Dow hits fresh records as energy and hard assets lead a broad market surge.

US equities opened 2026 with strong upside momentum, as major indexes advanced sharply on Monday and the Dow Jones Industrial Average set new intraday and closing all-time highs. Gains were driven primarily by energy stocks and value-linked sectors, while broader risk sentiment remained constructive following another year of double-digit returns in 2025.

Market focus shifted over the weekend after US military forces entered Venezuela and captured President Nicolás Maduro, who was transferred to New York to face criminal charges. President Donald Trump said the US would oversee Venezuela during a transition period, bringing renewed attention to the country’s role as the holder of the world’s largest proven oil reserves and raising questions around future energy supply dynamics.

Energy markets reacted quickly. US crude prices moved higher, while oil-linked equities surged on expectations that increased US involvement could eventually lead to the rehabilitation of Venezuela’s deteriorated energy infrastructure. Chevron (CVX), the only major US oil company currently active in Venezuela, rose sharply, while refiners and oilfield services firms including Valero Energy (VLO), SLB (SLB), Halliburton (HAL), Phillips 66 (PSX), and Marathon Petroleum (MPC) all posted outsized gains.

Elsewhere, cross-asset moves reflected a shift toward assets most sensitive to geopolitical risk. Gold and silver prices jumped as investors sought stores of value, Treasury yields declined, and Bitcoin rebounded from weekend lows. Meanwhile, select AI stocks such as Nvidia (NVDA) and Advanced Micro Devices (AMD) lagged as investors awaited clearer signals from CES 2026, suggesting a temporary rotation away from growth toward commodities and cyclicals.

