Traders position ahead of next week’s Fed decision.

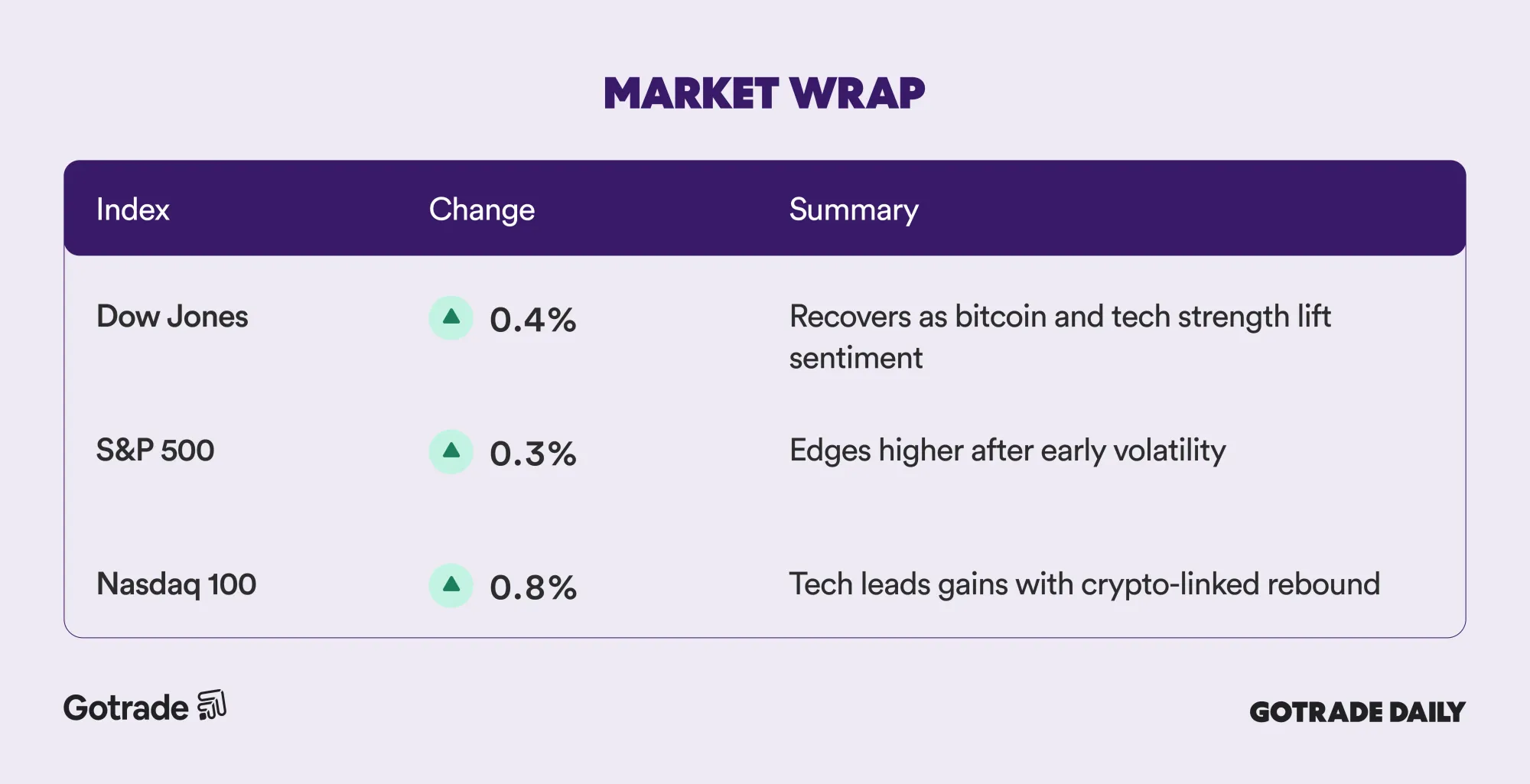

US stocks bounced back on Tuesday as a sharp rebound in bitcoin and renewed strength across mega-cap tech helped offset the turbulence seen at the start of the week. The Dow rose 0.4 percent, the S&P 500 added 0.3 percent, and the Nasdaq 100 gained 0.8 percent, with risk appetite improving after Monday’s selloff.

Bitcoin’s 7 percent rally back above 90,000 dollars lifted sentiment across crypto-linked names after its worst day since March. The recovery supported a broader shift toward growth and AI beneficiaries, reversing part of Monday’s risk-off move. Nvidia (NVDA) climbed nearly 1 percent, while Credo Technology (CRDO) surged 10 percent after delivering stronger-than-expected results.

Even so, volatility remains elevated. Investors are balancing concerns over sticky inflation, stretched tech valuations, and questions about whether the AI spending cycle can sustain current expectations. With all major indexes briefly turning negative intraday, the market continues to show signs of hesitation as traders reassess positioning into year end.

