Rate cut momentum offsets tech pressure after Oracle earnings.

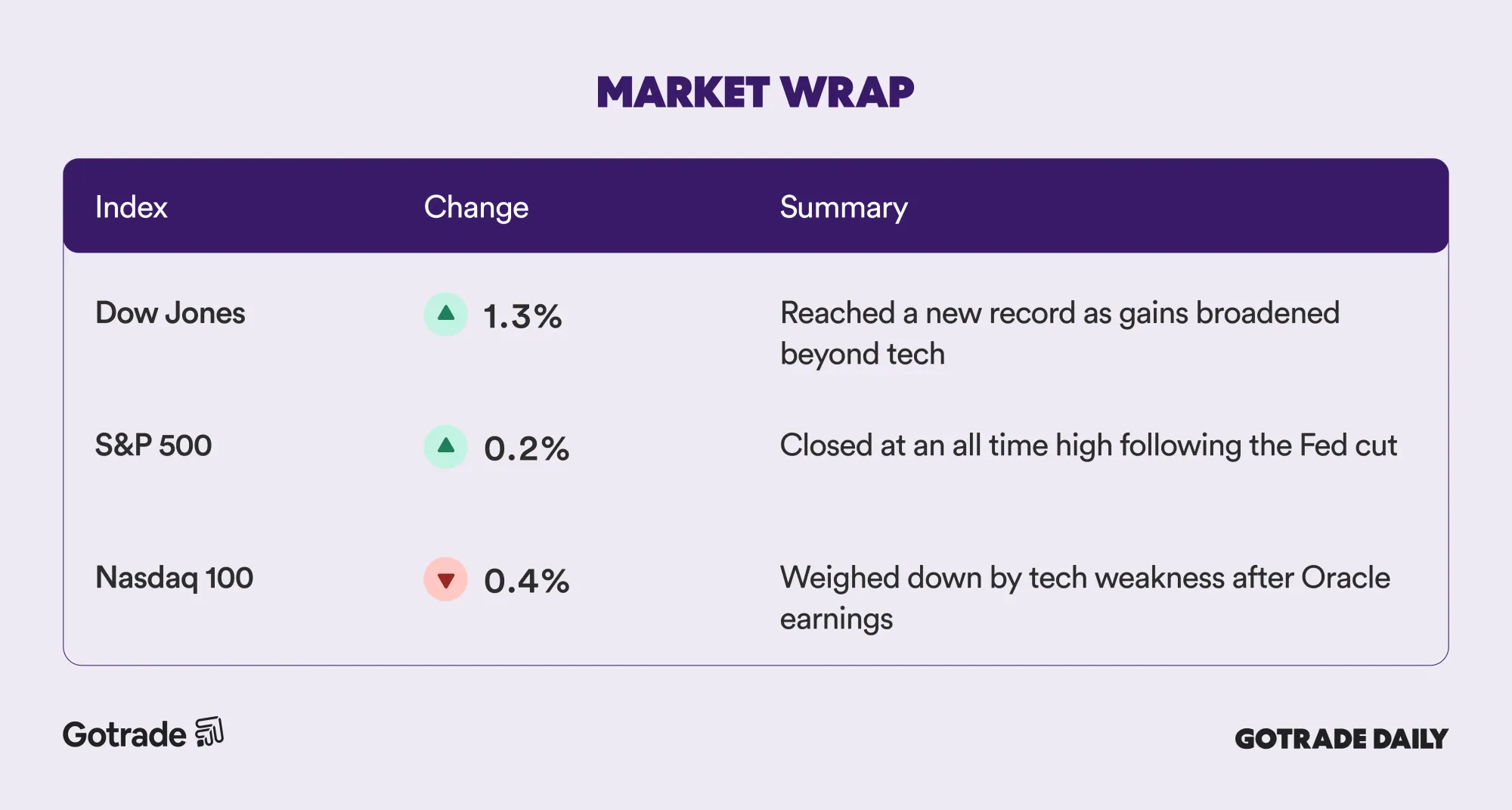

US stocks mostly moved higher on Thursday, with the Dow Jones Industrial Average and S&P 500 closing at fresh record highs. The Dow surged more than 650 points, while the S&P 500 climbed above 6,900 for the first time. Technology shares lagged, weighing on the Nasdaq as concerns around AI spending resurfaced.

