Stock rally cools as bonds strengthen and sector moves diverge.

US equities pulled back modestly on Thursday as investors reassessed economic data and policy-related headlines tied to President Donald Trump. After pushing to fresh highs earlier in the week, markets shifted into a more selective tone, with gains narrowing and bond yields moving lower.

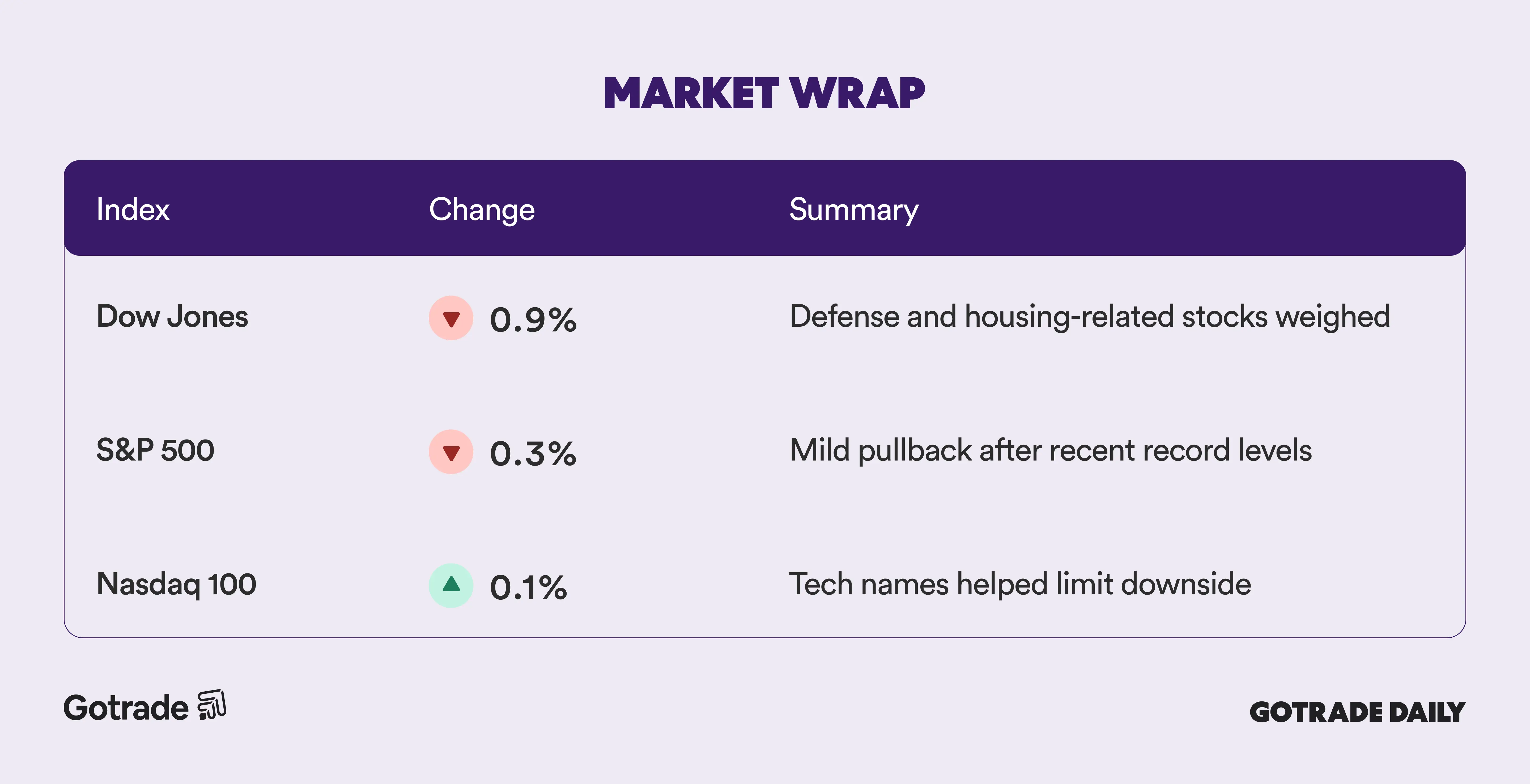

The S&P 500 (SP500) slipped 0.3% while the Dow Jones Industrial Average (DJI) fell 0.9%. The Nasdaq 100 (NDX) held slightly higher, supported by pockets of resilience in large-cap technology. In rates, the US 10-year Treasury yield eased to 4.14% as investors balanced mixed labor data with expectations that the Federal Reserve may keep policy steady in the near term.

