Retail stocks show resilience as seasonal spending picks up.

Markets opened December on weaker footing as volatility extended into the new month. US equities slipped on Monday, snapping a five day winning streak, with the S&P 500 down 0.53 percent, the Nasdaq off 0.38 percent, and the Dow Jones falling 0.9 percent. The pullback followed a sharp selloff in Bitcoin, which slid about 6 percent and pressured risk assets across the board. It was Bitcoin’s worst day since March and added to broader caution inside the AI trade as profit taking hit names like Broadcom and Super Micro Computer.

At the same time, retail stocks stood out as a rare area of strength. Holiday shopping momentum lifted names like Walmart and Ulta, while the SPDR S&P Retail ETF (XRT) extended its recent run, pushing its five day gain above 6 percent and bucking the market’s downturn. The move reflects early strength in holiday demand and underscores a key seasonal trend: consumer activity often acts as a stabilizer when broader markets wobble in early December.

Despite Monday’s slide, sentiment remains supported by favorable seasonality and expectations of a Fed rate cut next week. December has historically been one of the strongest months for the S&P 500, averaging more than a 1 percent gain, and last week’s rally showed that buyers remain active when valuations cool. Strategists continue to highlight resilient consumer spending and the likelihood of easier monetary policy as near term anchors for market stability.

📊 Market Wrap Dec 2nd 2025

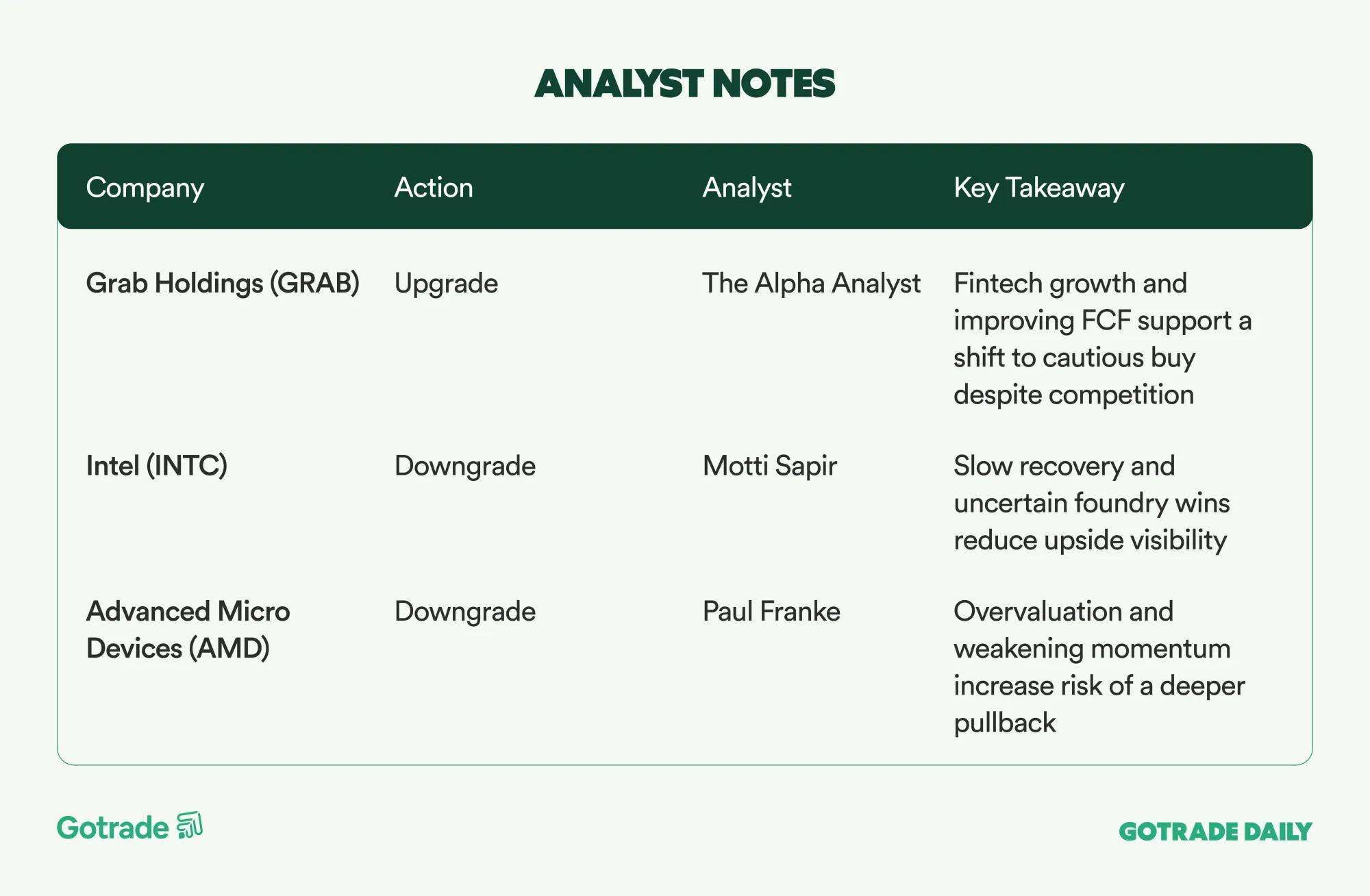

🧠 Analyst Notes

💬 Market Highlights

MongoDB Atlas and AI Demand Drive Strong Growth

MongoDB (MDB) posted Q3 2026 revenue of 628.3 million dollars, up 19 percent year over year, with Atlas growing 30 percent and now representing 75 percent of total revenue. Management raised Q4 guidance to 665 to 670 million dollars and expects Atlas growth to reaccelerate toward 27 percent. The company cited cloud modernization, early stage AI workloads, and AI native startups moving away from relational databases as core demand drivers. Non GAAP operating margin expanded to roughly 20 percent with strong free cash flow, reinforcing MongoDB’s positioning as an AI ready data platform.