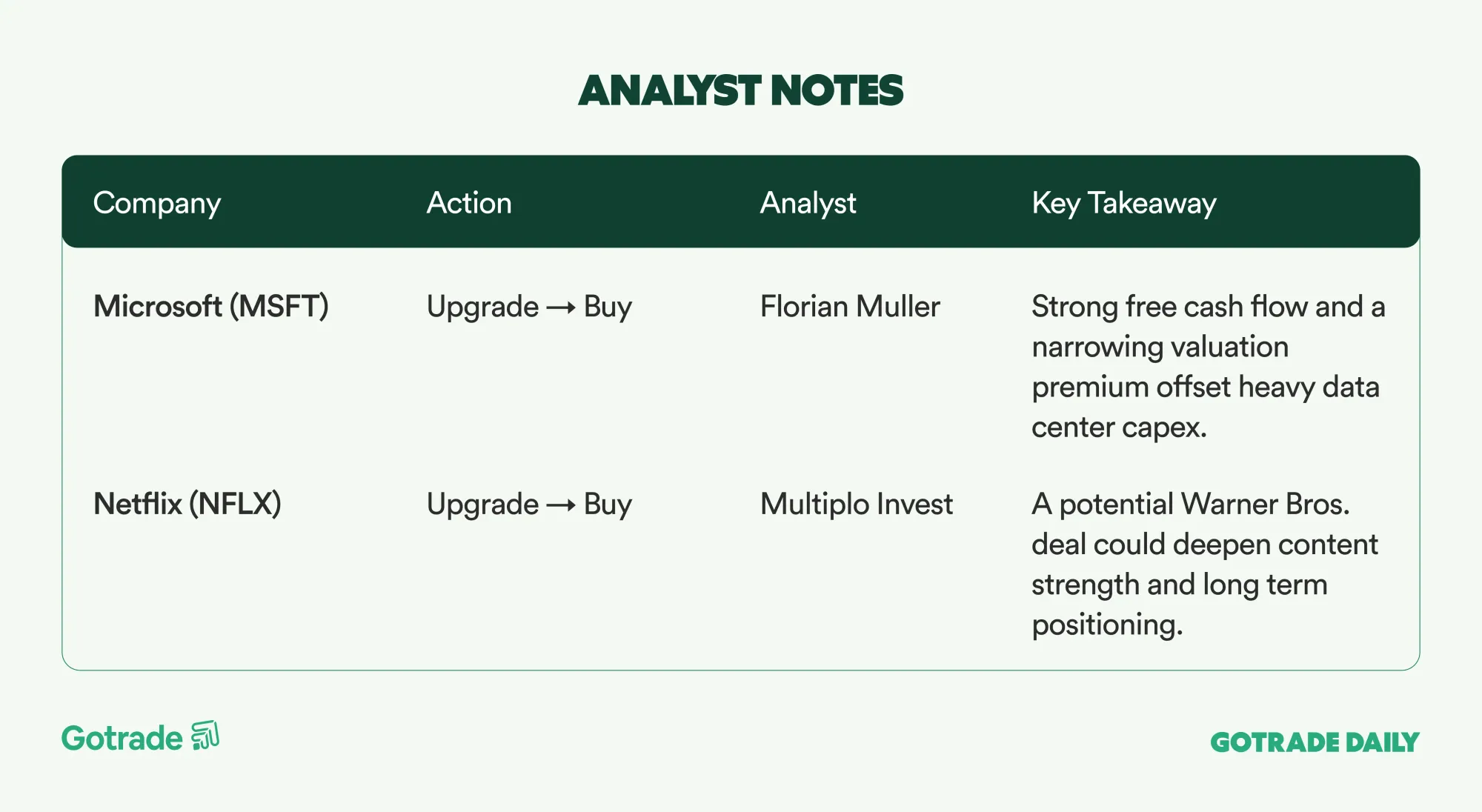

The rally extended Wednesday’s post rate cut momentum, even as Oracle (ORCL) fell sharply following earnings that missed cloud expectations and pointed to a sizable increase in data center investment. The results revived debate around AI capex discipline and pressured several large tech names, including Nvidia (NVDA).

For traders, attention is shifting from the rate cut itself to how policy messaging and earnings trends interact. While the Fed signaled a slower easing path ahead, Chair Powell emphasized economic resilience, keeping risk appetite supported despite growing dispersion across sectors.

