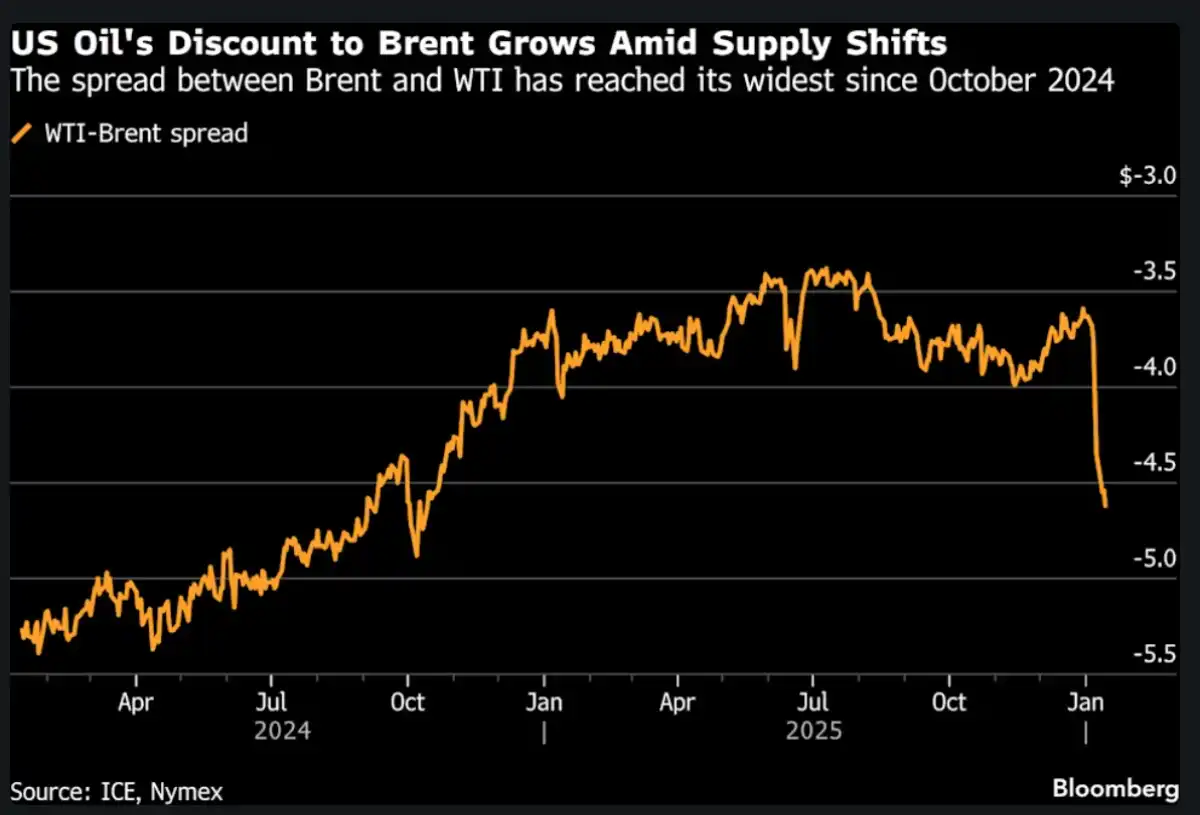

The combo of rising inventories, more Venezuelan oil flowing to the US, and disruptions at a Black Sea terminal has pushed WTI prices down significantly compared to Brent.

The WTI discount relative to Brent is now approaching its widest level in 15 months, as seen in the chart above. For investors, this widening spread is a key indicator to watch when analyzing US domestic supply dynamics versus the global market.

Reference:

-

Bloomberg, Oil Falls After Trump Signals US Response to Iran Is On Hold. Diakses pada 15 Januari 2026

-

Featured Image: Shutterstock