Trump heads to Davos as markets rotate near record highs.

U.S. stocks enter the heart of earnings season just below record highs, but leadership is changing. Instead of another straight-line rally led by mega-cap tech, money is rotating into small caps, industrials, and AI infrastructure. The Russell 2000 and equal-weighted S&P 500 both closed at fresh highs, showing broader participation even as the Nasdaq loses momentum.

This rotation matters for traders. Hardware, defense, and energy infrastructure are now leading the AI trade, while many software names start 2026 in correction territory. Investors are looking for AI exposure without paying peak multiples for the “Magnificent Seven,” shifting focus to semiconductor equipment, power, and industrial automation.

Global politics are back in focus as President Trump heads to Davos. Tensions with the EU over tariffs, Greenland, and trade policy risk spilling into a broader trade conflict. Any change in tone from Trump could quickly move equities, currencies, and commodities.

The Federal Reserve story remains a market catalyst. Trump is expected to signal his pick for the next Fed Chair, with prediction markets favoring Kevin Warsh. With inflation still sticky, the choice could reshape rate expectations and reprice bonds, the dollar, and growth stocks.

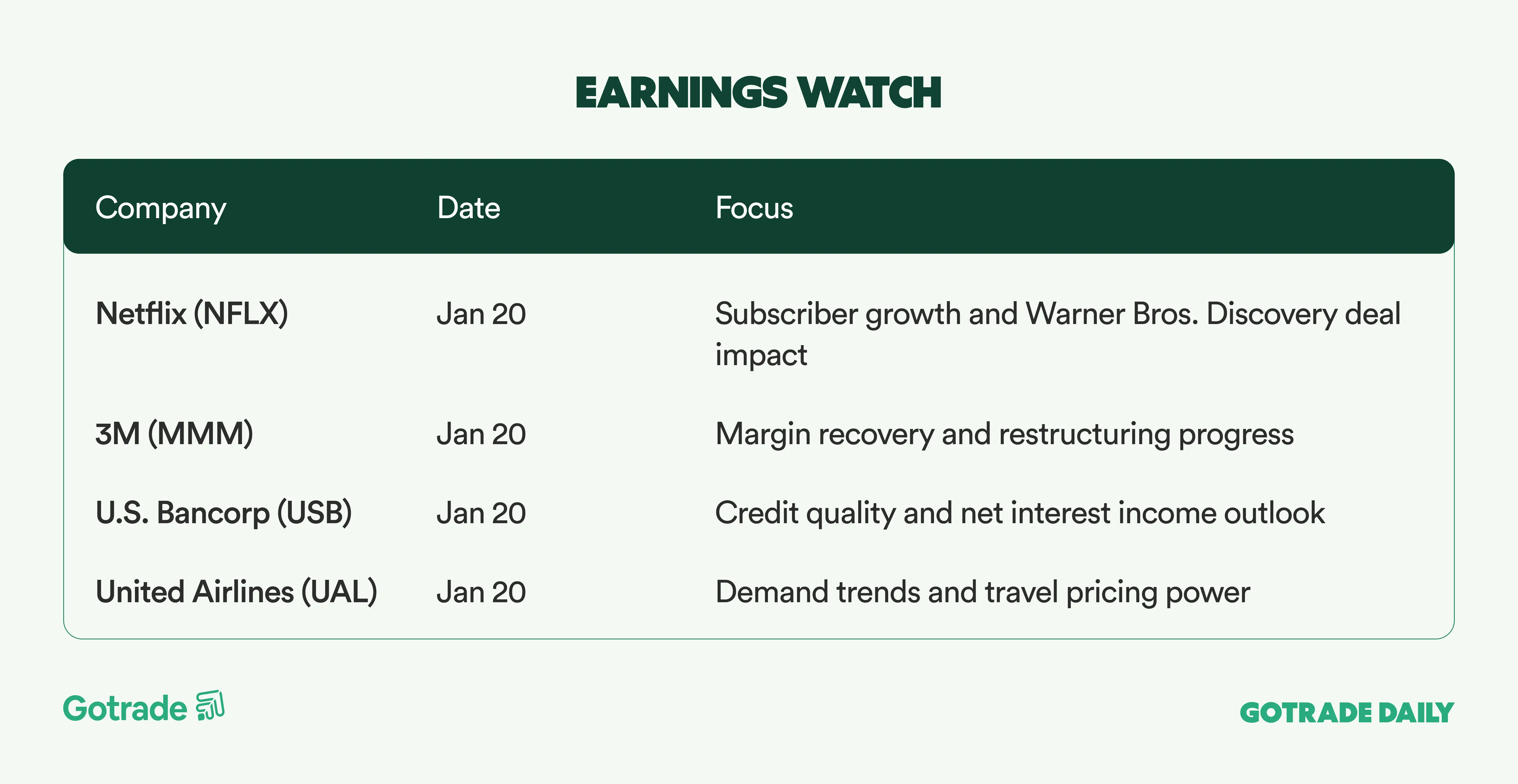

Earnings are the real test. Netflix (NFLX) and Intel (INTC) headline the week, giving traders a read on streaming demand, M&A risk, and the AI hardware cycle. Their results will help decide whether this new market leadership can hold.

