Markets watch labor signals, Fed implications, and corporate guidance.

Global markets head into the new week with investor attention split between U.S. labor market data and a heavy slate of corporate earnings. The January jobs report, due Friday, will be a key focal point as Federal Reserve officials continue to assess whether hiring conditions are softening after the Fed held interest rates steady last week.

The labor data carries added weight for policy expectations. While the unemployment rate edged lower at the end of last year, job creation slowed more than economists anticipated, raising questions about how much room the Fed has to keep policy restrictive without pressuring employment. Any surprise in Friday’s report could quickly shift expectations around the timing of future rate cuts.

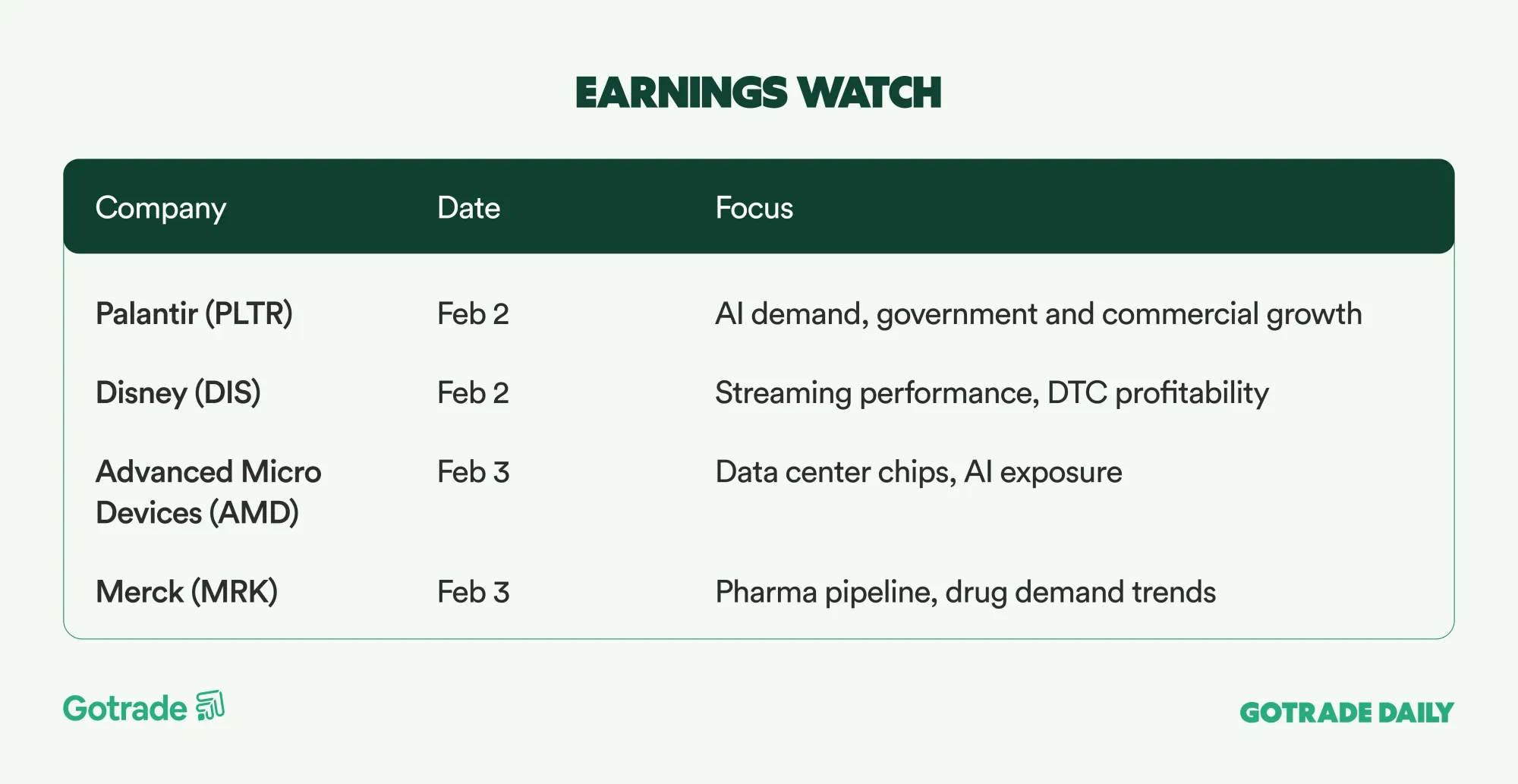

Earnings will be the other major driver of market direction. Reports from Alphabet (GOOGL) and Amazon (AMZN) arrive after both companies posted strong revenue growth in recent quarters, while results from AMD (AMD), Qualcomm (QCOM), and Palantir (PLTR) are expected to offer fresh signals on the durability of AI-related demand across chips, cloud, and software.

Outside of tech, investors will also track earnings from Disney (DIS) for updates on its direct-to-consumer strategy, as well as results from major pharmaceutical companies including Merck (MRK) and Eli Lilly (LLY). With macro data and earnings converging, markets are likely to react less to headlines and more to how growth, margins, and guidance hold up under tighter financial conditions.

