Geopolitical fears ease as risk appetite returns.

U.S. stocks extended their rebound on Thursday, continuing the recovery from earlier-week volatility triggered by President Trump’s Greenland-linked Europe tariff threats. Markets responded positively after Trump confirmed a deal “framework” over Greenland and formally called off the tariffs set to begin February 1, easing geopolitical and trade concerns.

The Dow rose 306 points, while the S&P 500 and Nasdaq advanced on renewed risk appetite, supported by gains in mega-cap tech names such as Nvidia (NVDA), Microsoft (MSFT), and Meta (META). The rally followed Wednesday’s sharp reversal, which saw stocks surge after Trump ruled out using force to acquire Greenland and signaled diplomatic engagement instead.

Under the surface, market breadth remained resilient. Small caps had already shown strength earlier in the week, and Thursday’s move confirmed a broader rotation back into equities rather than a narrow megacap bounce.

While the immediate tariff risk has faded, political uncertainty remains active. Denmark reiterated that sovereignty is non-negotiable despite openness to Arctic security cooperation, keeping geopolitics on the radar. For markets, however, narrative risk is giving way to fundamentals, with investors increasingly treating policy volatility as noise rather than structural threat.

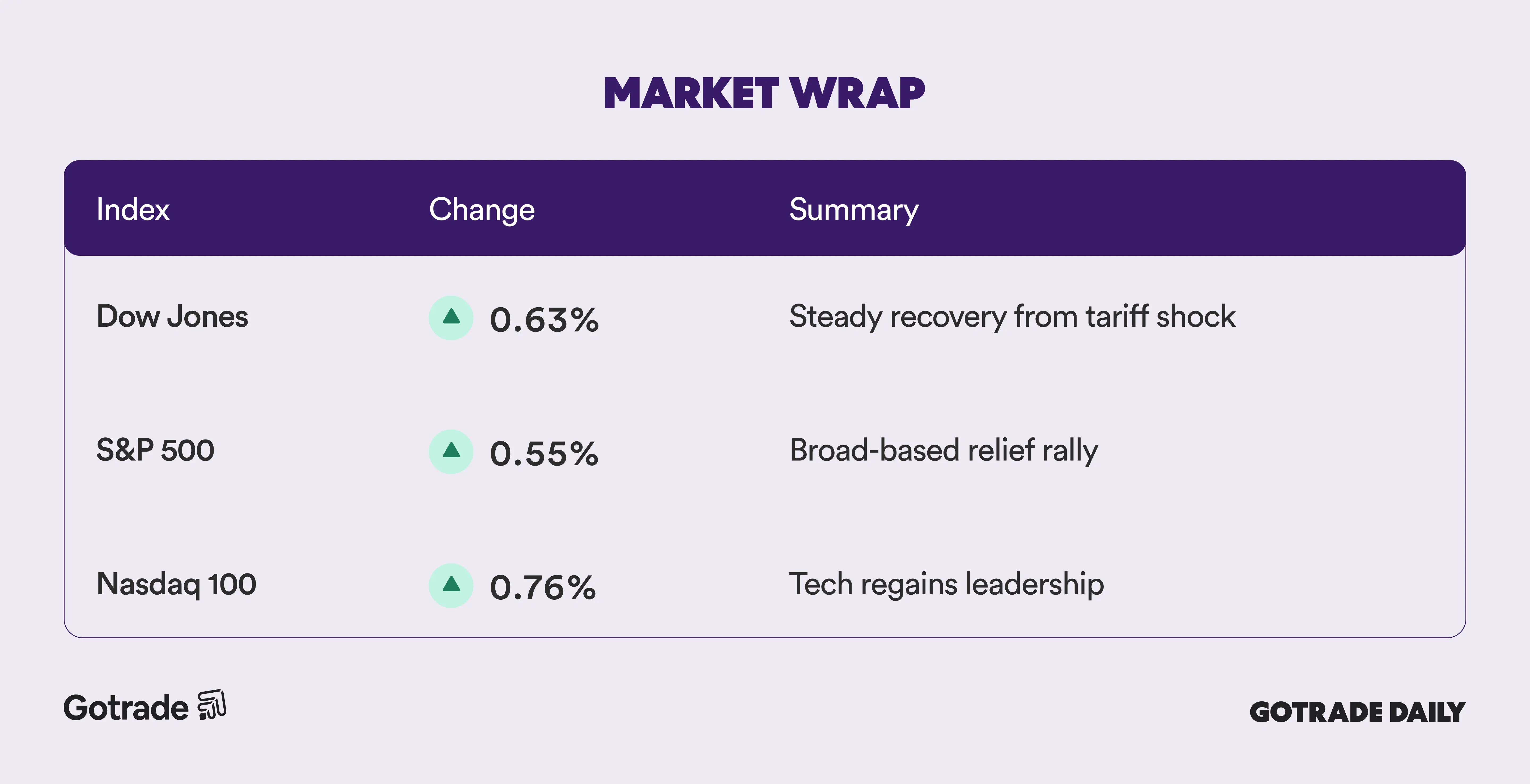

📊 Market Wrap Jan 23rd 2026

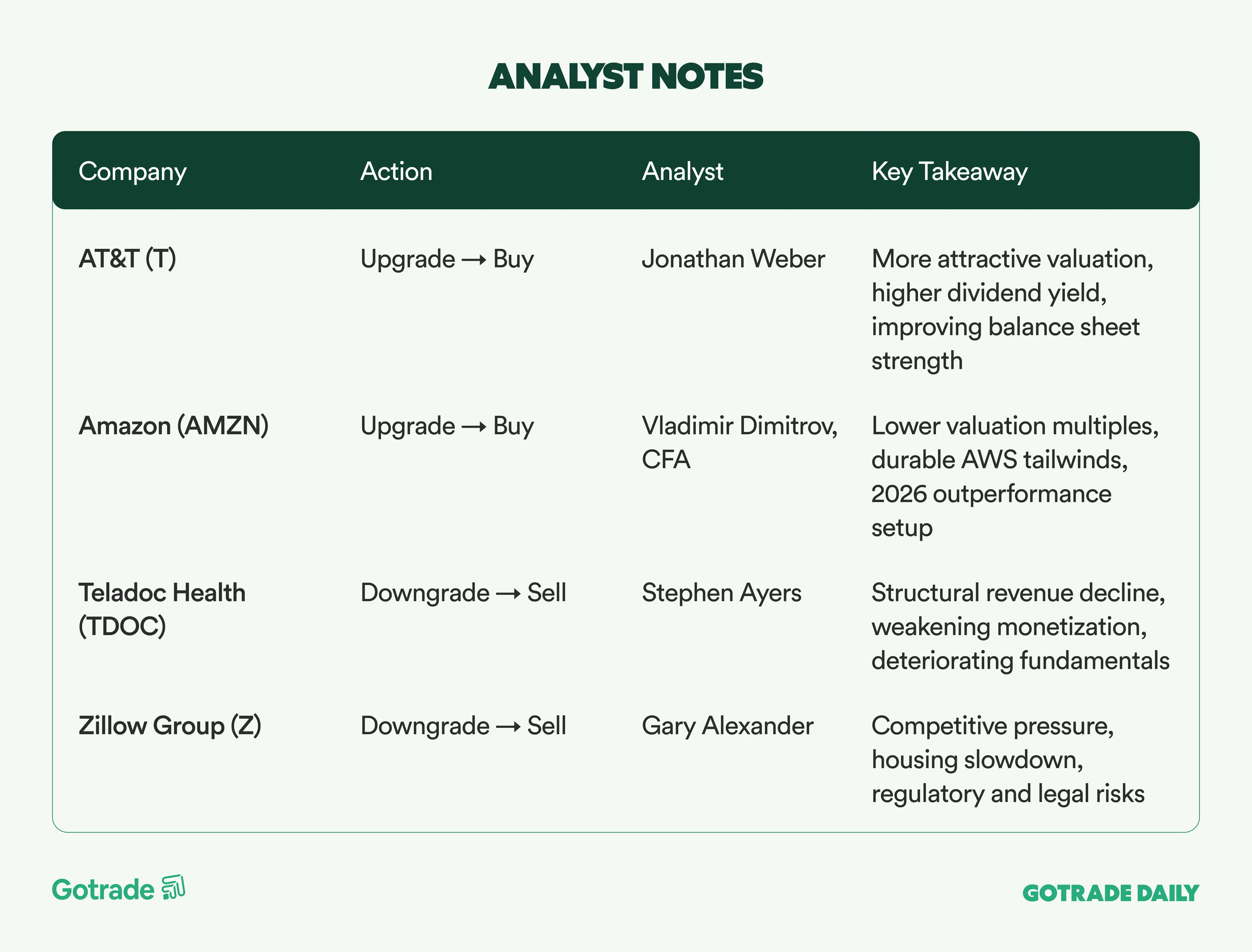

🧠 Analyst Notes

💬 Market Highlights

Trump Files $5B Lawsuit Against JPMorgan and CEO Jamie Dimon Over Alleged “Debanking”

U.S. President Donald Trump has filed a $5 billion lawsuit against JPMorgan Chase (JPM) and CEO Jamie Dimon, alleging the bank severed ties with him and his businesses for political reasons. Trump claims JPM violated good-faith business practices and engaged in unfair trade conduct. JPMorgan rejected the allegations, stating account closures are based solely on legal and regulatory risk, not political or ideological factors.

GE Aerospace Targets Up to $7.40 EPS and $8.4B Free Cash Flow in 2026

GE Aerospace (GE) guided for strong 2026 performance with EPS of $7.10-$7.40 and free cash flow of $8-$8.4 billion, driven by robust commercial aerospace demand and expanded LEAP engine MRO capacity. Management remains confident in aftermarket momentum, while acknowledging ongoing supply chain constraints and elevated R&D investment needs.

