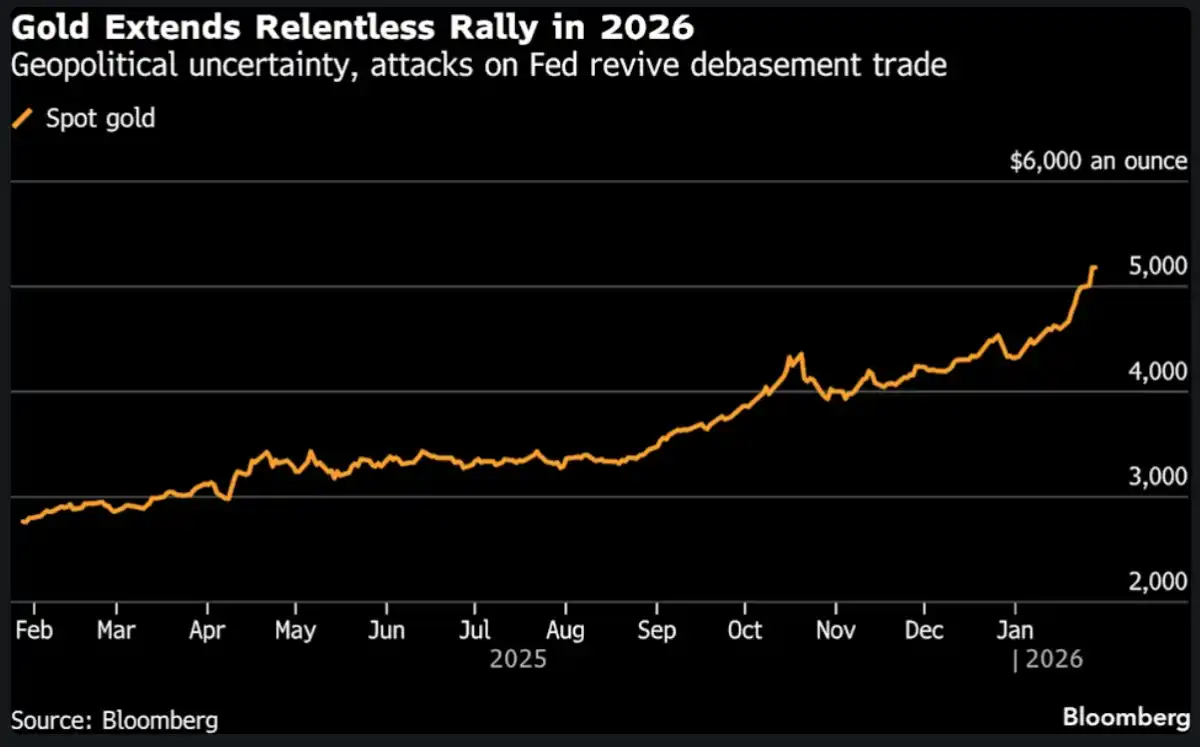

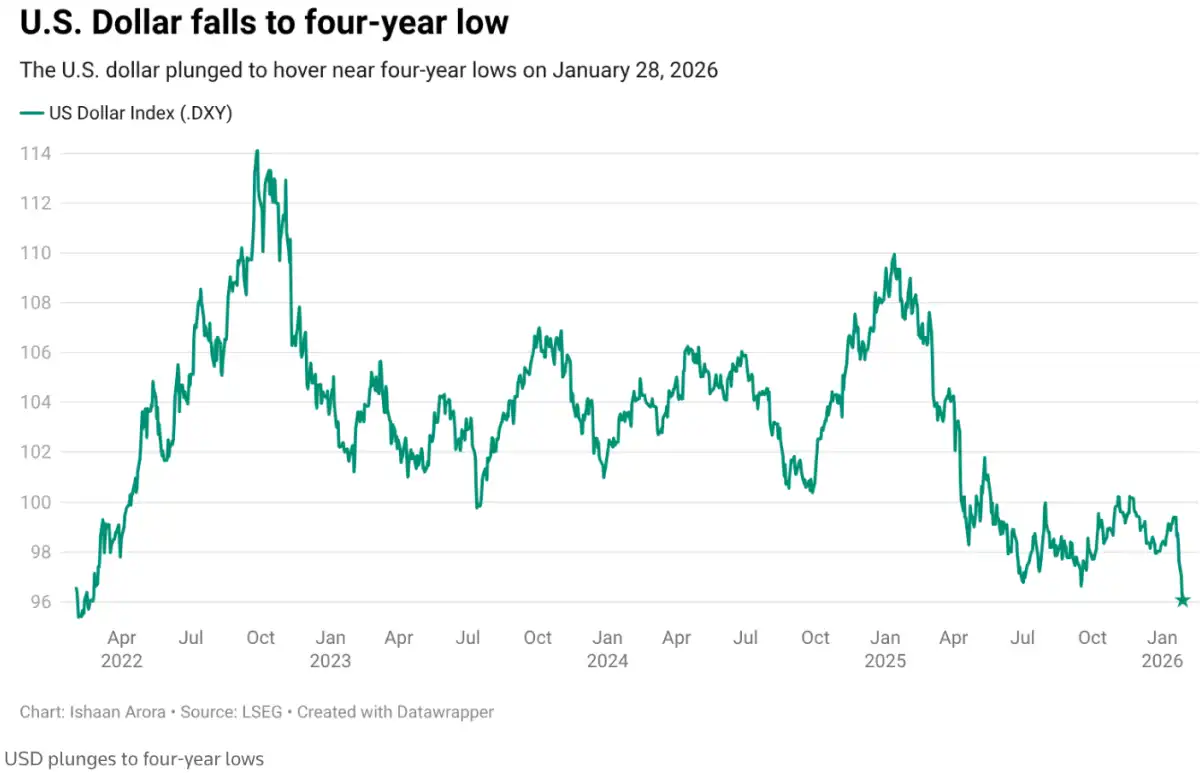

Gotrade News - Gold prices skyrocketed past the psychological $5,300 mark, clocking a fresh all-time high on Wednesday (Jan 28). The surge is largely fueled by a weakening US dollar and market sentiment reacting to President Donald Trump's latest take on currency.

Trump openly stated he isn't worried about the greenback hitting a four-year low. For real asset investors, this is a major green flag, as fiat currency weakness often sends capital fleeing into hedges like gold.

Key Takeaways:

-

Gold prices hit a record above $5,300, while silver is up nearly 60% this year.

-

President Trump is unfazed by the sliding US dollar, sparking market volatility.

-

Speculation about a more dovish Fed Chair is adding fuel to the fire.

The US dollar index took a 1.1% nosedive after Trump told reporters in Iowa that currency volatility is "great." A weaker dollar makes dollar-denominated commodities cheaper for overseas buyers, boosting global demand.

Bond traders are now ramping up bets on a softer monetary policy from the Federal Reserve (The Fed). Rumors are swirling that BlackRock executive Rick Rieder might replace Jerome Powell, potentially bringing a more aggressive rate-cutting approach.

A low-rate environment is historically bullish for gold prices, which don't pay interest. Analysts at Deutsche Bank are even projecting the metal could hit $6,000 this year if this investment craze keeps up.

Beyond monetary policy, geopolitical risks like trade tensions and tariff threats are pushing investors toward safety. Uncertainty over the Trump administration's stance on Fed independence is just another reason the market is rushing into safe havens.

Interestingly, crypto giants are joining the party, with Tether Holdings SA now holding around 140 tons of gold. CEO Paolo Ardoino confirmed to Bloomberg that this massive hoard is part of their reserve diversification strategy.

It’s not just gold; silver has posted an insane rally, up nearly 60% year-to-date. Despite some wild volatility, speculative demand from retail investors remains rock solid even at these record levels.

The mix of a sliding dollar and potential Fed easing has created a perfect storm for precious metals. Investors should keep a close watch to see if prices consolidate here or keep charging toward the next analyst price target.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

Bloomberg, Gold Hits Record Above $5,300 as Trump Dollar Comments Aid Rally. Accessed on January 28, 2026

-

Reuters, Gold climbs to record high above $5,300 as dollar slips. Accessed on January 28, 2026

-

Featured Image: Shutterstock