AI announcements at CES lift sentiment as markets extend record highs

U.S. stocks closed higher on Tuesday, with the S&P 500 and Dow Jones Industrial Average both finishing at new all-time highs as technology shares regained leadership. Investor sentiment improved following a series of artificial intelligence and semiconductor announcements at CES 2026 in Las Vegas, led by Nvidia (NVDA) and other major chipmakers.

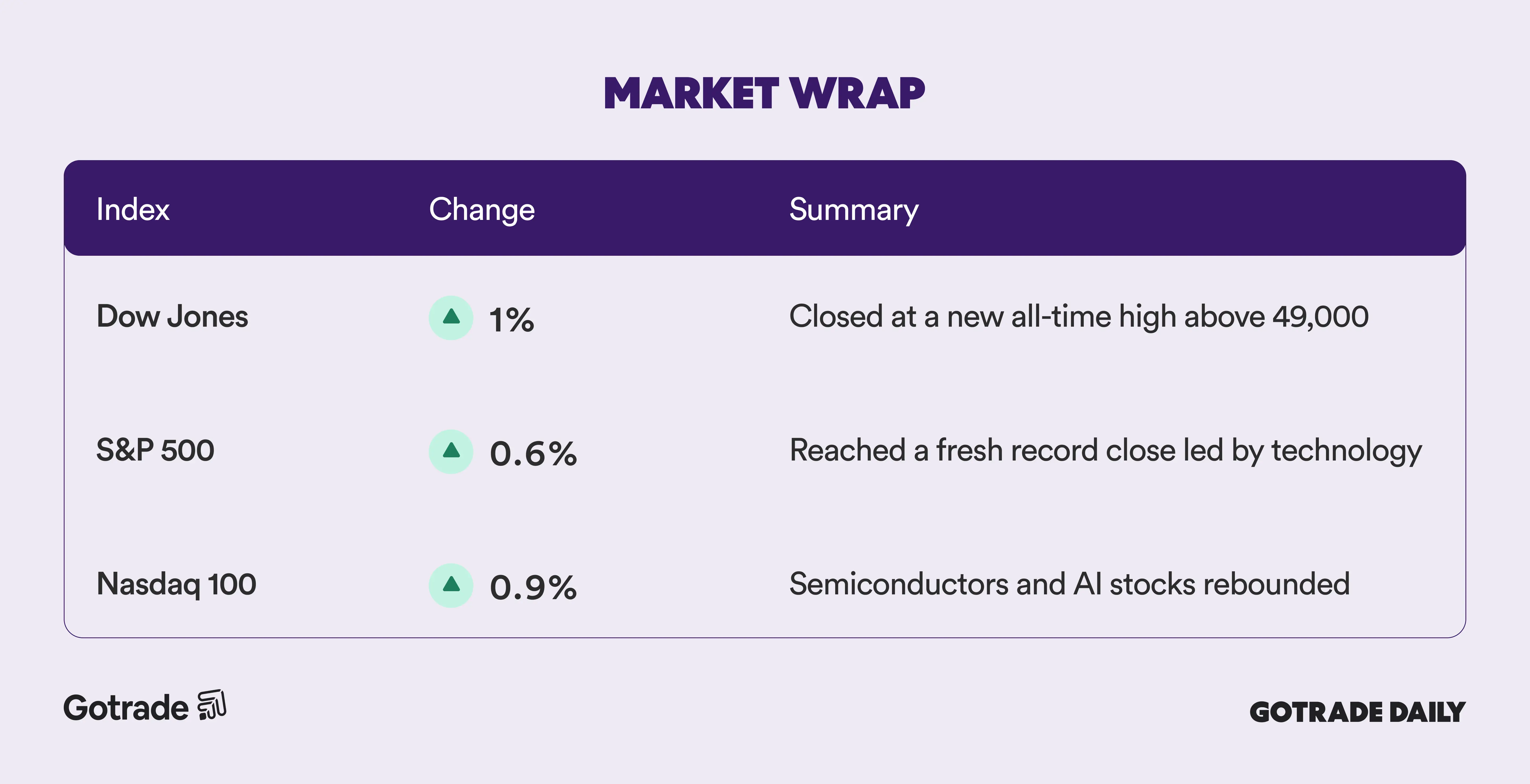

The Dow Jones Industrial Average rose about 1% to close above the 49,000 level for the first time, while the S&P 500 gained roughly 0.6%. The Nasdaq Composite advanced around 0.7%, snapping a recent losing streak as large-cap growth stocks outperformed.

