Markets rebound as tech and banks lead risk-on rotation.

U.S. equities rebounded sharply on Wednesday after President Donald Trump called off planned tariffs on Europe tied to Greenland, easing fears of an escalating geopolitical and trade conflict. Markets were already stabilizing after Trump said at the World Economic Forum in Davos that he would not use force to acquire Greenland, but sentiment improved further once he confirmed a tariff halt.

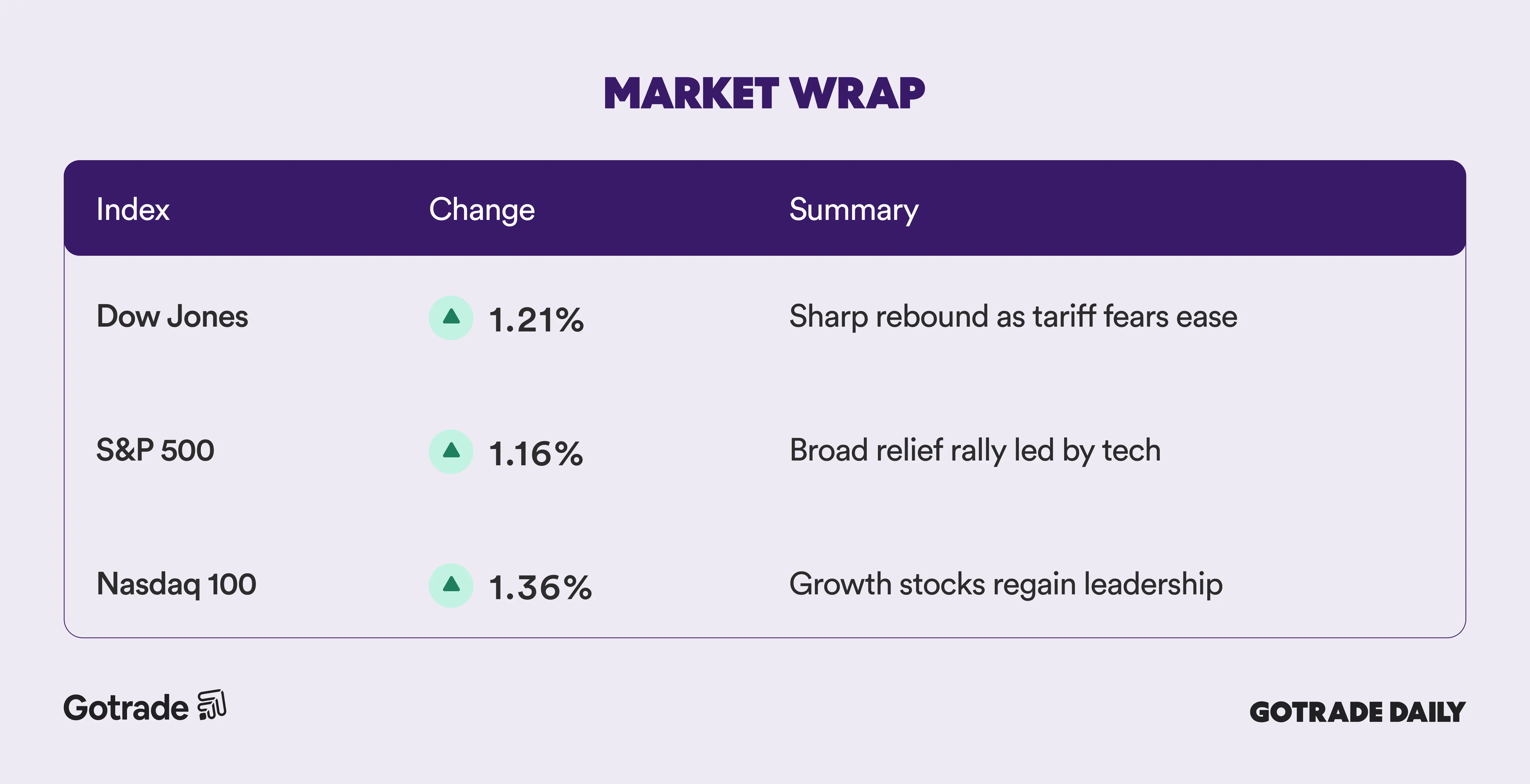

The Dow Jones Industrial Average surged nearly 600 points, while the S&P 500 and Nasdaq Composite each gained more than 1%, snapping a streak of heavy losses earlier in the week. Even with the rebound, all three major indexes remain down for the week, underscoring how fragile sentiment has been amid rapid policy shifts.

Relief came after Trump said a “framework of a deal” had been reached with NATO leadership regarding Greenland and broader Arctic cooperation, removing the immediate need for tariffs scheduled to begin February 1. The reversal triggered a quick unwind of Tuesday’s “sell America” trade, with U.S. assets recovering across equities, bonds, and currencies.

