Investor focus shifts to policy direction, geopolitics, and sector leadership.

Global markets moved in a selective tone after the Federal Reserve kept its policy rate unchanged at 3.5%-3.75%, in line with expectations. While the decision itself was widely anticipated, investor attention shifted toward the broader political context surrounding Fed independence and the longer-term direction of U.S. monetary policy.

Market movements were uneven across sectors. Meta (META), Microsoft (MSFT), and Tesla (TSLA) all reported results that beat expectations, but price reactions were mixed. Meta rallied strongly in extended trading, Tesla posted modest gains, while Microsoft declined on slower cloud growth and softer margin guidance.

The S&P 500 briefly crossed the 7,000 level for the first time on an intraday basis but closed flat. The U.S. dollar strengthened, gold surged to a new record above $5,500 per ounce, and oil prices rose following heightened geopolitical tensions after President Trump’s warning toward Iran. Together, these moves reflect a market that is not fully risk-on, but increasingly selective and catalyst-driven.

With the Fed signaling no near-term shift toward monetary easing, and geopolitical and sector dynamics gaining influence, markets are entering a phase where direction is shaped more by structural positioning, sector leadership, and fundamental quality than broad macro sentiment.

📊 Market Wrap Jan 29th 2026

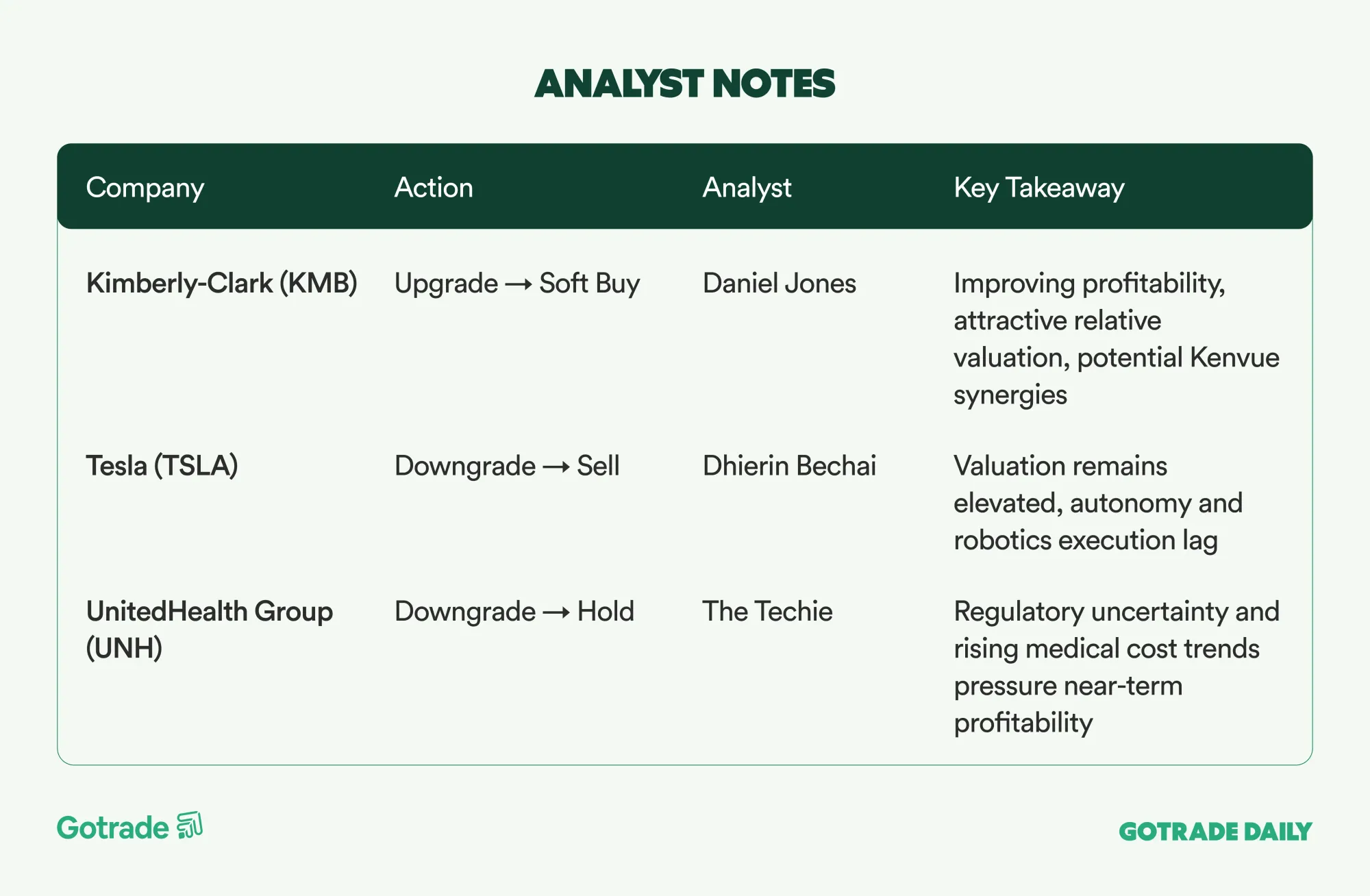

🧠 Analyst Notes

💬 Market Highlights

Microsoft Stumbles Despite Strong Results

Microsoft (MSFT) shares fell around 5% in extended trading despite beating estimates on both earnings and revenue, reflecting growing investor sensitivity to cloud growth momentum. Azure revenue grew 39% year-over-year, slightly below the prior quarter’s 40% pace, which the market interpreted as early deceleration despite strong performance across Intelligent Cloud, Microsoft 365, and AI-driven businesses. The reaction highlights a market dynamic where marginal changes in growth trajectories now matter more than headline beats.

