Jakarta, Gotrade News - Oracle's stock price recently took a sharp hit, but Wall Street is actually predicting a massive rally next year. This situation is catching the eyes of investors looking for growth opportunities amidst the current tech market volatility.

Keytakeaways:

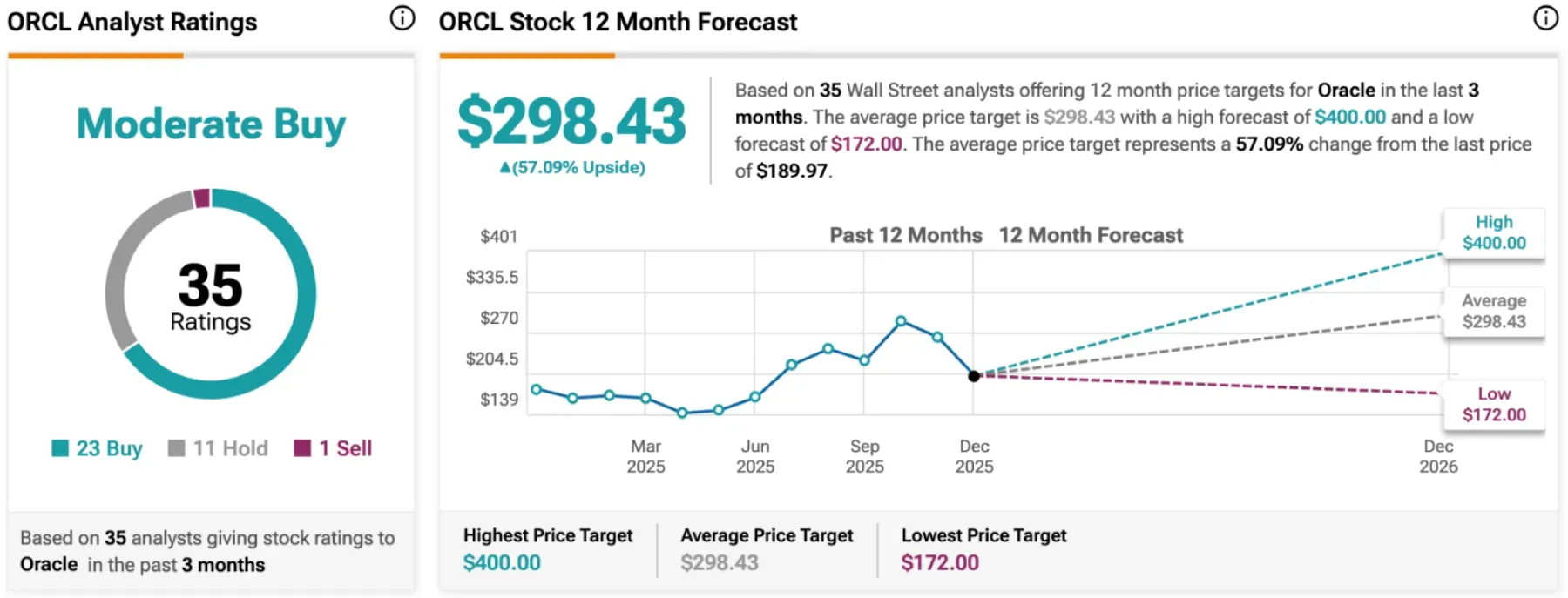

- Oracle stock price is predicted to rally up to 57% in the next 12 months.

- 23 out of 35 analysts recommend 'Buy' despite rising AI infrastructure costs.

- Oracle's long-term investment in AI is seen as more crucial than missing short-term revenue targets.

The price drop happened because the company's revenue guidance was weaker than what the market initially expected. As reported by Finbold, Oracle is now hiking its AI infrastructure budget up to $50 billion.

Wall Street's Optimism Despite the Drop

Most analysts are sticking to a 'Buy' rating despite the short-term pressure on the stock price right now. Data from TipRanks shows that 23 out of 35 analysts recommend a 'Buy' position for this stock.

- The average price target sits at $298.43.

- This figure signals a potential upside of 57.09% from the last closing price.

- The highest forecast even reaches the $400.00 level.

This bullish view is backed by a strong conviction that massive investments in AI will pay off. According to Siti Panigrahi from Mizuho, short-term revenue weakness doesn't derail Oracle's long-term growth prospects.

Cost Challenges and Future Strategy

However, investors still need to watch out for the operational cost burden that's spiking this fiscal year. Patrick Colville from Scotiabank notes that short-term profit growth might be limited due to that massive capital expenditure.

This situation creates a very interesting risk-reward dynamic to consider for your portfolio. You have to decide if Oracle's long-term vision is worth the price volatility happening right now.

Reference:

- Finbold, Wall Street predicts Oracle stock price for the next 12 months. Accessed on December 15, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.