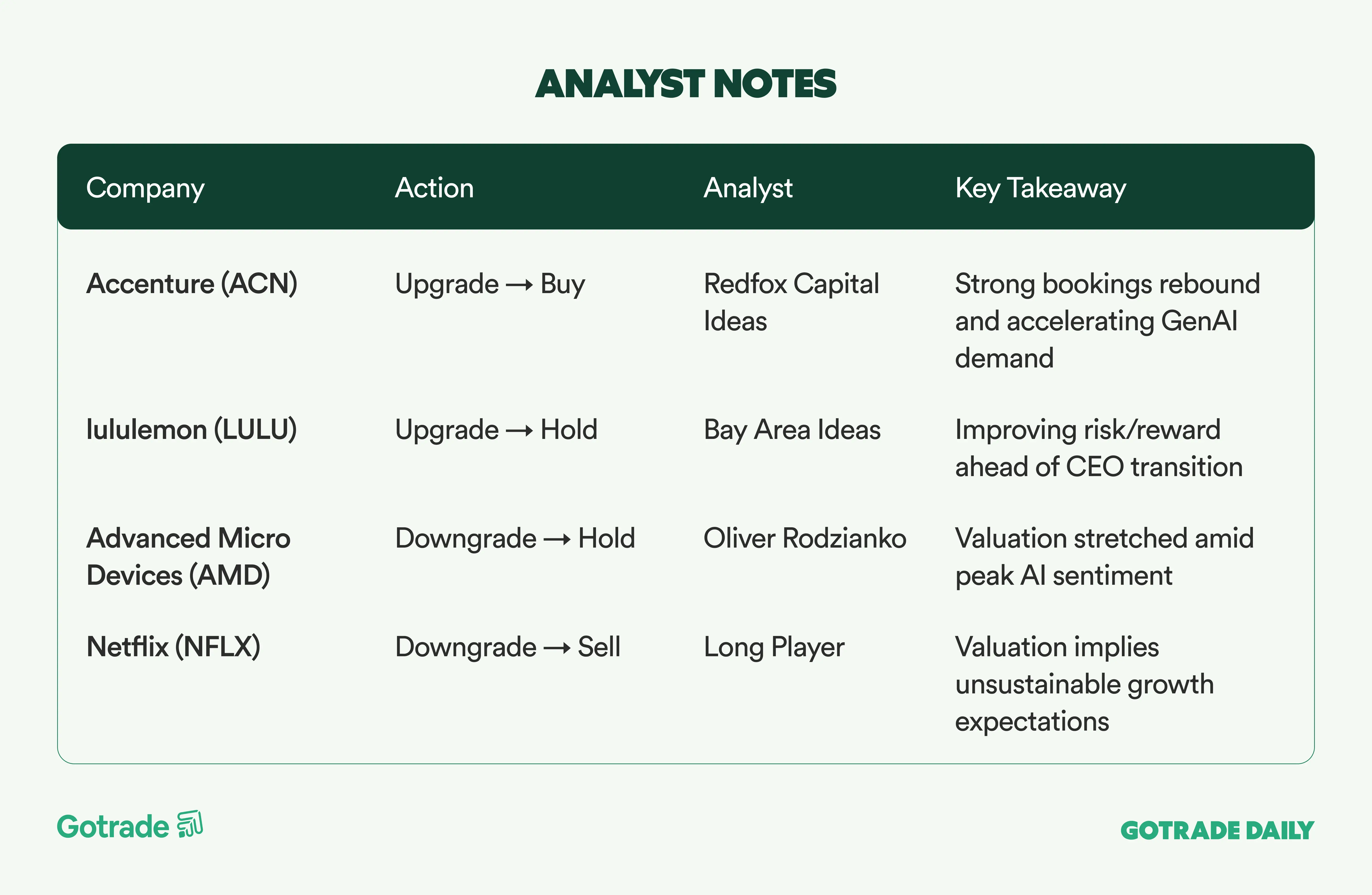

Technology stocks led the bounce, with NVIDIA (NVDA) and Advanced Micro Devices (AMD) among the strongest performers as investors rotated back into growth after de-risking earlier in the week. Bank stocks also advanced after Trump reiterated his push for a 10% credit card interest cap, though investors remain skeptical such legislation could pass Congress.

Despite the relief rally, uncertainty remains elevated. European lawmakers have paused parts of a U.S.–EU trade agreement, and U.S. courts signaled resistance to political interference with the Federal Reserve, keeping policy risk firmly in focus as markets head deeper into earnings season.

