Gotrade News - Global gold prices just suffered their biggest daily drop in over a decade during Monday's trading (02/02). The sharp correction has sent shockwaves through the market, forcing investors to reassess the sustainability of the recent record-breaking rally.

This drop serves as a massive wake-up call for those who have been riding the precious metals wave without caution. You need to understand the shifting dynamics between a strengthening US Dollar and its impact on safe-haven assets before making your next move.

Key Takeaways:

-

Spot gold plunged 6.3% due to massive profit-taking and a resurgent US Dollar.

-

Kevin Warsh’s nomination as Fed Chair triggered expectations of tighter monetary policy, pressuring non-yielding assets.

-

Silver also faced extreme volatility, wiping out recent gains to trade around $75 an ounce.

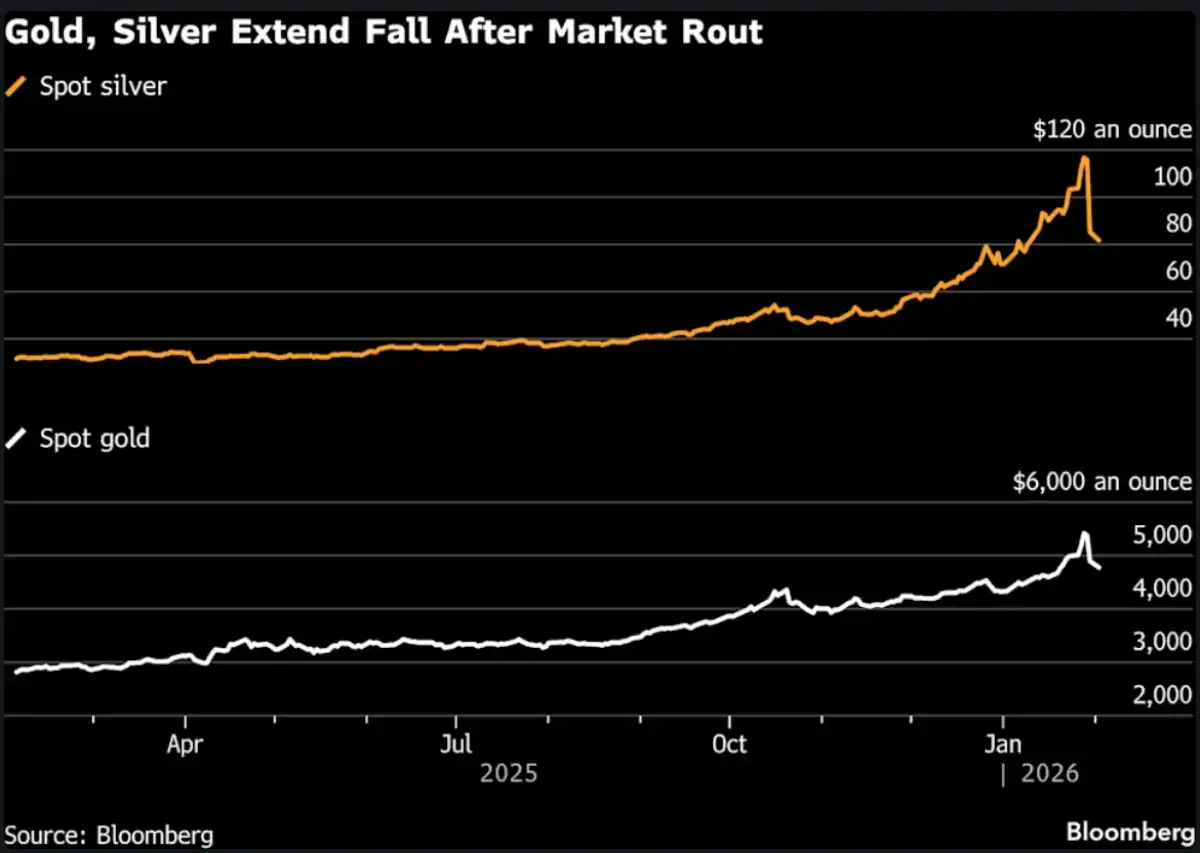

According to a Bloomberg report, spot gold tumbled up to 6.3% on Monday, with silver also seeing extreme volatility. This drop snaps a rally that had recently hit all-time highs, catching many seasoned traders off guard.

The catalyst for this dramatic selloff was the news that US President Donald Trump plans to nominate Kevin Warsh to lead the Fed. The market views Warsh as a hawk on inflation, triggering a dollar rally and putting pressure on assets priced in greenbacks.

"This isn’t over," said Robert Gottlieb, a former precious metals trader at JPMorgan Chase & Co., adding that risk aversion could constrain liquidity.

José Torres, senior economist at Interactive Brokers, noted in a CNBC report that the "Buy America" trade is back in vogue. The Fed's independence—previously a reason investors piled into gold—is now seen as shifting direction significantly.

Analysts at Goldman Sachs Group Inc. added that the market structure was already fragile. A record wave of call options had mechanically reinforced the upward momentum, but that same leverage is now amplifying the downside as traders hedge their exposure.

This risk-off sentiment spilled over into silver, which briefly dipped to around $75 an ounce after climbing earlier. Christopher Forbes from CMC Markets views this as a classic "air-pocket" correction, suggesting that profit-taking is just blowing the "froth" off a crowded trade rather than killing the long-term bullish thesis.

However, volatility is expected to remain high. With the "Trump Trade" gaining traction again, the opportunity cost of holding non-yielding bullion is rising, making the short-term outlook for gold tricky.

Capitalize on Gold Volatility with Gotrade

The turbulent gold market opens doors for savvy investors to enter at more strategic price points. If you want to diversify your portfolio into the gold mining sector without the hassle of storing physical bars, ETFs are your answer.

The VanEck Gold Miners ETF (GDX) gives you instant access to the world's largest gold mining companies, which often move more aggressively than the metal price itself. You can start owning this global asset on Gotrade starting from just $1, giving you the flexibility to manage your risk without needing massive capital.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

Bloomberg, Gold Plunges After Biggest Drop in a Decade as Rally Unwinds. Accessed on February 2, 2026

CNBC, Gold and silver extend sell-off after historic plunge — yellow metal drops 5%. Accessed on February 2, 2026

Featured Image: Shutterstock