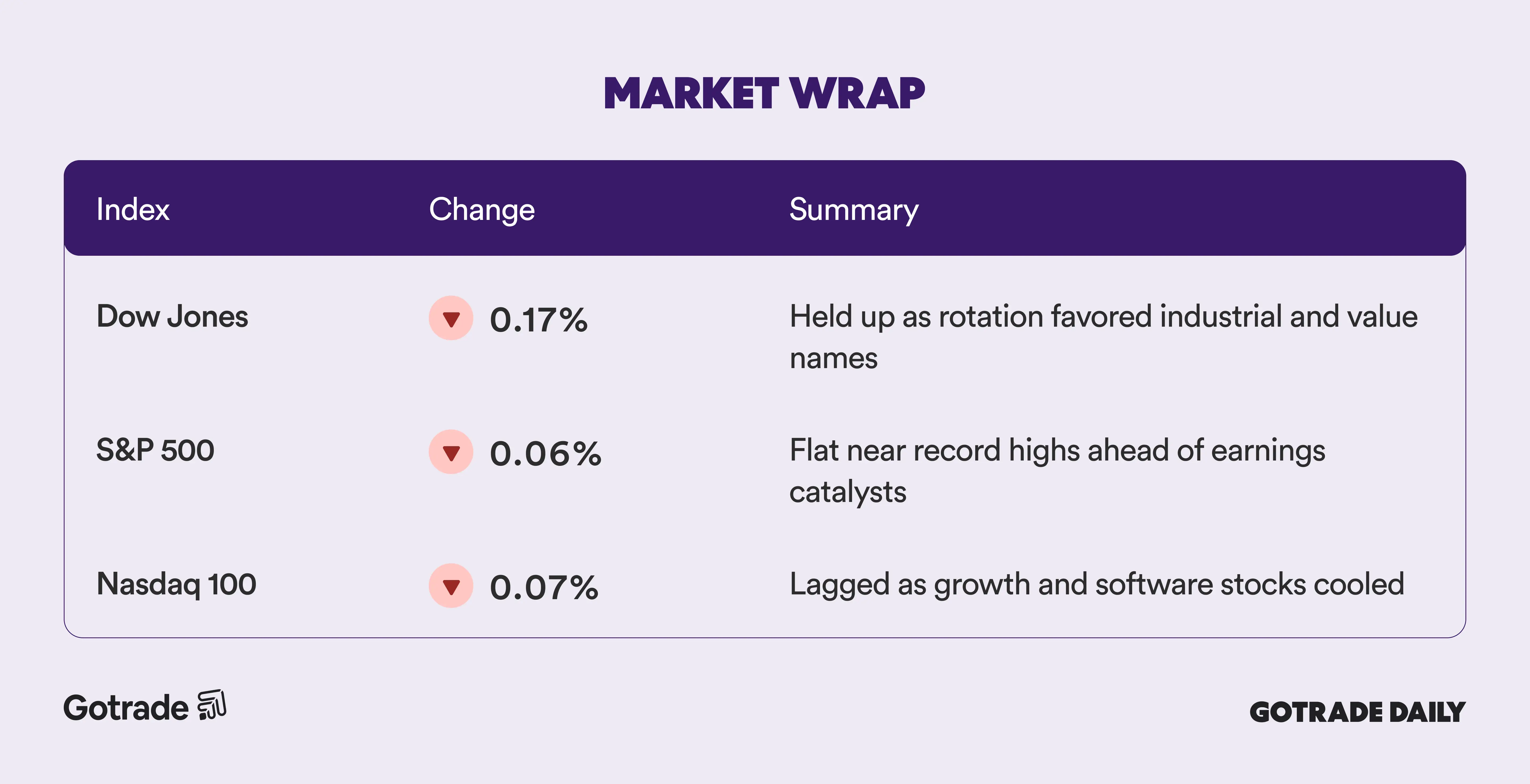

📊 Market Wrap Jan 20th 2026

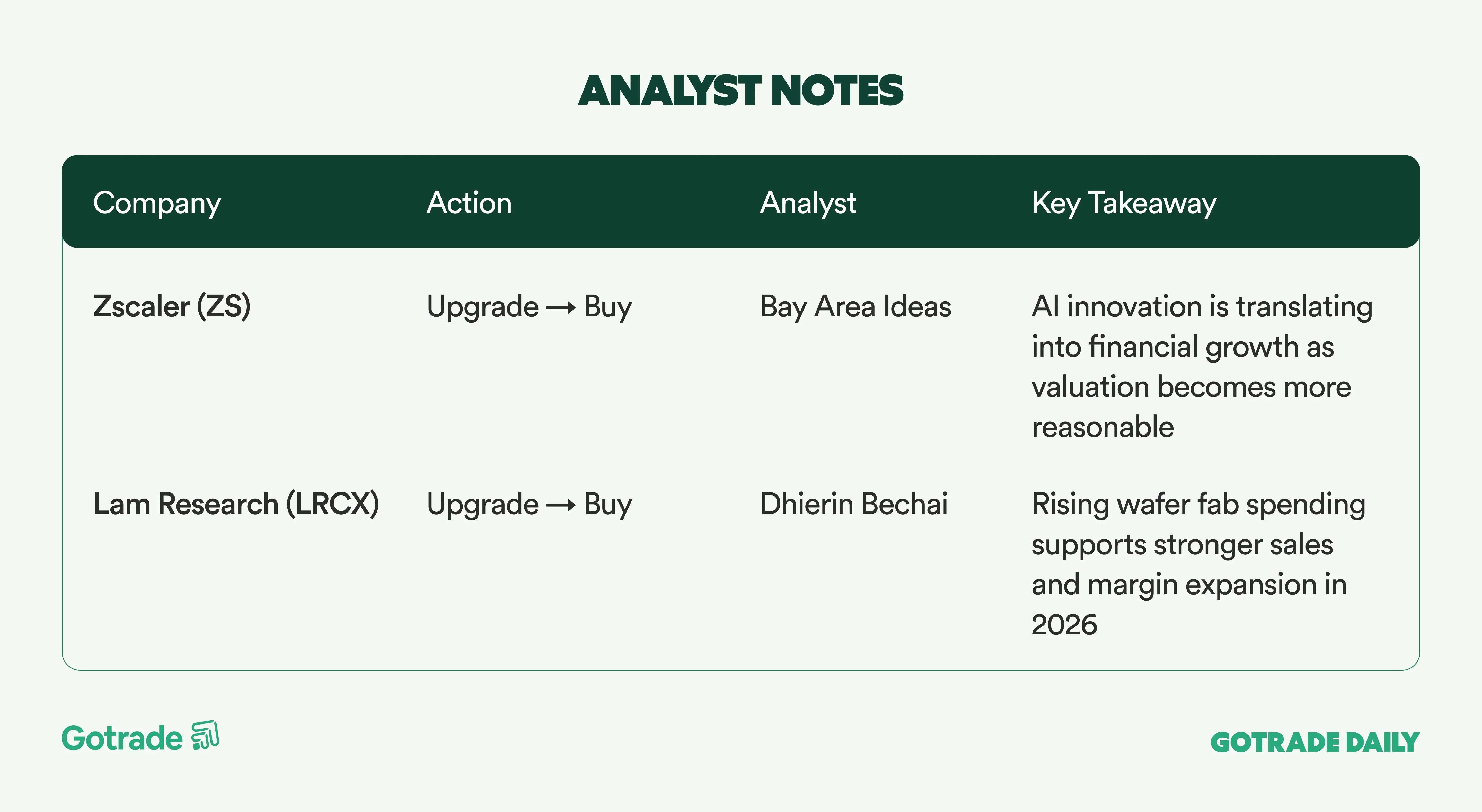

🧠 Analyst Notes

💬 Market Highlights

Target Faces Renewed Backlash After Immigration Detentions at Minnesota Store

Target (TGT) is facing renewed political and consumer backlash after federal Border Patrol agents detained two employees outside a store in Richfield, Minnesota, an incident that sparked protests and fresh boycott calls.

The detentions, which occurred in a public area of the store property, come at a sensitive time amid heightened tensions around immigration enforcement in the Minneapolis area. With Target remaining publicly silent, analysts warn that continued scrutiny could further pressure the retailer’s brand, which has already been weighed down by prior political controversies and declining consumer sentiment.

Israel Moves to Open Ride-Hailing Market to Boost Competition and Cut Costs

Israel has approved draft legislation that would allow ride-hailing platforms such as Uber (UBER) and Lyft (LYFT) to operate in the country, aiming to increase competition and lower transportation costs.

The proposal would establish a regulatory framework covering driver vetting, insurance, and vehicle safety, while easing the transition for the existing taxi industry. If fully approved by parliament, the move would mark a significant shift in Israel’s transportation market and could improve service availability during peak hours and weekends.

Elon Musk Seeks Up to $134 Billion in Damages From OpenAI and Microsoft

Elon Musk is seeking damages ranging from $79 billion to $134 billion from OpenAI and Microsoft (MSFT), alleging fraud tied to OpenAI’s shift away from its original nonprofit mission.

Musk claims he is entitled to a share of OpenAI’s current valuation, arguing that both companies benefited improperly from his early contributions. OpenAI has rejected the claims as baseless, while Microsoft has declined to comment. The case is set to proceed to a jury trial later this year, raising fresh legal overhangs for both companies.

📅 Earnings Watch

Markets are not breaking, they are rotating. With geopolitics, the Fed, and earnings colliding this week, leadership will be decided by results, not narratives.

What stocks are you watching today?