Investor focus shifts toward AI dynamics, geopolitics, and pressure across Big Tech.

Global markets moved in a selective tone after Apple (AAPL) reported strong earnings, but investor reaction remained restrained. Apple posted a 16% year-over-year revenue increase in its fiscal first quarter, driven by robust iPhone demand and a current-quarter revenue outlook above market expectations. Despite the strong numbers, AAPL shares rose only modestly in extended trading, reflecting investor caution around Apple’s positioning in the AI race.

Big Tech dynamics became increasingly polarized. Meta Platforms (META) surged as investors saw clear signs that AI investments are translating into profitability, while Microsoft (MSFT) sold off sharply amid concerns over rising capital expenditure and a slowdown in cloud growth. Pressure on MSFT weighed heavily on tech indices and reinforced the market’s selective leadership structure.

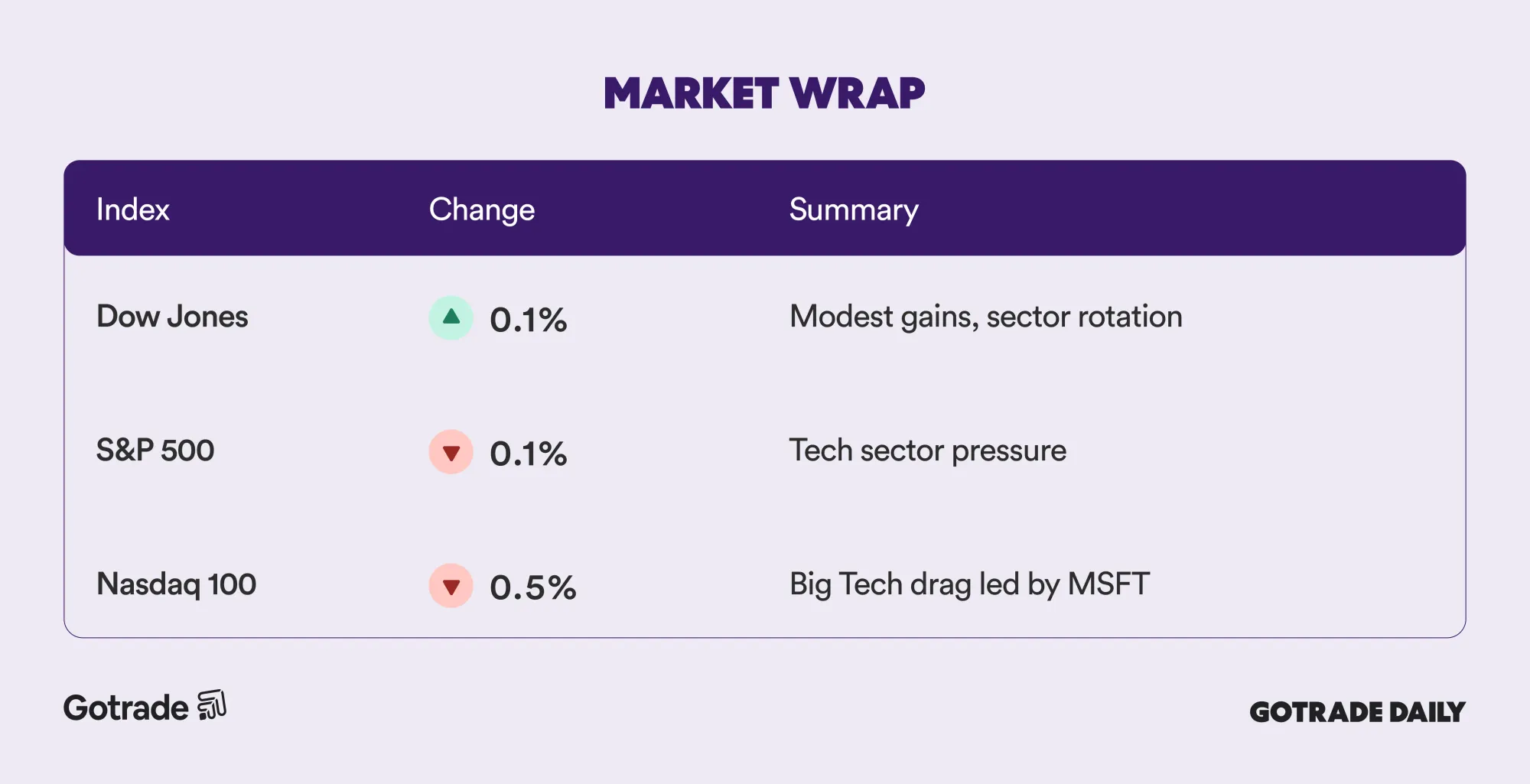

The S&P 500 closed slightly lower, the Nasdaq declined more sharply, while the Dow Jones edged higher. Risk assets such as cryptocurrencies weakened, while gold rebounded after an intraday pullback, having earlier reached a new all-time high. Oil prices jumped sharply as geopolitical tensions rose following renewed rhetoric on Iran.

