Traders watch labor signals before the Fed meeting.

US stocks ended mixed on Thursday as traders weighed softer job cut data, renewed strength in mega cap tech, and shifting expectations ahead of next week’s Federal Reserve meeting. Meta (META) was the standout, rising more than 3 percent after reports the company plans to scale back its Metaverse investments, helping the Nasdaq stabilize after a volatile week.

Markets opened with uncertainty as jobless claims came in lower than expected and corporate layoffs fell sharply from October. The figures added to a string of labor indicators showing a cooling but resilient job market, reinforcing expectations for a rate cut at the December meeting.

Sector moves were uneven. AI linked names traded narrowly, while small caps outperformed, with the Russell 2000 closing at a record high. Bond yields also shifted, with the 10 year Treasury near 4.1 percent as traders reassessed how quickly policy may ease next year.

For traders, the path into next week remains guided by rate expectations and positioning around tech leadership. With markets pricing an 87 percent chance of a 25 basis point cut, sentiment remains sensitive to labor or inflation updates that could influence the Fed’s final decision of the year.

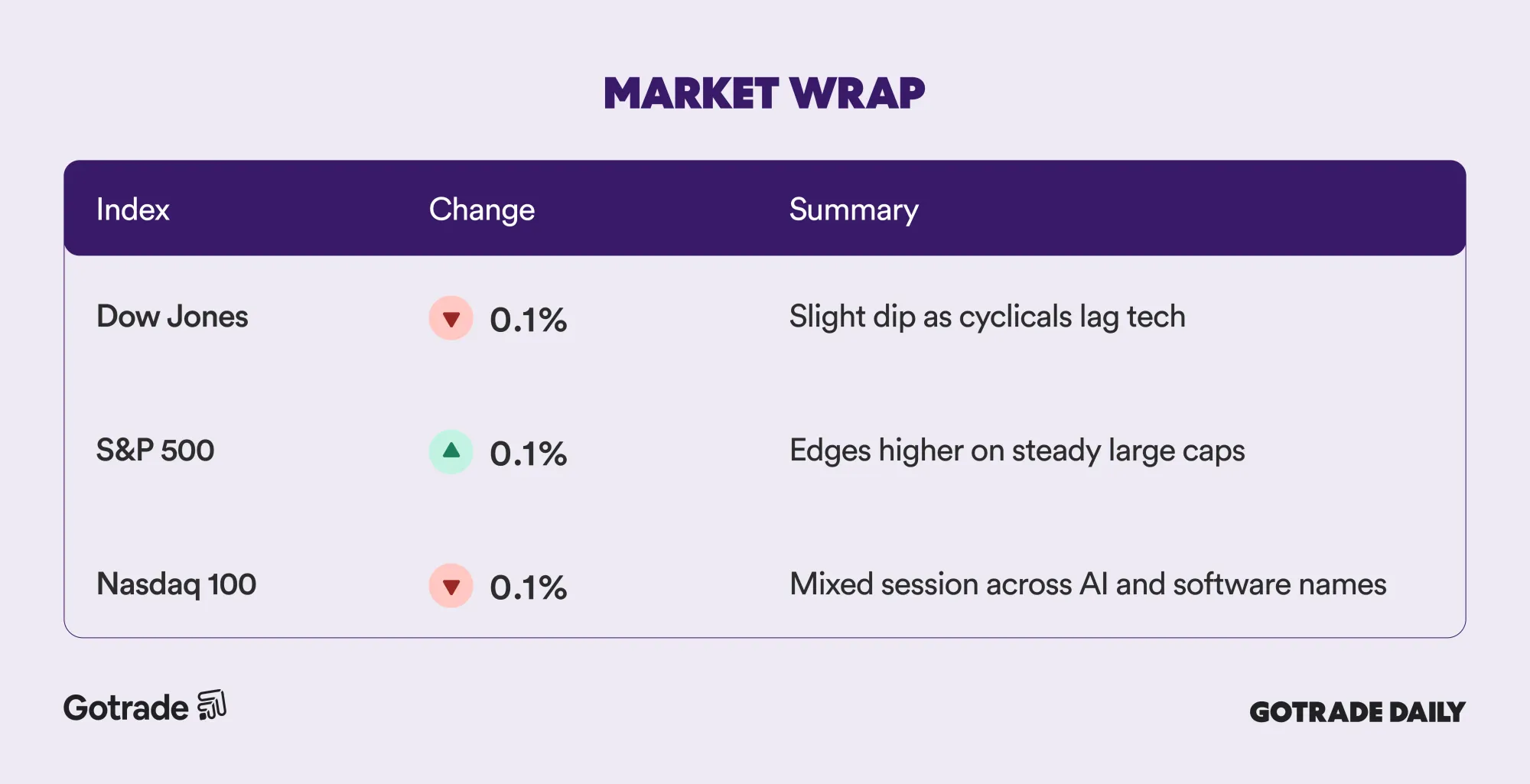

📊 Market Wrap Dec 5th 2025

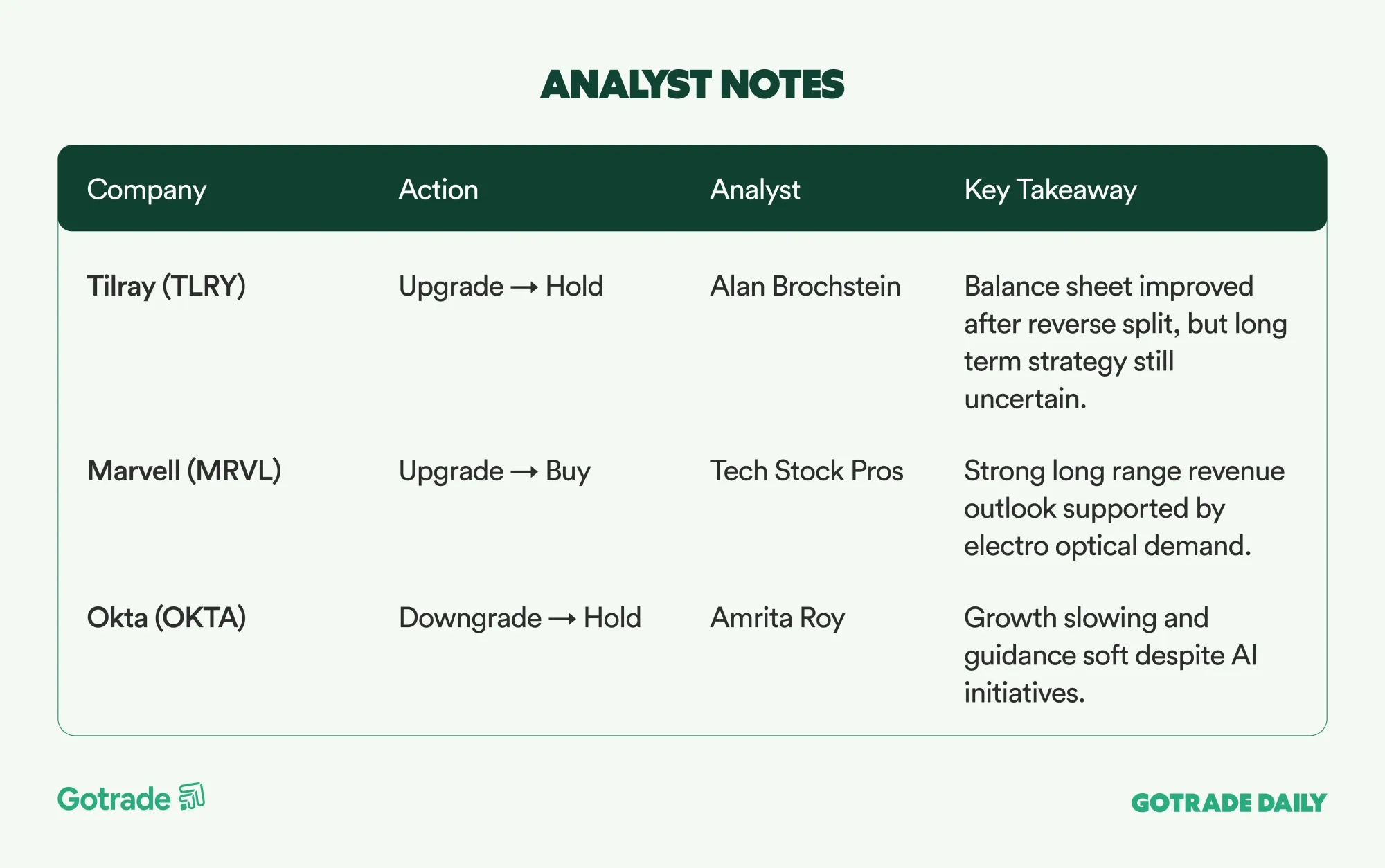

🧠 Analyst Notes

💬 Market Highlights

📄 DocuSign raises Q4 outlook as IAM adoption expands

DocuSign (DOCU) posted Q3 revenue of 818 million dollars and strong free cash flow, supported by rising adoption of its Intelligent Agreement Management platform. IAM now exceeds 25 thousand customers, driving more cross sell into eSignature. The company guided Q4 revenue up to 829 million dollars and plans to shift to ARR reporting next year as IAM becomes a larger share of recurring revenue.

🪨 Freeport McMoRan focuses on core asset development

Freeport McMoRan (FCX) emphasized that growth will come from expanding existing copper assets rather than aggressive acquisitions. Management remains open only to highly strategic opportunities. The company also urged policymakers to expand permitting and incentive structures to strengthen US copper supply, noting tariffs do not directly affect its raw ore and cathode business.

🌐 HPE lifts FY26 targets as networking momentum builds

HPE (HPE) ended FY25 with a record quarter driven by 150 percent year over year networking growth aided by the Juniper integration. Management raised FY26 earnings and free cash flow guidance, expecting networking to remain a major growth engine as AI workloads scale. Component costs and integration execution remain the main watchpoints heading into next year.

📅 Earnings Watch

Markets traded cautiously into the close, and traders continue to monitor flows ahead of next week’s Fed meeting. Sentiment remains sensitive to labor data and policy expectations as the year winds down.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.