ServiceNow Strengthens Its Position as an Enterprise AI Platform

ServiceNow (NOW) reinforced its positioning as a core enterprise AI platform after guiding for ~20% subscription revenue growth in 2026, supported by strong AI product adoption, rising large-deal volume, and disciplined cost management. Management paired optimistic growth guidance with a new US$5B share repurchase authorization, signaling confidence in both long-term platform strategy and capital allocation discipline. The combination of growth visibility, margin expansion, and balance sheet strength positions NOW as one of the clearer structural winners in enterprise AI adoption.

Lam Research Benefits From AI-Driven Semiconductor Recovery

Lam Research (LRCX) moved higher after reporting strong Q2 results, with revenue up 22% year-over-year and forward guidance above market expectations. Management highlighted accelerating demand driven by AI, advanced packaging, and next-generation semiconductor manufacturing complexity, reinforcing the cyclical recovery narrative in semiconductor equipment. The results strengthen the view that AI infrastructure spending is translating into tangible order flow across the chip supply chain.

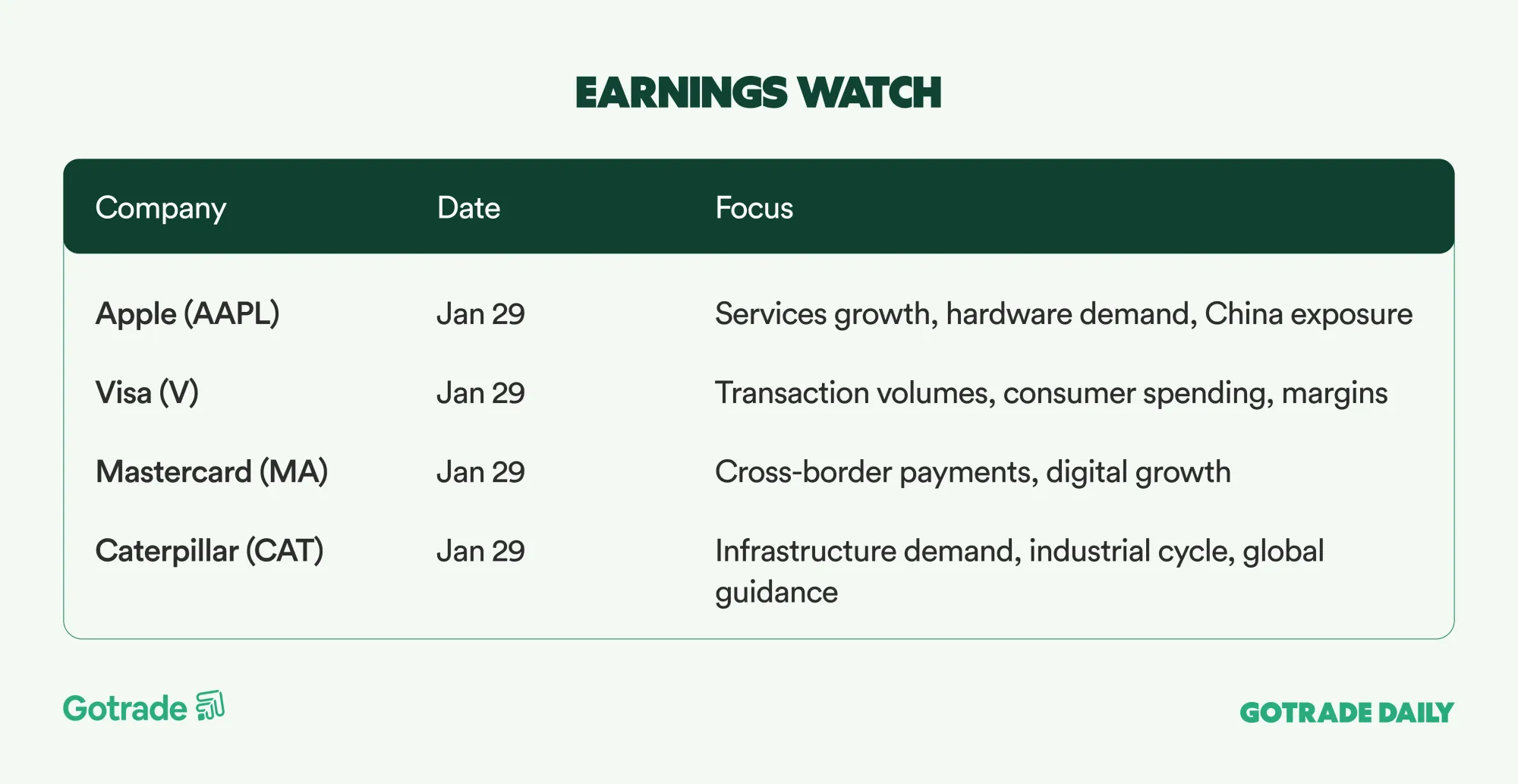

📅 Earnings Watch

Markets are moving into a selective phase, where near-term direction is driven by policy signals, sector structure, and fundamental quality rather than headline-driven macro sentiment.