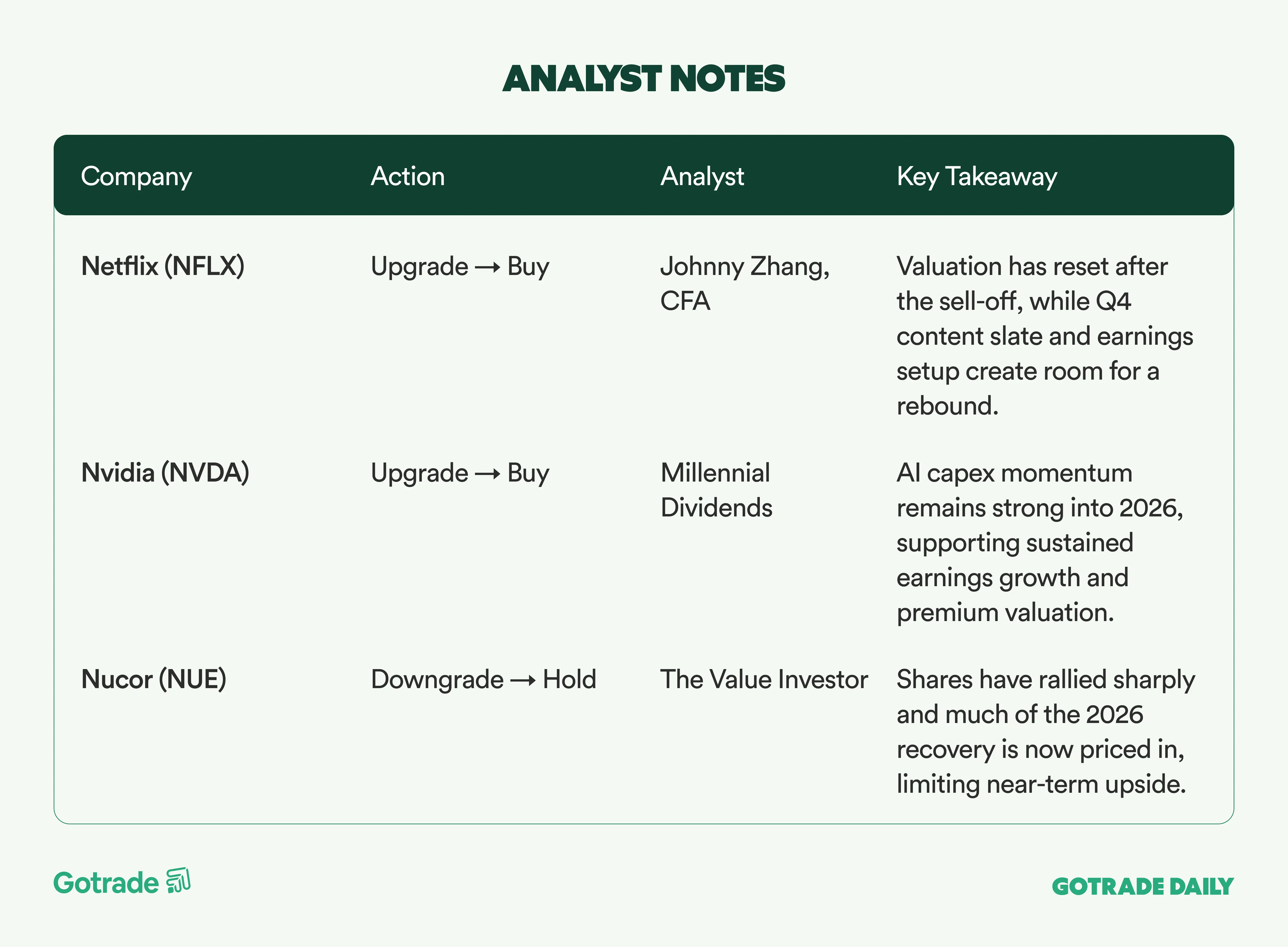

Technology momentum was driven by Nvidia (NVDA), whose CEO introduced Alpamayo, a new family of open models designed for autonomous driving, and confirmed that the company’s next-generation Vera Rubin computing platform has entered full production. The announcements reinforced expectations that AI infrastructure investment will remain a key driver for earnings growth in 2026.

