Markets pull back from record highs as investors reassess results and policy risks.

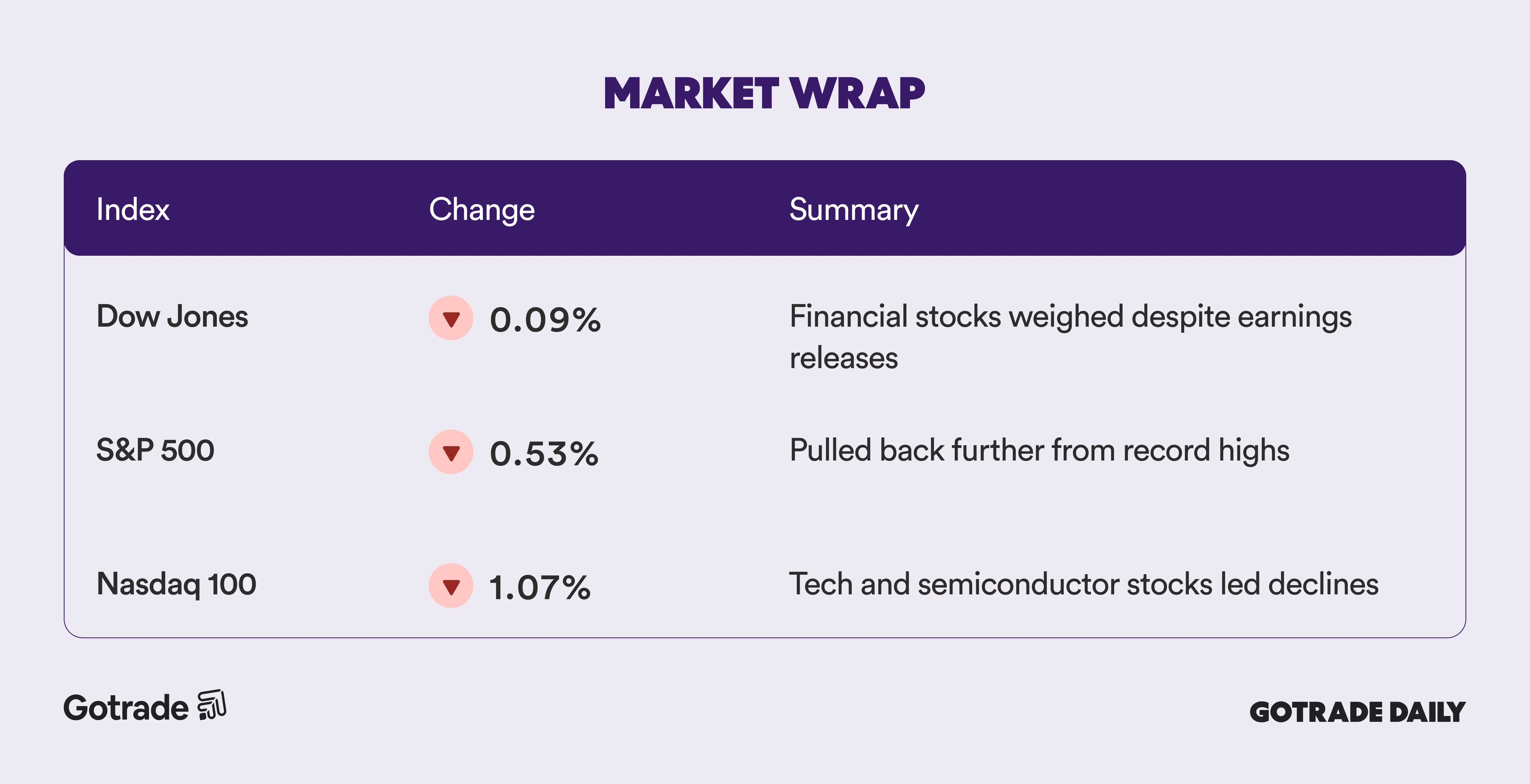

US equities extended losses on Wednesday as technology and financial stocks weighed on sentiment, pulling major indexes further from recent record highs. The S&P 500 slipped 0.53%, while the Dow Jones Industrial Average edged down 0.09%. The Nasdaq 100 underperformed, falling 1.07% as chipmakers and megacap tech stocks came under pressure.

Technology shares led the decline after reports that Chinese customs authorities may restrict imports of Nvidia’s H200 chips, sending semiconductor stocks lower. Broadcom fell sharply, while Nvidia (NVDA) and Micron (MU) also declined. At the same time, bank stocks struggled despite earnings beats, as investors questioned whether results were strong enough to support valuations near cycle highs.

Financials extended recent losses following President Trump’s renewed push for credit card interest rate controls. JPMorgan (JPM), Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) all moved lower, adding pressure to the broader market.

Macro data offered limited relief. Producer price and retail sales data came in solid, but concerns around inflation persistence and Federal Reserve independence continued to dominate discussions ahead of upcoming policy decisions.

Geopolitical risks added another layer of uncertainty, with oil prices fluctuating amid developments involving Iran and renewed tensions tied to US foreign policy statements.