With the combination of AI investment cycles, geopolitical risk, and diverging performance among large-cap tech stocks, markets are entering a phase where price action is driven more by sector selection and company-specific catalysts than by a single macro narrative.

📊 Market Wrap Jan 30th 2026

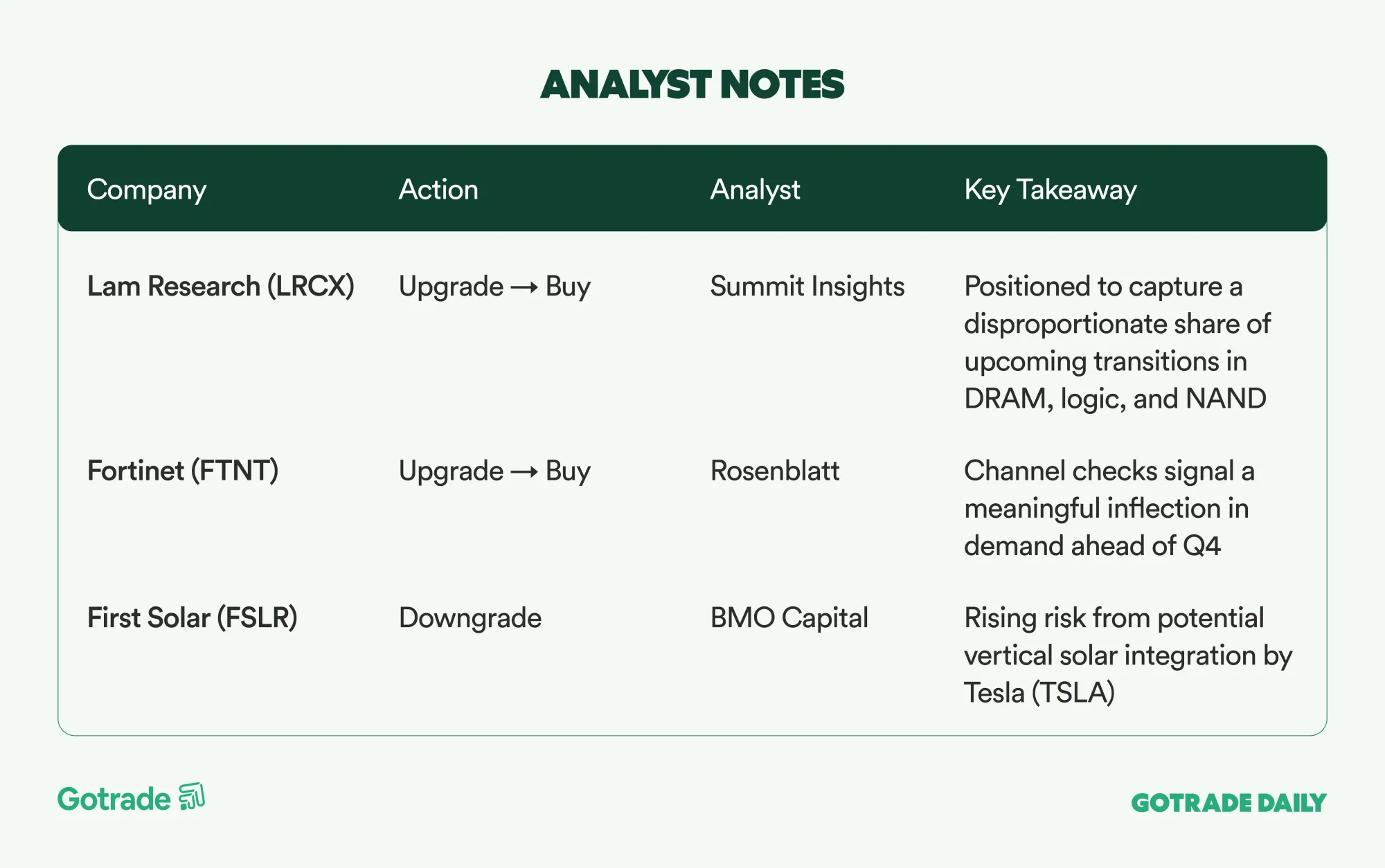

🧠 Analyst Notes

💬 Market Highlights

Visa Expands Beyond Payments Into Digital Financial Infrastructure

Visa (V) delivered a strong start to fiscal 2026, reporting 15% year-over-year net revenue growth and guiding for low double-digit adjusted net revenue growth for the full year, supported by resilient consumer spending and accelerating value-added services.

Management highlighted rapid expansion in tokenization, stablecoins, Visa Direct, and agentic commerce, with stablecoin settlement reaching a US$4.6B annualized run rate and value-added services now driving nearly half of overall revenue growth. The results position Visa not just as a payments network, but as a growing digital infrastructure platform across commercial payments, money movement, and programmable finance.