Sector reactions were uneven. Valero Energy (VLO) led refiners higher after Trump suggested Venezuela could deliver additional oil volumes to the US, even as crude prices continued to decline. Meanwhile, defense stocks weakened after comments pointing to potential changes in defense relationships, with RTX Corp. (RTX) sliding more than 5% after the close.

With two rate cuts already priced into 2026 expectations, attention now turns to Friday’s US nonfarm payrolls report. Markets are watching closely for confirmation that growth is moderating without materially weakening, a key condition for maintaining the current risk backdrop.

📊 Market Wrap Jan 8th 2026

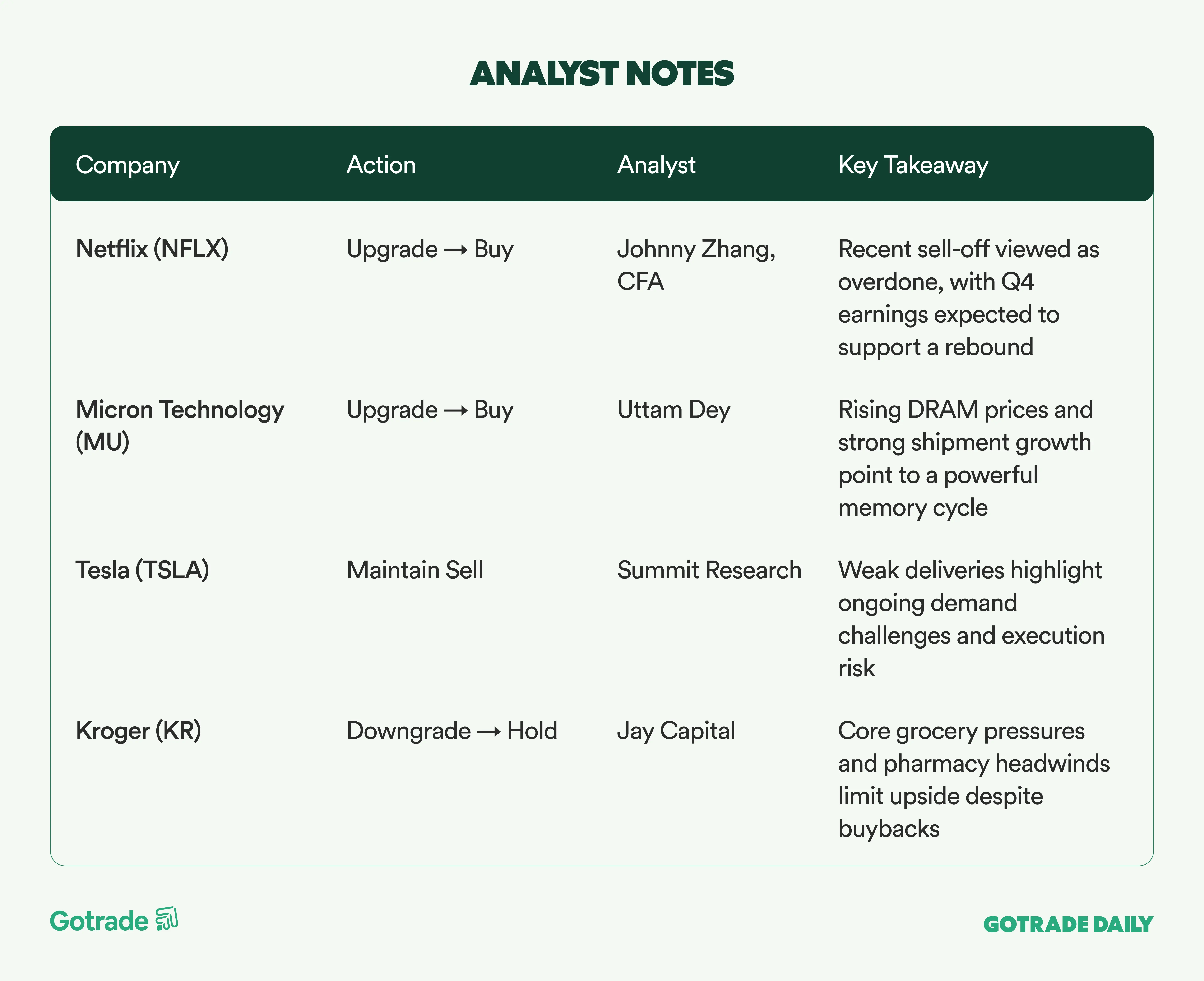

🧠 Analyst Notes

💬 Market Highlights

Canadian Crude Prices Slide, Weighing on Energy Stocks

Canadian crude prices on the U.S. Gulf Coast fell sharply after President Trump said Venezuela would supply 30 to 50 million barrels of oil to the U.S. at market prices. The wider discount on Cold Lake crude pressured Canadian oil producers such as Canadian Natural Resources (CNQ) and Cenovus (CVE), while U.S. refiners benefited from the prospect of cheaper heavy crude feedstock, lifting refining stocks.