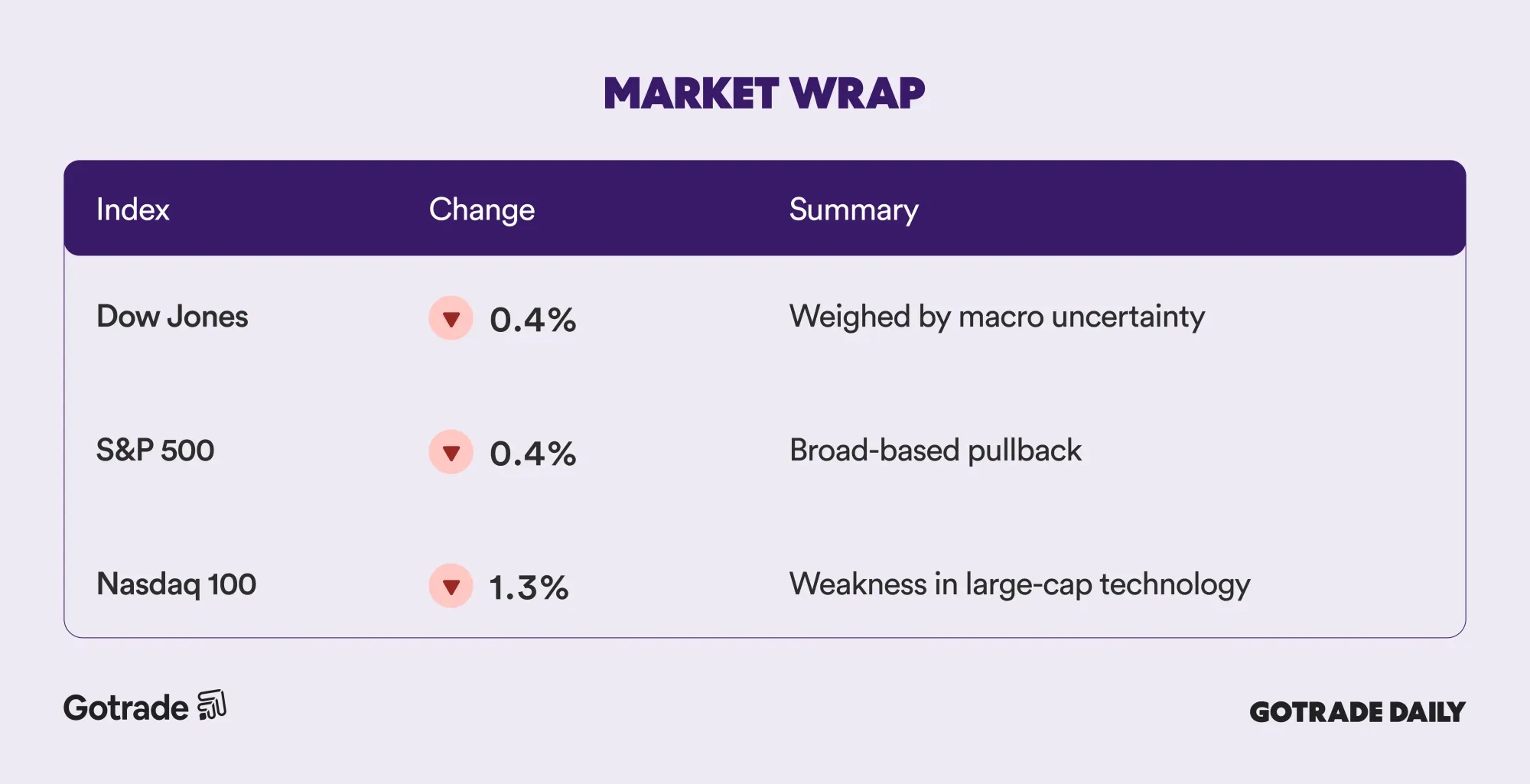

📊 Market Wrap Feb 2nd 2026

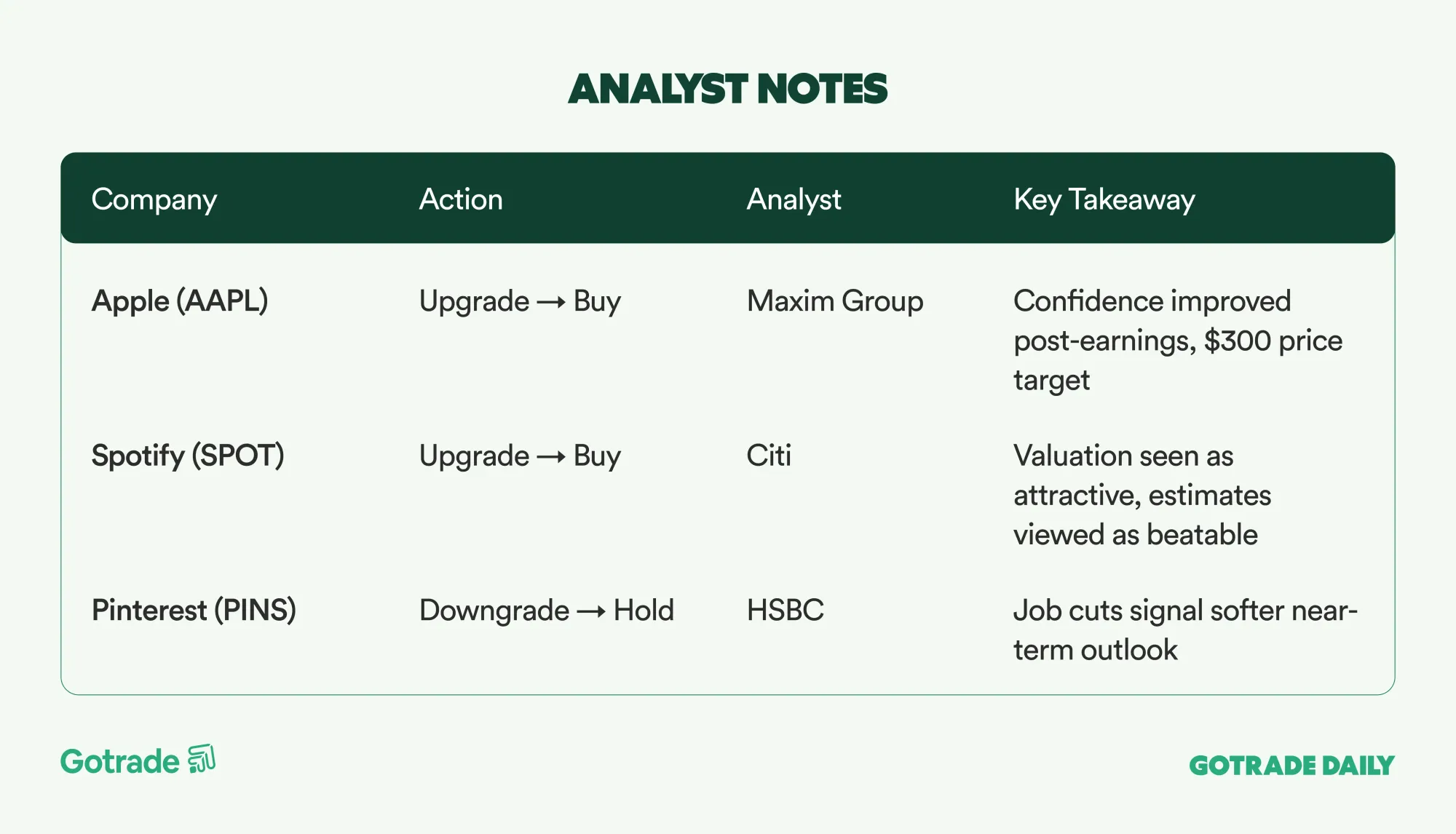

🧠 Analyst Notes

💬 Market Highlights

Silver Price Surge Reshapes the Global Precious Metals Market

Silver prices experienced an extreme rally over the past year before a sharp correction, driven more by financial speculation and industrial demand than by physical supply shortages.

The price spike created wide regional arbitrage gaps, encouraging physical air shipments and even smuggling into China, while severely pressuring manufacturers, especially solar panel producers, where silver now represents a much larger share of production costs.

As refiners increase scrap processing and industrial users reduce silver intensity, the market remains highly volatile, with sharp reversals increasingly likely. This dynamic has direct implications for silver-linked instruments such as the iShares Silver Trust (SLV).

The AI Boom Begins to Erode Apple’s Supply Chain Advantage

Apple’s (AAPL) long-standing dominance as the most powerful buyer in consumer electronics is coming under pressure as AI hyperscalers aggressively bid for chips, memory, and advanced components.

Explosive AI infrastructure spending has shifted pricing power toward semiconductor and memory suppliers, driving up DRAM and NAND costs and narrowing Apple’s traditionally strong margins. While Apple retains strategic advantages in scale, ecosystem integration, and product pricing discipline, rising input costs suggest the company may need to absorb margin pressure rather than fully pass it on to consumers.

This marks a structural shift where AI demand increasingly dictates semiconductor capacity allocation, often at the expense of consumer hardware leaders.

F-Series Reinforces Its Role as Ford’s Structural Profit Engine

Ford Motor’s (F) F-Series pickup line remains one of the most durable and profitable vehicle franchises in automotive history, combining stable volumes, strong pricing power, and high-margin product mix.

The evolution from a pure work truck into a technology-rich and premium offering has expanded margins while preserving scale, supported by a massive installed base, strong resale values, and deep penetration across commercial and retail customers.

As competition intensifies in the full-size pickup segment, the F-Series continues to function not just as a flagship product, but as a strategic asset underpinning Ford’s cash flow, earnings resilience, and long-term profitability.

📅 Earnings Watch

With jobs data and earnings landing in the same week, markets enter a phase where guidance, execution, and labor resilience are likely to matter more than headline index moves, reinforcing the importance of selective positioning.

What stocks are you watching today?