Intel Targets 45% Client Market Share; 14A Foundry Customer Decisions Expected by Late 2026

Intel (INTC) outlined a path to reach 45% client computing market share over the coming years, supported by broad adoption of Core Ultra Series 3 and initial shipments on the 18A process. In foundry services, Intel expects customers to make firm commitments on the 14A node starting in the second half of 2026 into early 2027. Near-term results remain pressured by supply constraints and margin headwinds, despite a constructive long-term outlook.

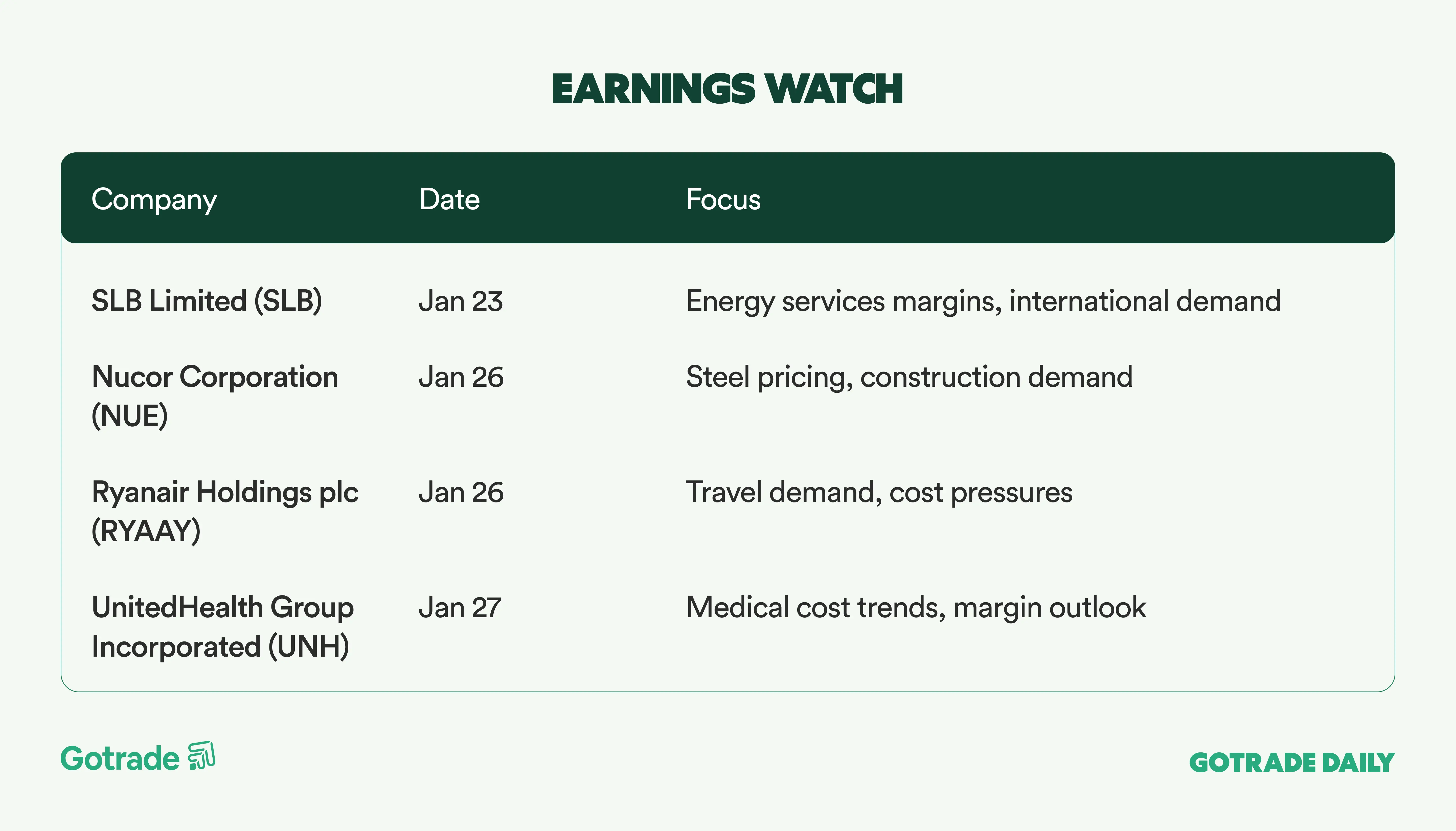

📅 Earnings Watch

Markets are not reacting to headlines alone anymore. With geopolitical risk cooling and liquidity rotating back into equities, leadership is shifting from fear-driven moves to earnings quality, balance sheet strength, and sector rotation. The rebound is real, but sustainability will be decided by fundamentals, not diplomacy.

What stocks are you watching today?