Gotrade News - Palantir Technologies is slated to drop its Q4 2025 earnings report this Monday (02/02) after the closing bell. This moment serves as a critical gut check for investors: can the company’s AI demand actually justify its premium valuation?

Expectations are sky-high, even as economic uncertainty clouds the software sector's start to the year. You need to pay attention to this print because Palantir’s price action often acts as a sentiment bellwether for the broader AI trade.

Key Takeaways:

-

Analyst consensus projects revenue growth could rocket over 60% year-over-year (YoY).

-

The options market is pricing in a potential swing of up to 9% post-earnings.

-

Despite strong fundamentals, "nosebleed" valuations have analysts split between "buy" and "hold" ratings.

Revenue Surge vs. Market Expectations

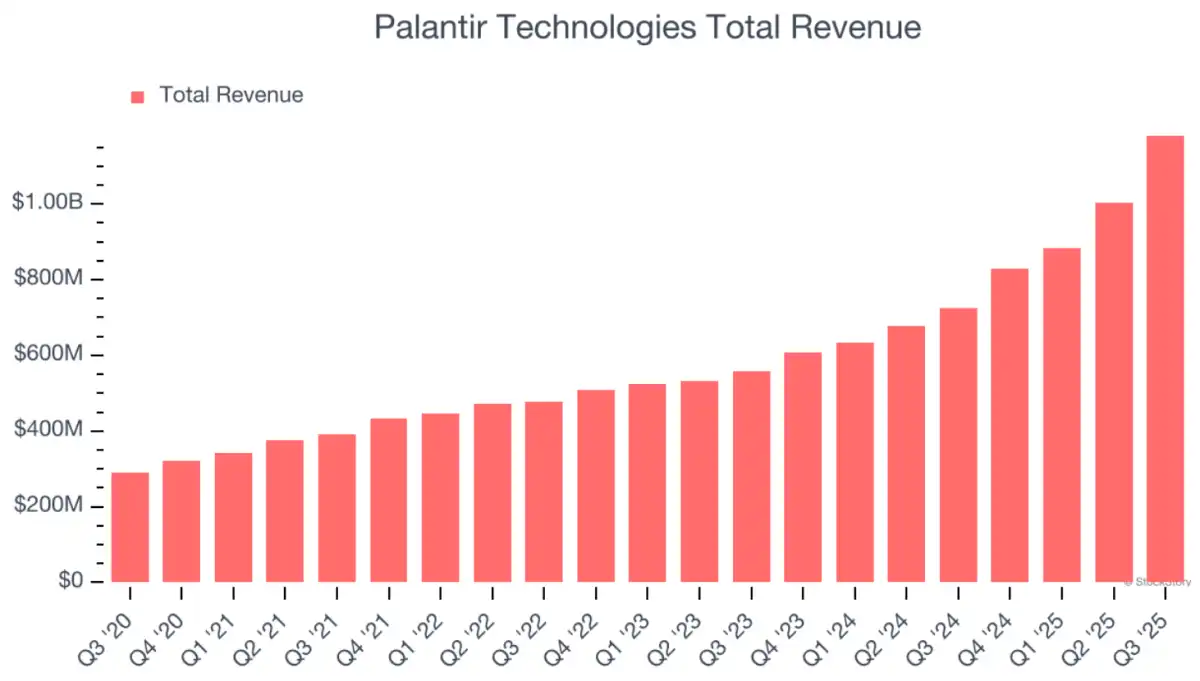

According to data compiled by Zacks, Palantir is expected to post revenue of $1.4 billion this quarter, a massive 62.8% jump from last year. This growth is being powered by the Commercial segment—predicted to soar 73.5%—and the Government arm, growing 55.4% thanks to the rapid adoption of their AI platforms.

A report from StockStory notes a slightly more conservative revenue estimate of $1.34 billion, with adjusted earnings per share (EPS) of $0.23. Palantir has a solid track record of crushing Wall Street’s expectations, averaging a revenue surprise of 4.4% over the last two years.

The analytics platform also notes that investors should be on high alert for short-term price volatility. According to StockStory data, Palantir shares have slid about 12.3% in the last month leading up to this release.

Volatility Risks and Premium Valuation

A report from Indexbox highlights that the options market is pricing in a move of at least 9% in either direction by the end of the week. If sentiment turns bullish, the stock could claw its way back near the $158 level, but the risk of a drop to $133 remains on the table if the report disappoints.

The main worry for investors right now isn’t business execution, but rather the stock’s valuation, which many deem too rich after 2025's massive rally. Indexbox notes that Palantir is trading nearly 30% below its November record highs as investors rotated into the hardware sector.

Analysis from Zacks indicates that their prediction model isn’t flashing a conclusive "earnings beat" signal for this quarter. The mix of a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00% suggests plenty of uncertainty heading into the official announcement.

On the flip side, comparisons with other tech giants remain relevant for gauging the long-term landscape. StockStory mentions that the market dominance principles once applied by Microsoft and Apple are now becoming visible in enterprise software firms leveraging Generative AI capabilities.

Despite the valuation debates, the average analyst price target for Palantir still sits at $189.84, per StockStory data. This figure suggests significant upside potential from current trading levels—if the company can prove its growth story has legs.

Ready to Own the Hottest AI Stock?

All eyes are locked on Palantir Earnings tonight, and the incoming volatility could be a prime opportunity for sharp investors.

Do you believe Palantir is about to smash records and beat market expectations again?

Don’t just watch the AI trend from the sidelines—make a real move for your portfolio now with super low commission fees.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

StockStory, Palantir Technologies (PLTR) Reports Earnings Tomorrow: What To Expect. Accessed on February 2, 2026

-

Zacks, Palantir Gears Up to Report Q4 Earnings: What's in the Offing?. Accessed on February 2, 2026

-

Indexbox, Palantir Stock Faces Volatile Week Following Q4 Earnings Report. Accessed on February 2, 2026

-

Featured Image: Shutterstock