Looking ahead, the focus turns to next week’s Federal Reserve meeting, where markets are pricing in an 89 percent chance of a rate cut. Seasonal trends are also supportive: December has historically been one of the strongest months for the S&P 500, averaging gains of over 1 percent since 1950. Strategists argue that improving earnings expectations for Q4 and 2026 could help stabilize sentiment despite macro uncertainties.

📊 Market Wrap Dec 3rd 2025

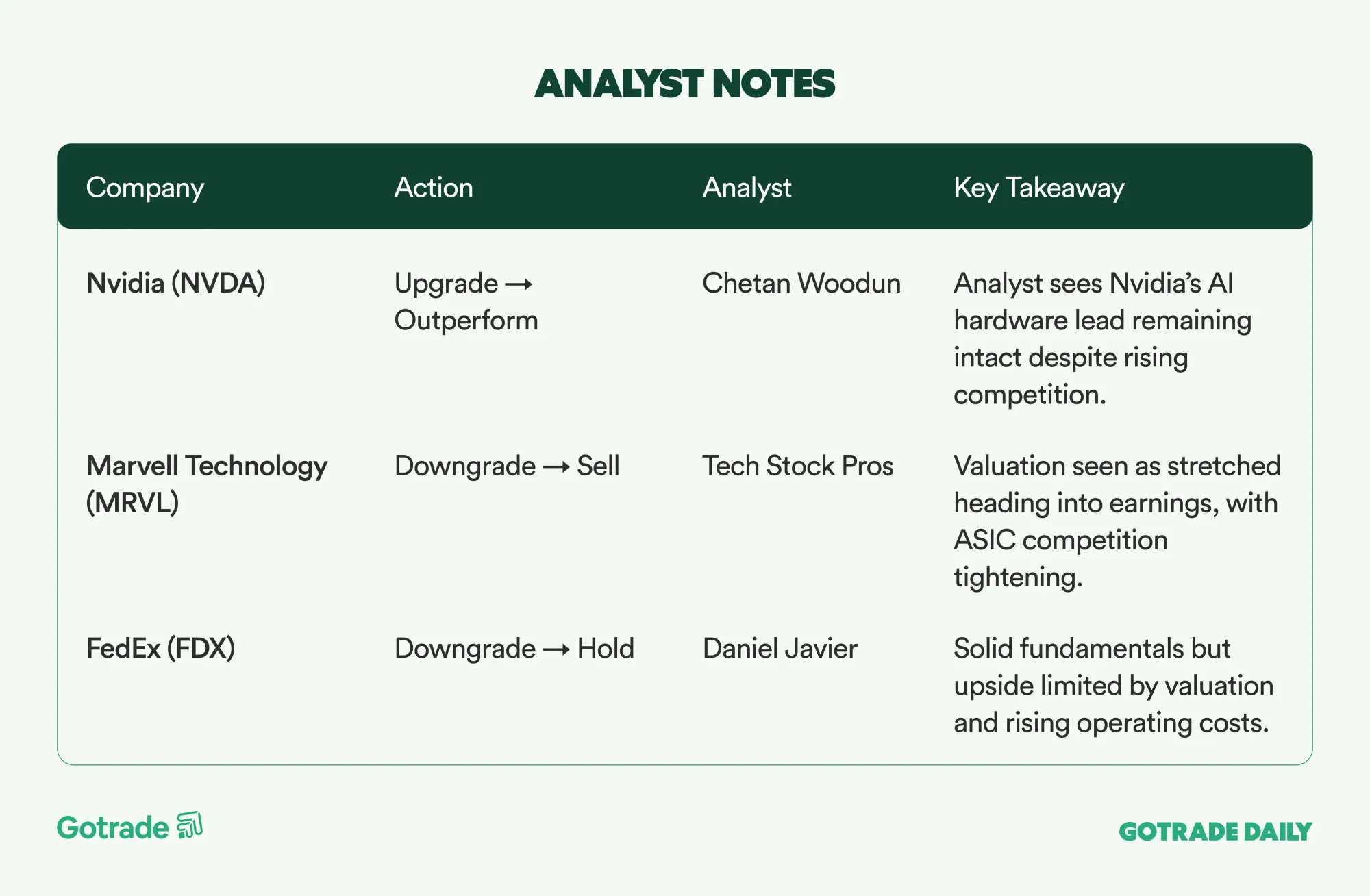

🧠 Analyst Notes

💬 Market Highlights

FedEx to lay off 856 workers in Texas facility

FedEx (FDX) will cut 856 employees at its supply chain and electronics hub in Dallas starting January 29, 2026, after a major client shifted most of its business to a new logistics provider. The company said affected workers were notified early and may be reassigned to nearby FedEx facilities. The move underscores how competitive pressures and client turnover are reshaping capacity and labor needs across the logistics industry.