Applied Digital Targets Over $1B in NOI Within Five Years

Applied Digital (APLD) expects net operating income to exceed $1 billion within five years, supported by rapid expansion of its hyperscale data center campuses in the Dakotas and a lease pipeline totaling roughly $16 billion. Long-term contracts with investment-grade hyperscalers and the start of lease revenue generation mark a key inflection point as AI-driven demand accelerates.

Blue Owl Raises Redemption Cap as Private Credit Faces Pressure

Blue Owl Capital (OWL) increased the redemption limit at one of its private BDC funds to 17% of net assets following elevated withdrawal requests. The move highlights growing investor caution toward private credit, an asset class that has recently seen rising redemption activity. Shares of Blue Owl and related entities declined amid heightened market scrutiny.

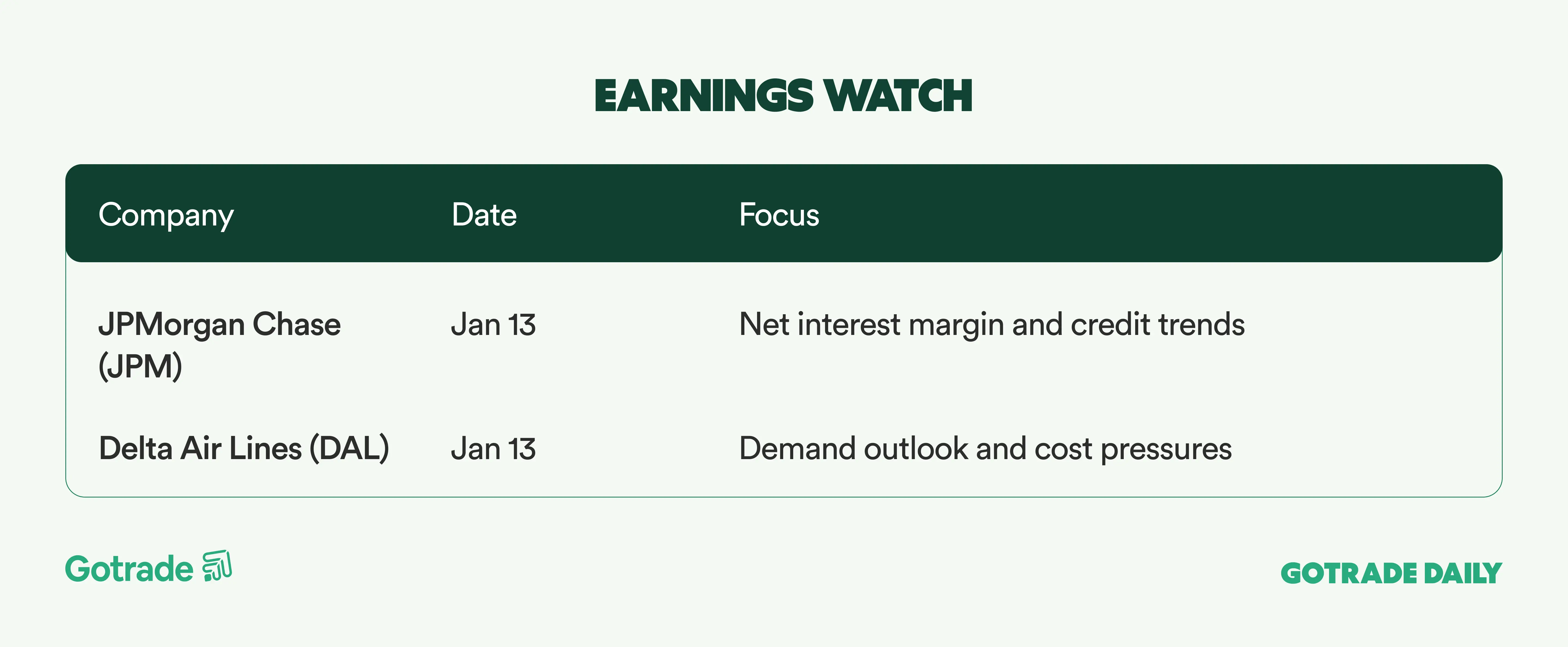

📅 Earnings Watch

Markets remain supported by easing inflation and resilient earnings expectations, but policy risk and geopolitics are reasserting influence early in 2026. With payrolls, tariffs, and Fed expectations all converging, short-term volatility is likely to stay elevated.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.