📊 Market Wrap Jan 22nd 2026

🧠 Analyst Notes

💬 Market Highlights

Intel Leads Semiconductor Stocks Higher Ahead of Earnings

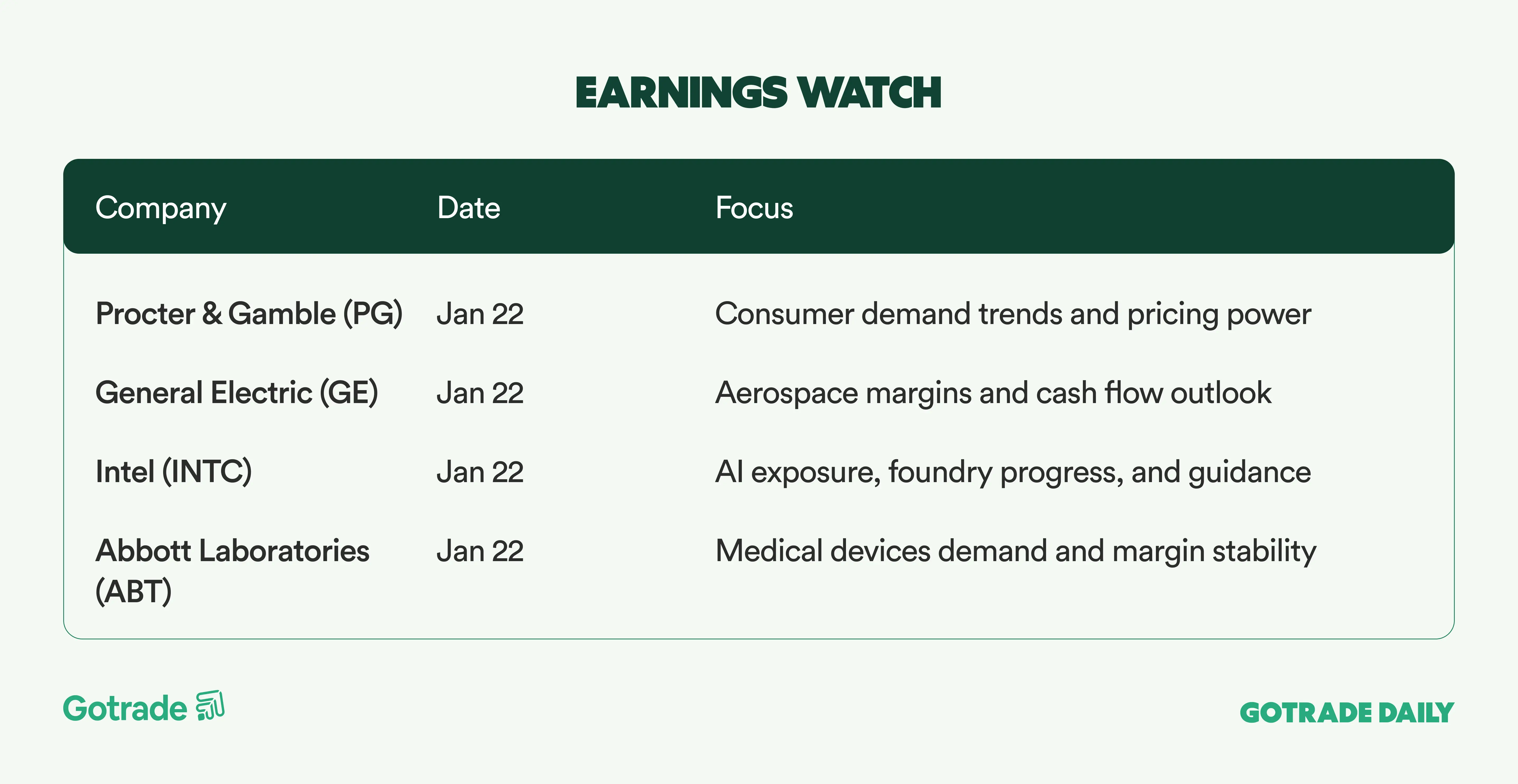

Intel (INTC) surged more than 11% as semiconductor stocks broadly advanced ahead of the company’s fourth-quarter earnings release. Other major chipmakers also rallied, including Micron Technology (MU), Advanced Micro Devices (AMD), Nvidia (NVDA), and Marvell Technology (MRVL), while the Philadelphia Semiconductor Index (SOX) climbed nearly 4%.

The sector benefited from optimism around AI-driven demand and broader market relief after President Trump said planned U.S. tariffs scheduled for February 2026 would not be implemented.

Advanced Micro Devices Extends Winning Streak to Seven Sessions

Advanced Micro Devices (AMD) extended its rally to a seventh consecutive session, supported by strong momentum in AI and data center positioning. Investors remain optimistic about upcoming EPYC Venice CPUs built on TSMC’s 2nm process and AMD’s growing role as a full-stack AI platform provider combining CPUs, GPUs, networking, and software. Analyst sentiment remains constructive, with expectations for potential upside to 2026 guidance as enterprise and hyperscaler CapEx expands.

Procter & Gamble Develops New Gillette Razor System

Procter & Gamble (PG) is developing a new Gillette razor system branded Lystra, based on a series of recent patent filings. The design focuses on improved ergonomics for sensitive areas and signals a broader grooming ecosystem rather than a limited product refresh.

Analysts note that the pace of intellectual property activity points to a potential commercial launch in the first half of 2026, which could help reinvigorate Gillette’s portfolio through technology-led differentiation.

📅 Earnings Watch

Markets are not breaking, they are recalibrating. With geopolitics, policy credibility, and earnings all colliding, near-term leadership will depend less on headlines and more on which companies can still deliver results under pressure.

What stocks are you watching today?