Chip-related strength broadened across the sector. CoreWeave said it will integrate Nvidia’s Rubin technology into its AI cloud platform, while Advanced Micro Devices (AMD) unveiled new processors aimed at smaller enterprise data centers and embedded AI use cases. Storage and memory stocks posted sharp gains, with Sandisk, Western Digital (WDC), and Seagate Technology (STX) among the top performers.

Outside of technology, markets continued to monitor developments in Venezuela following U.S. military action over the weekend. While crude oil prices declined on the day, analysts noted that geopolitical uncertainty around energy supply could introduce volatility in the weeks ahead, particularly for U.S. refiners and oil-services companies. For now, however, oil remained a secondary factor compared with the renewed focus on AI-driven growth.

📊 Market Wrap Jan 7th 2026

🧠 Analyst Notes

💬 Market Highlights

Memory Stocks Extend Rally as AI-Driven Demand Fuels Supply Tightness

Chevron Retreats After Venezuela-Driven Rally as Analysts Urge Caution

SoFi Shares Slide After Underwriters Exercise Stock Offering Option

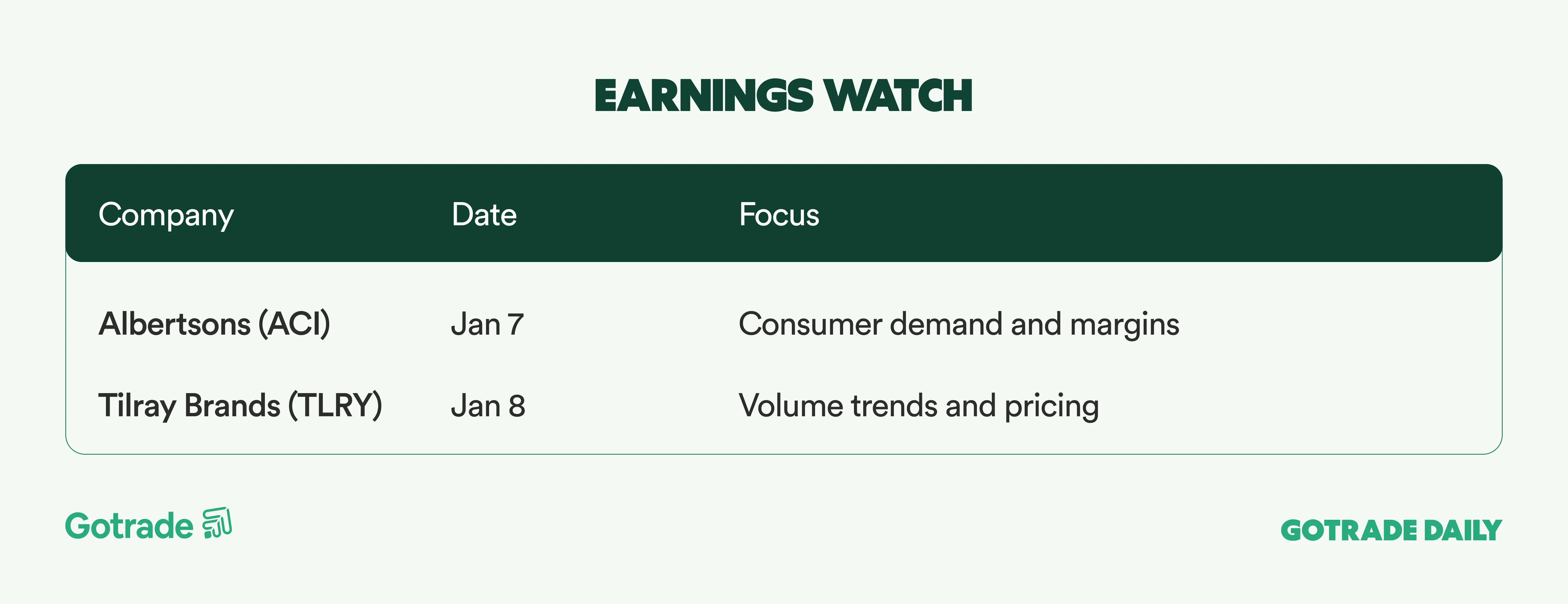

📅 Earnings Watch

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.