Bank of America and ICBC face higher capital buffers under new G-SIB tiers

Bank of America (BAC) and Industrial and Commercial Bank of China moved up to bucket 3 in the global systemically important banks (G-SIB) framework, requiring them to hold larger capital buffers starting January 1, 2027. Deutsche Bank (DB) moved down to bucket 1, lowering its requirement, while JPMorgan (JPM) remains in bucket 4, the highest among the 29 global banks. Regulators signaled that increased systemic risk at BAC and ICBC warrants stronger loss-absorbing capacity.

Alibaba and ByteDance train AI models abroad to access Nvidia chips

Chinese tech giants Alibaba (BABA) and ByteDance are reportedly training AI models outside China, particularly in Southeast Asia, to bypass US restrictions on Nvidia’s (NVDA) advanced chips. China has also barred foreign AI chips from state-funded data centers, while President Trump is still evaluating whether Nvidia may sell H200 chips to the Chinese market. By renting overseas data centers from non-Chinese operators, firms can continue using Nvidia hardware despite export controls.

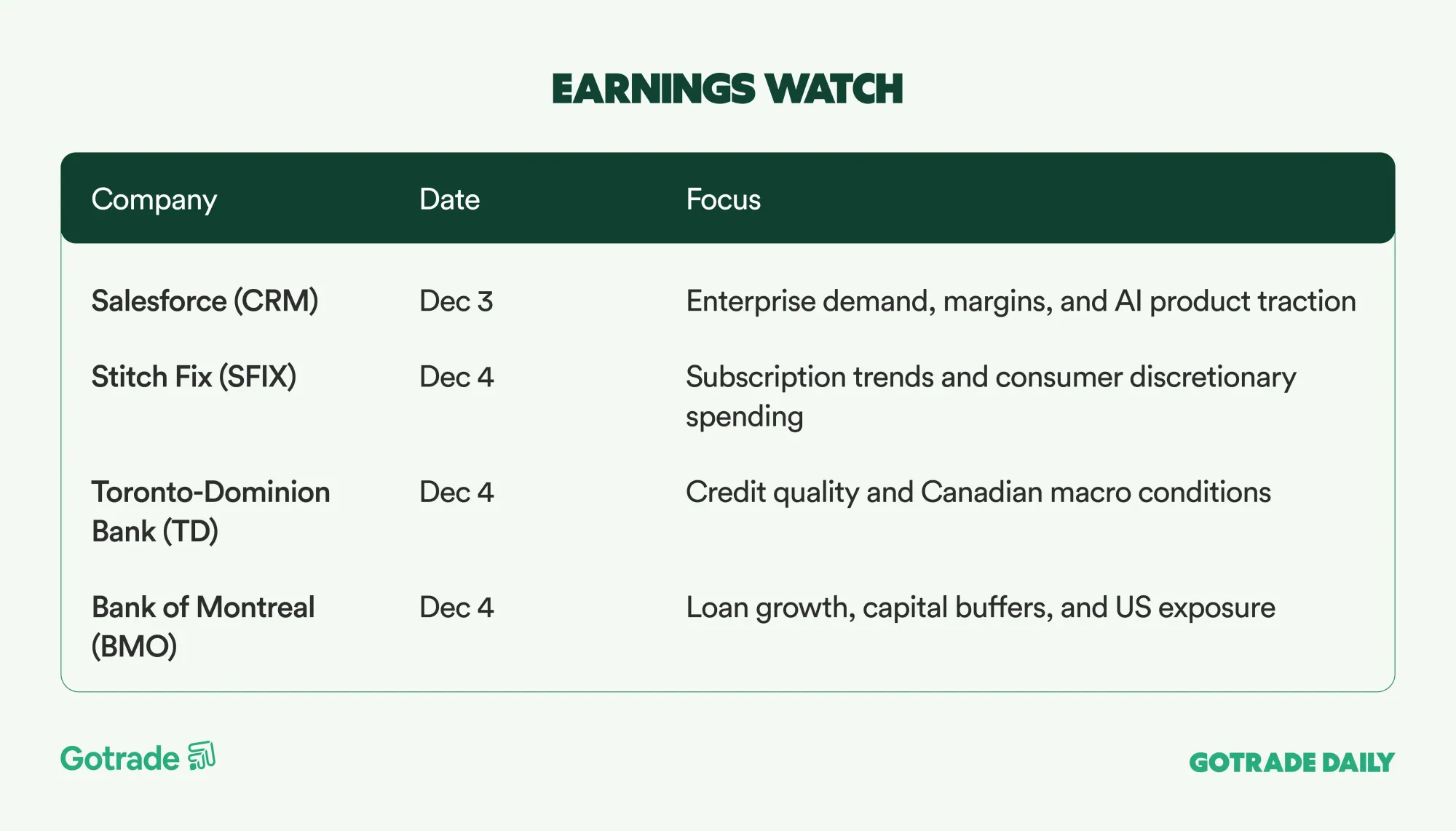

📅 Earnings Watch

Markets continue to balance crypto volatility, AI-driven rotations, and expectations ahead of next week’s Fed decision.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.