Gotrade News - Small-cap stocks are kicking off 2026 with a bang, leaving their larger counterparts in the dust. This sudden shift is turning heads as tech heavyweights like Microsoft stumble right out of the gate.

Key Takeaways

-

Small-cap ETFs are leading the market rally with gains topping 7 percent.

-

Mega-cap tech stocks are lagging, effectively weighing down the S&P 500.

-

Investors are watching to see if this asset rotation has the legs to last.

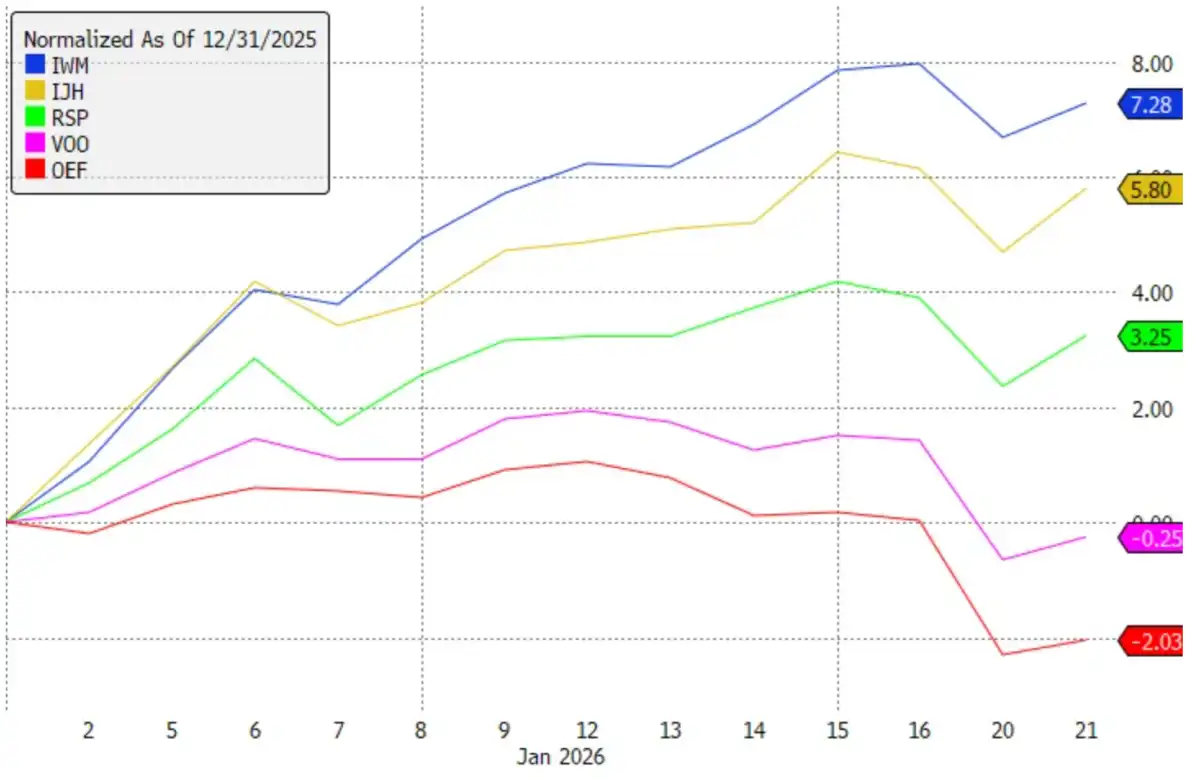

The iShares Russell 2000 ETF (IWM) has emerged as the standout performer, rallying 7.3 percent year-to-date. Market data shows this is a sharp reversal from 2025, when the fund fell out of favor and shed billions in assets.

In contrast, ETFs dominated by massive companies, such as the S&P 500 ETF, are trading flat. The sluggish performance of major tech names is currently dragging down the traditional market-cap-weighted indices.

Investors looking to spread their bets are shifting attention to the Invesco S&P 500 Equal Weight ETF (RSP). By treating every company equally regardless of size, the fund has climbed 3.3 percent and attracted $4.1 billion in fresh capital.

However, the big question remains: is this shift here to stay? Mega-cap tech has dominated market returns for over a decade, meaning any rotation faces significant historical headwinds.

For small caps to truly take the lead, big tech would need to show continued fundamental weakness. Until then, the sheer size of the market giants remains the biggest hurdle to a lasting changing of the guard.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

etf, Small Cap ETFs Outperform as Mega-Cap Tech Stumbles. Accessed on January 23, 2026

-

Featured Image: Shutterstock