📊 Market Wrap Dec 12 2025

🧠 Analyst Notes

💬 Market Highlights

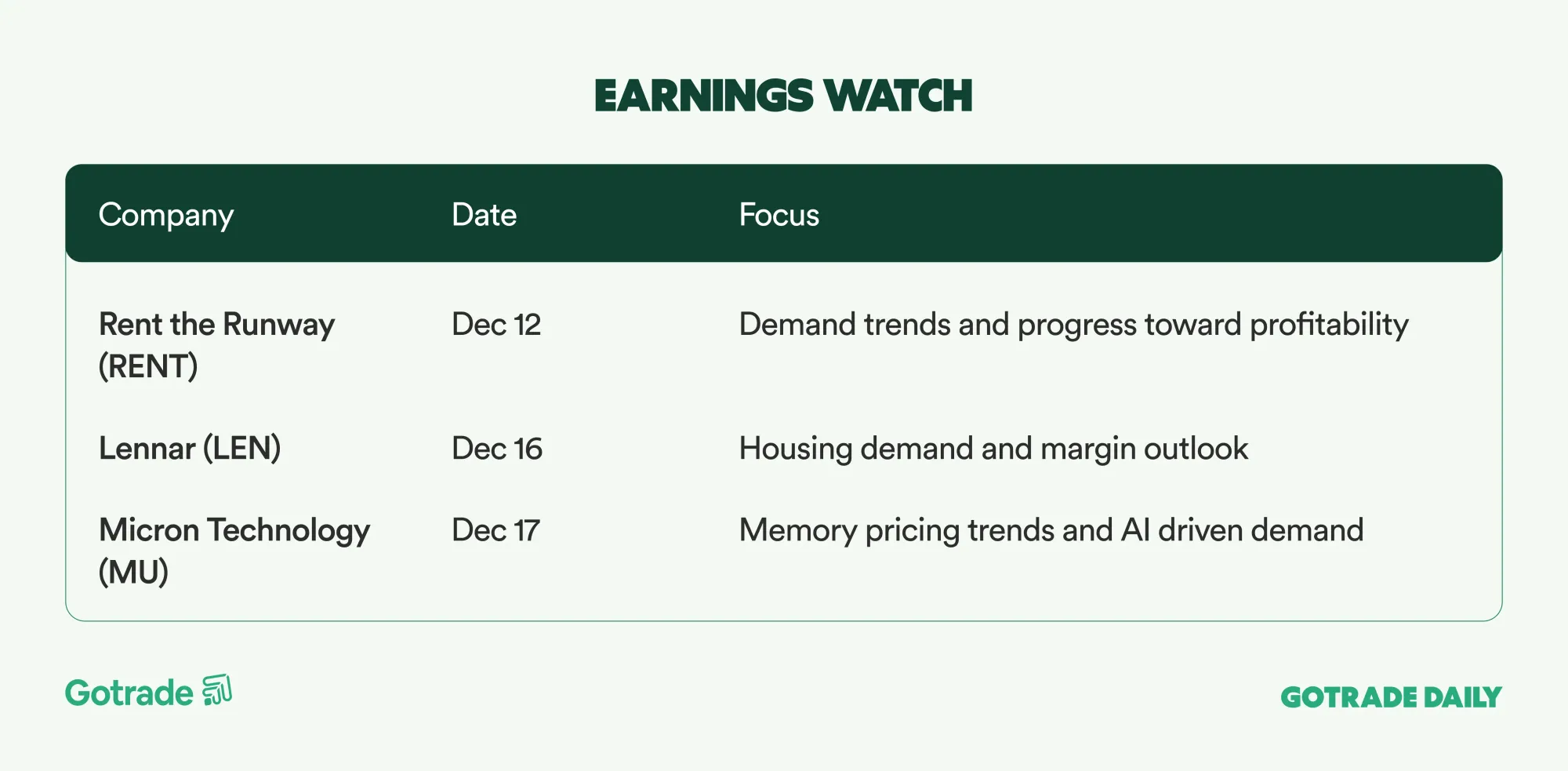

Broadcom Strengthens AI Spending Narrative After Q4 Beat

Broadcom (AVGO) reported fiscal Q4 results and forward guidance that exceeded expectations, supported by continued strength in AI driven semiconductor demand. Semiconductor revenue surged 61% year over year, while infrastructure software also delivered solid growth. Management guided Q1 revenue to $19.1 billion, well above consensus, reinforcing confidence that hyperscaler and enterprise AI spending remains intact despite broader concerns around capex discipline.

Costco Balances Expansion Plans With Digital and AI Execution

Costco (COST) delivered a solid Q1 performance, highlighted by steady membership growth and resilient operating metrics. Management reiterated its long term goal of more than 30 net warehouse openings per year, supported by creative real estate strategies to manage capital intensity. Digital initiatives and targeted AI use cases are increasingly contributing to productivity gains, while renewal rates remain an area under close watch.

Lululemon Athletica Leans on International Growth Amid U.S. Softness

Lululemon Athletica (LULU) outlined a path toward approximately $11 billion in revenue for fiscal 2025, driven primarily by strong international momentum, particularly in China. U.S. demand showed signs of moderation, while margin pressure persisted due to tariffs and higher markdowns. Management raised full year EPS guidance and emphasized product innovation and operational efficiency as key levers heading into 2026.

📅 Earnings Watch

Markets closed higher overall, with investors balancing policy clarity and selective sector pressure. As the year draws to a close, positioning and risk management remain front of mind amid thinner liquidity.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.