Apple Strengthens AI Leadership with New Executive Hire

Apple (AAPL) appointed Amar Subramanya as VP of AI, reporting directly to Craig Federighi. Subramanya spent 16 years at Google and also served as a Corporate VP of AI at Microsoft, contributing to the Gemini assistant ecosystem. Meanwhile, long standing AI executive John Giannandrea will retire in spring 2026 after a transition period. The moves signal a more assertive AI strategy as Apple prepares a more personal, next generation version of Siri and works to close perceived gaps relative to Google and Microsoft.

Hilton Issues 1 Billion Dollar Bond to Refinance 2028 Debt

Hilton (HLT) priced 1 billion dollars in senior notes maturing in 2034 with a 5.500 percent coupon.About half of the proceeds will fully repay its existing 5.750 percent notes due 2028, with the remainder allocated to general corporate purposes. The transaction effectively extends debt maturity while modestly reducing interest cost, a move typically seen as disciplined balance sheet management assuming sector demand remains steady.

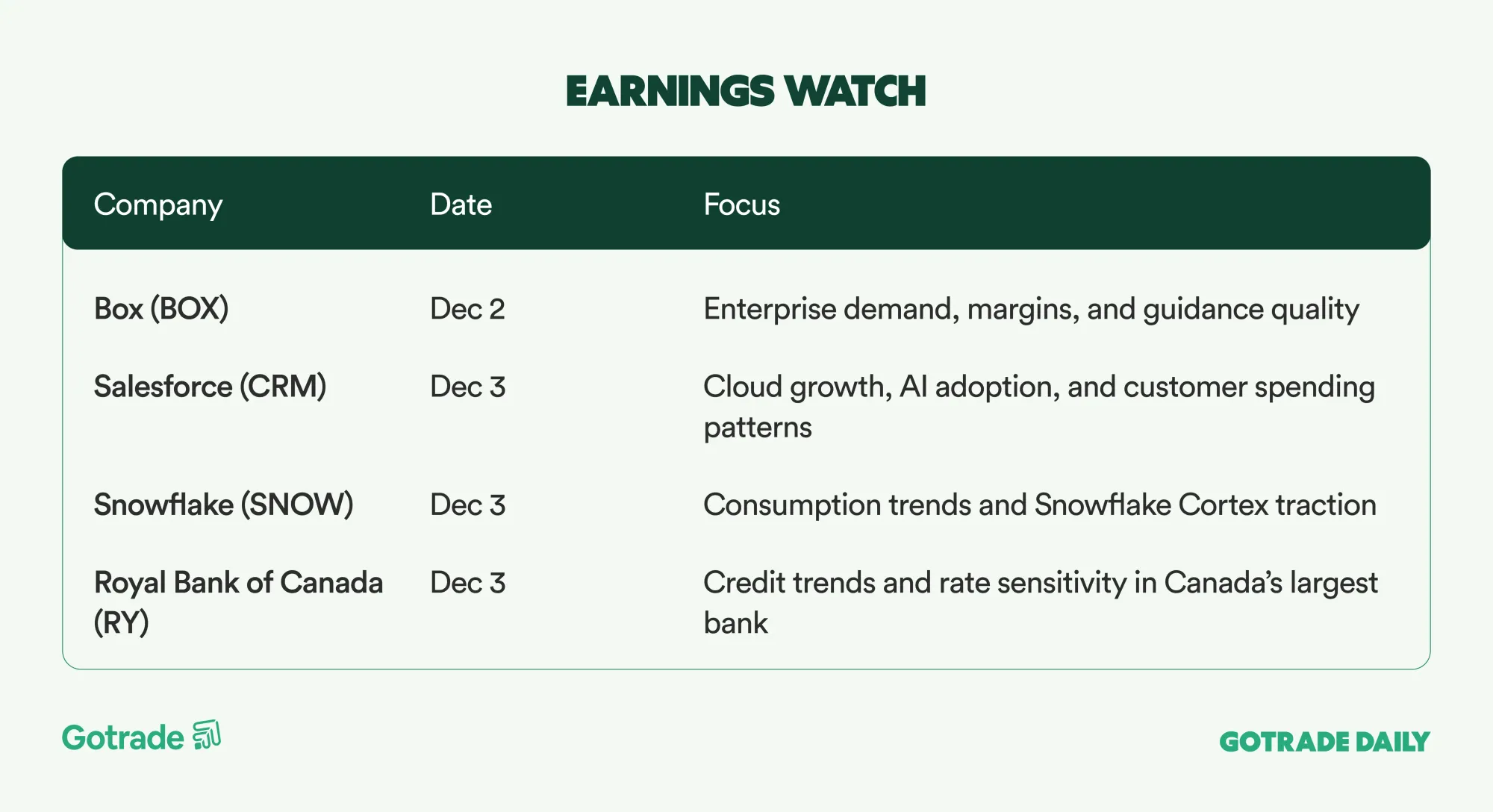

📅 Earnings Watch

Markets enter December with seasonal tailwinds, rising expectations of a Fed rate cut, and renewed attention on crypto driven volatility. Traders will be watching how risk appetite stabilizes as new data and sector rotation shape the tone for the week.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.