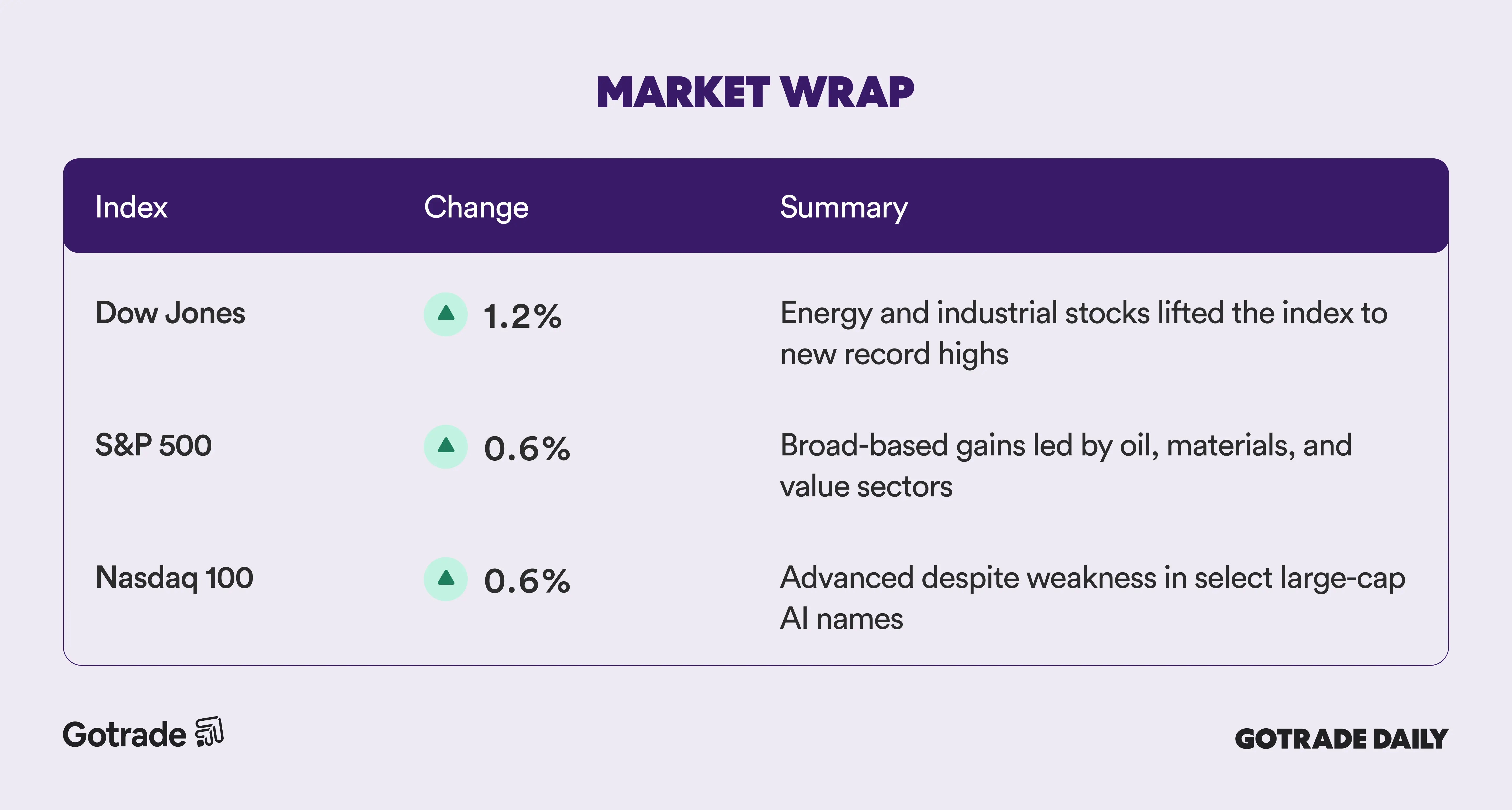

📊 Market Wrap Jan 6th 2026

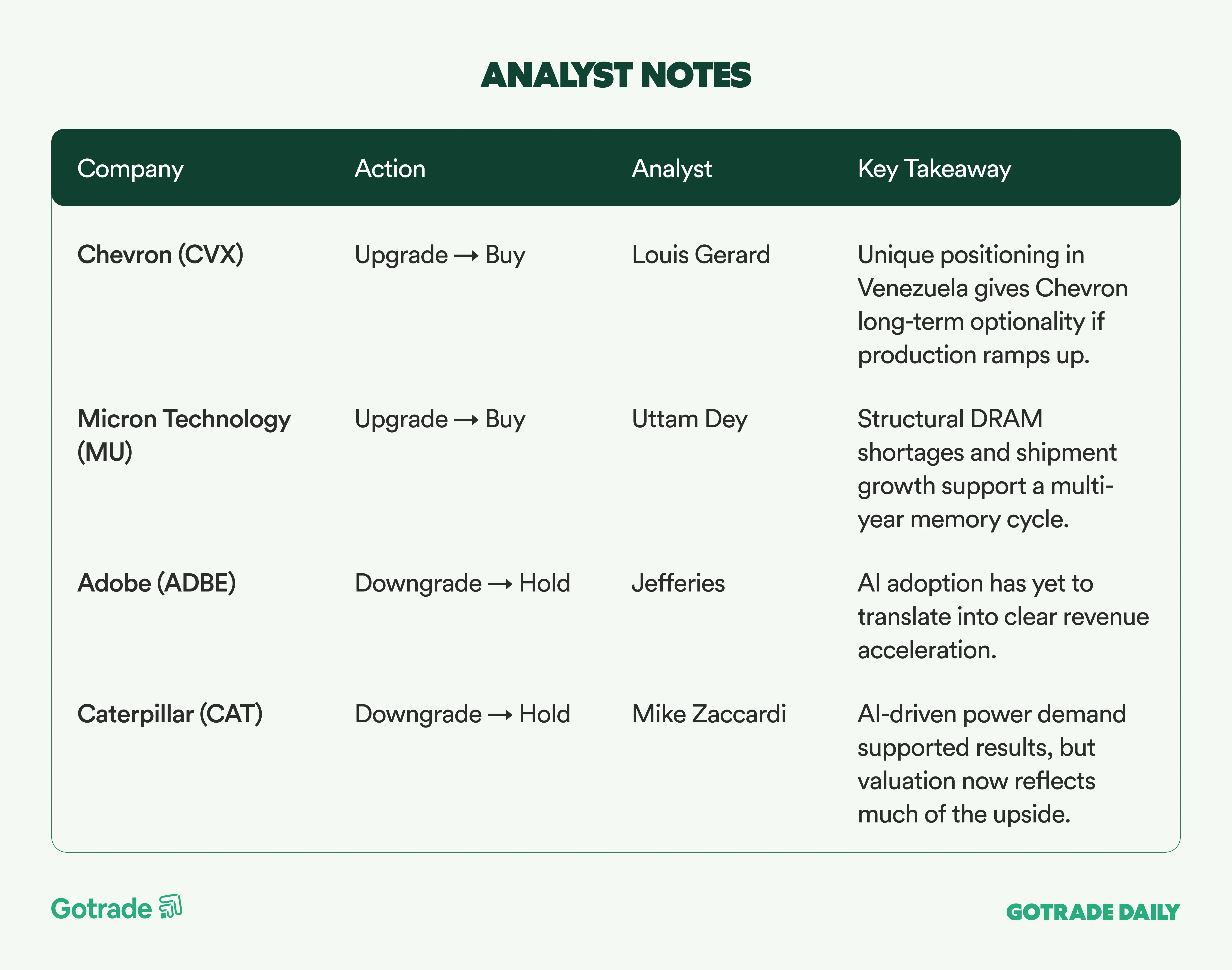

🧠 Analyst Notes

💬 Market Highlights

Procter & Gamble Maintains a Tactical Operating Presence in Venezuela

Procter & Gamble (PG) remains one of the few global consumer companies maintaining active operations in Venezuela, albeit on a limited and tactical basis. Once a key South American growth market, Venezuela has shifted into survival mode for P&G amid hyperinflation and currency devaluation.