Deckers Raises Guidance as HOKA and UGG Sustain Global Momentum

Deckers Outdoor (DECK) raised its FY2026 revenue outlook to up to US$5.425B, driven by sustained double-digit growth in HOKA and resilient demand for UGG across global markets. Management pointed to balanced growth across direct-to-consumer and wholesale channels, strong international expansion, and disciplined inventory and pricing strategy, while also lifting gross margin and EPS guidance. The update reinforces Deckers’ positioning as a structurally strong consumer brand platform with multi-brand growth engines and improving operating leverage.

Dolby Positions Itself as a Scalable IP and Platform Business

Dolby Laboratories (DLB) raised full-year guidance and outlined a 15%–20% long-term growth target for Dolby Atmos, Dolby Vision, and its imaging patent portfolio, supported by expanding partnerships in automotive, TV manufacturing, and streaming platforms.

Management highlighted rapid OEM adoption, deeper integration with Qualcomm’s automotive platform, and growing presence across Meta’s ecosystem, while accelerating monetization through licensing and patent pools. The strategy positions Dolby as a scalable IP and technology infrastructure provider rather than a traditional media licensing business.

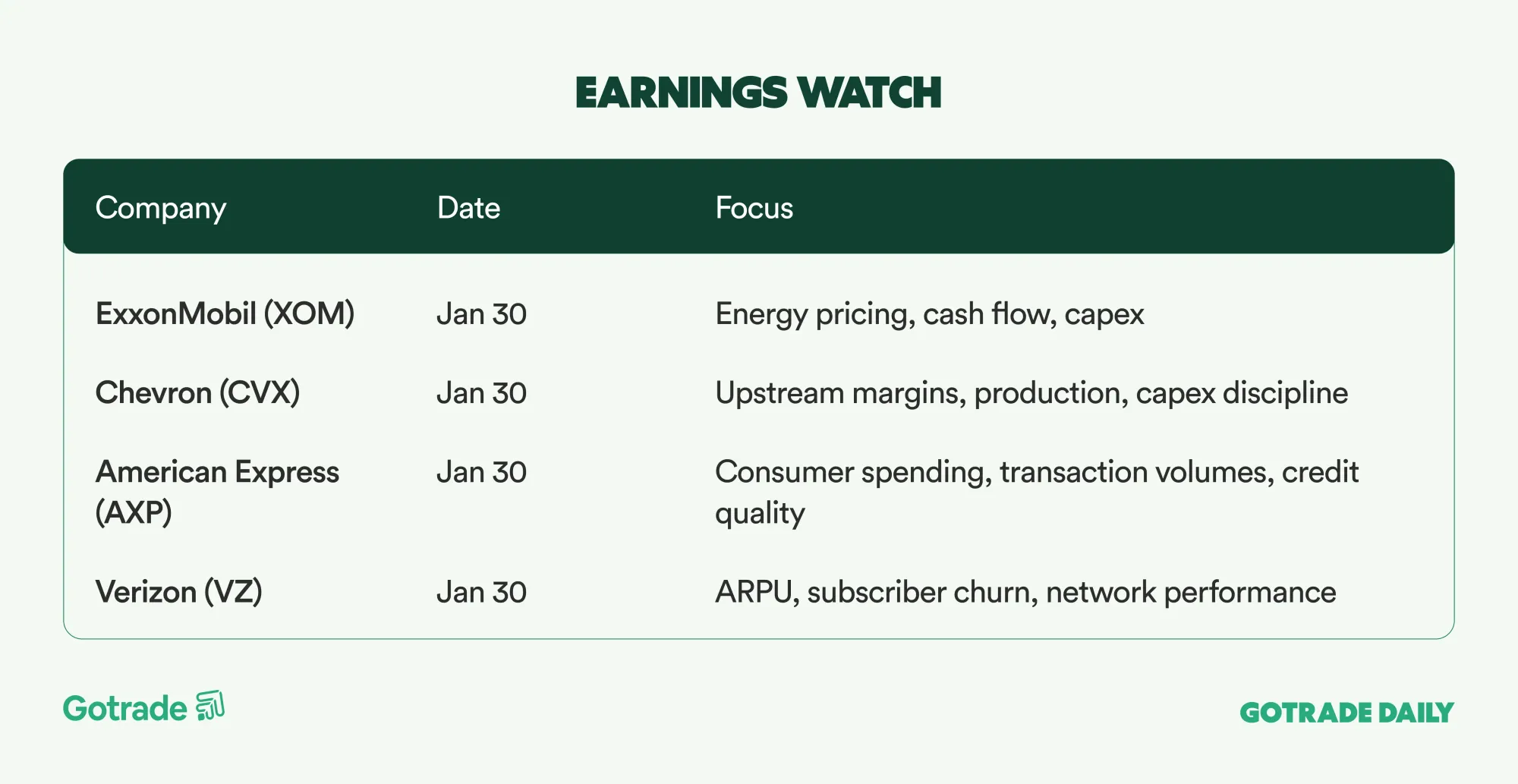

📅 Earnings Watch

Markets are moving into a selective phase, where near-term direction is shaped by sector dynamics, fundamental quality, and specific catalysts, rather than broad macro sentiment.

What stocks are you watching today?