📊 Market Wrap Jan 15th 2026

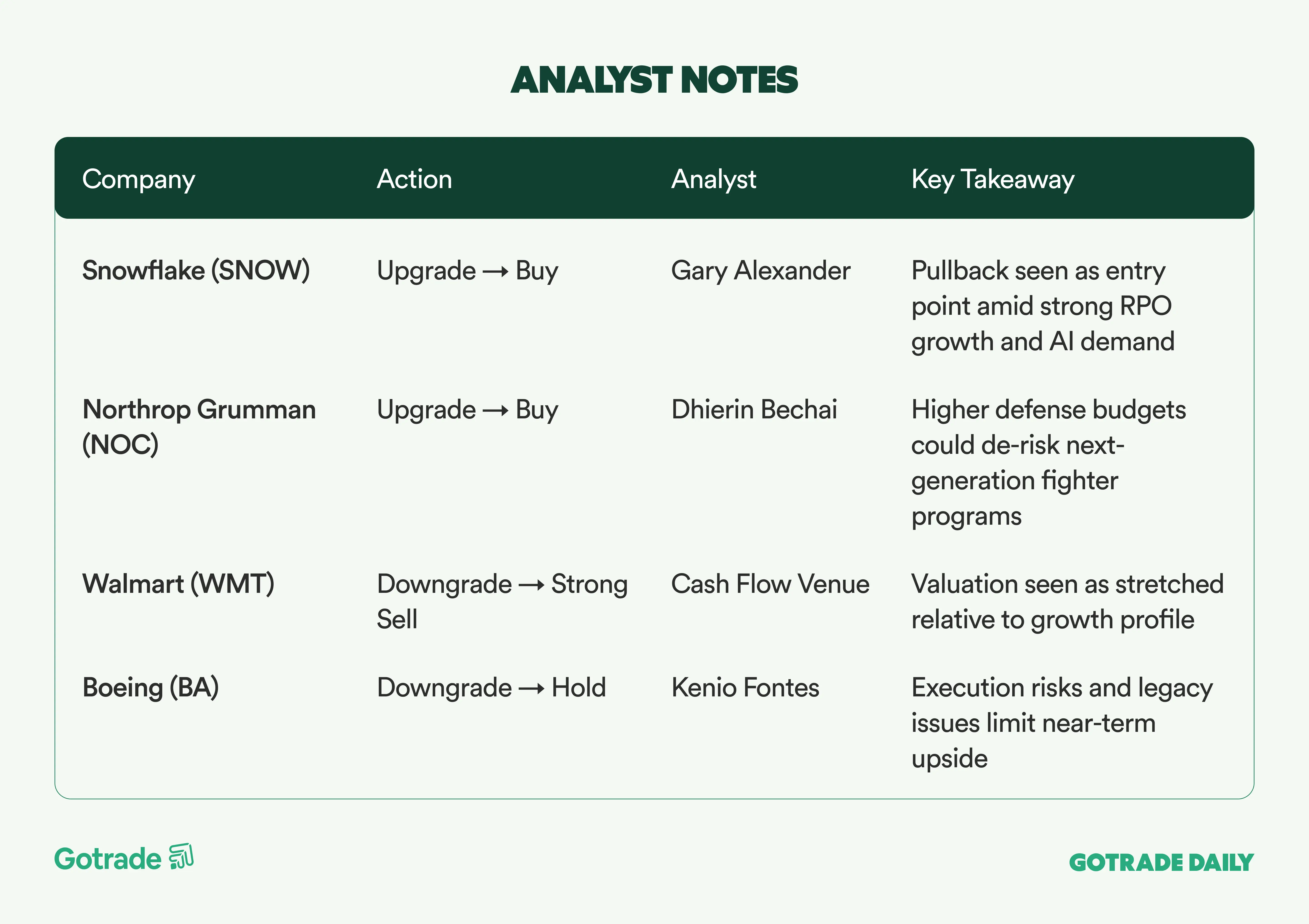

🧠 Analyst Notes

💬 Market Highlights

UnitedHealth to Accelerate Medicare Advantage Payments for Rural Hospitals

UnitedHealth Group (UNH), through its insurance unit UnitedHealthcare, has launched a pilot program aimed at cutting Medicare Advantage payment timelines by 50% for independent rural hospitals.

The initiative seeks to reduce payment periods to under 15 days from less than 30 days, providing faster cash flow support for financially strained rural providers. The six-month pilot will run in Oklahoma, Idaho, Minnesota, and Missouri, with potential expansion depending on outcomes.

Citigroup Targets 5-6% NII Growth in 2026 as Transformation Nears Completion

Citigroup (C) outlined a 5-6% net interest income (NII ex-Markets) growth target for 2026, driven by card loan growth, wealth management expansion, and higher deposit volumes.

Management highlighted that more than 80% of its multiyear transformation programs are at or near their target state, alongside progress in exiting non-core international operations. Citi reaffirmed its focus on positive operating leverage, an efficiency ratio around 60%, continued capital returns through a $20B buyback program, and a 10-11% RoTCE target for 2026.

Bank of America Projects 5-7% NII Growth in 2026 While Maintaining Expense Discipline

Bank of America (BAC) expects net interest income to grow 5-7% in 2026, supported by loan growth, stable rate assumptions, and strong client activity. Management emphasized disciplined expense management and continued operating leverage, even as investments in technology and AI remain elevated.

BAC closed 2025 with solid earnings momentum, rising tangible book value, and robust capital returns, positioning the bank for steady profitability amid macro uncertainty.

📅 Earnings Watch

Markets remain in a consolidation phase as investors rotate across sectors, reassess earnings strength, and weigh policy and geopolitical risks. With key earnings and macro data ahead, short-term direction is likely to stay driven by sector leadership rather than broad index momentum.

What stocks are you watching today?

Note: U.S. stock markets are closed on January 19 in observance of Martin Luther King Jr. Day, so Gotrade Daily will not be published on that day.

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.