The company continues to manufacture a narrow set of products through two local plants, while regional management functions have been relocated abroad. Near-term political uncertainty has increased, but a potential economic normalization could allow selective reinvestment over the medium term.

Qualcomm Deepens Google Partnership and Expands AI Portfolio at CES

Qualcomm (QCOM) strengthened its strategic partnership with Google (GOOG) (GOOGL) to bring cloud-based artificial intelligence directly into vehicles, aiming to enhance personalization and intelligence in automotive experiences.

At CES, Qualcomm also introduced the Snapdragon X2 Plus platform for PCs, offering higher performance, improved battery efficiency, and enhanced AI capabilities powered by a third-generation Oryon CPU and an 80 TOPS NPU. Expanded IoT offerings and new partnerships with Toyota, ZF, and Leapmotor reinforce Qualcomm’s broader push to embed AI across multiple industries.

MercadoLibre Rallies on Speculation of a Venezuela Recovery Upside

MercadoLibre (MELI) shares rallied as investors speculated that increased U.S. Involvement could eventually support economic stabilization in Venezuela, unlocking long-term e-commerce potential. While Venezuela currently contributes less than 5% of MercadoLibre’s revenue and is grouped within its “other countries” segment, the country represents a large, underpenetrated digital market. Investors view regional stabilization as a potential long-term catalyst, pushing the stock to its highest level in ten weeks.

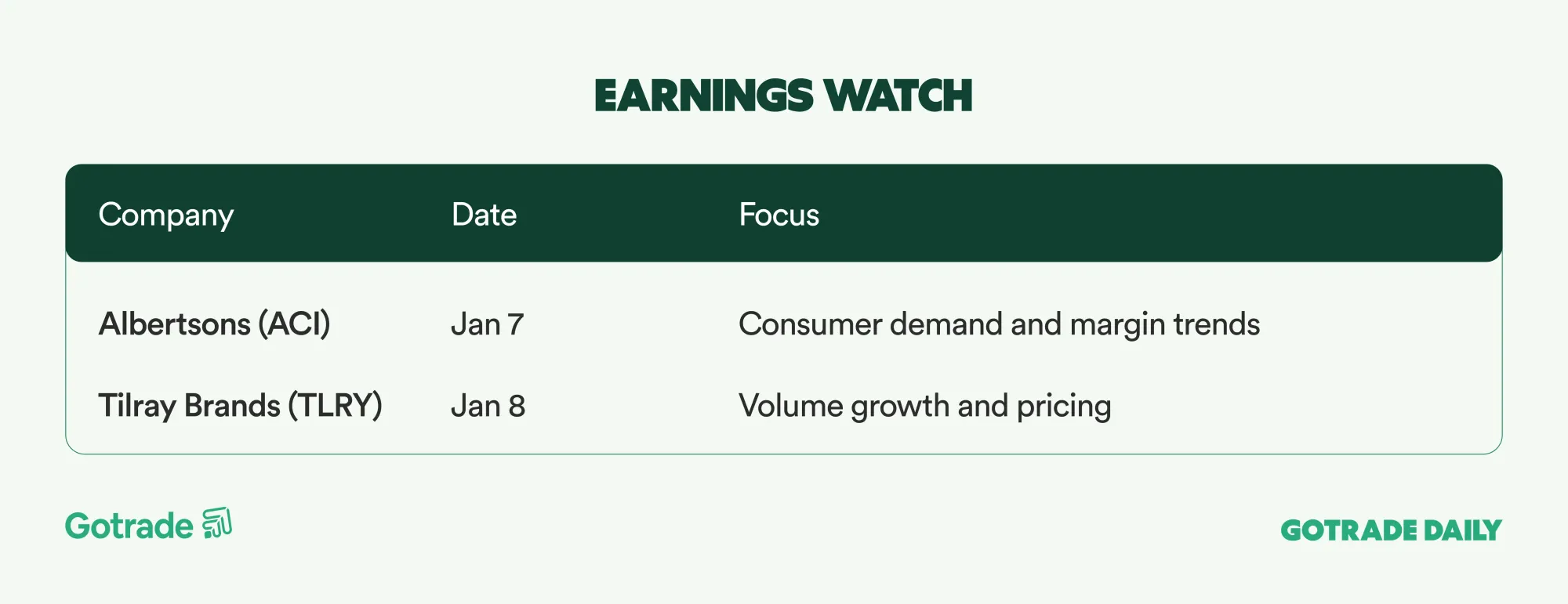

📅 Earnings Watch

Markets began 2026 with strong momentum, led by energy and commodity-linked assets as geopolitical risk returned to the foreground. Developments in Venezuela, movements in oil prices, and ongoing sector rotation are likely to shape early-year positioning across global markets.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.