Gotrade News - The Walt Disney Company (DIS) is set to release its fiscal 2026 first-quarter earnings results this Monday (02/02).

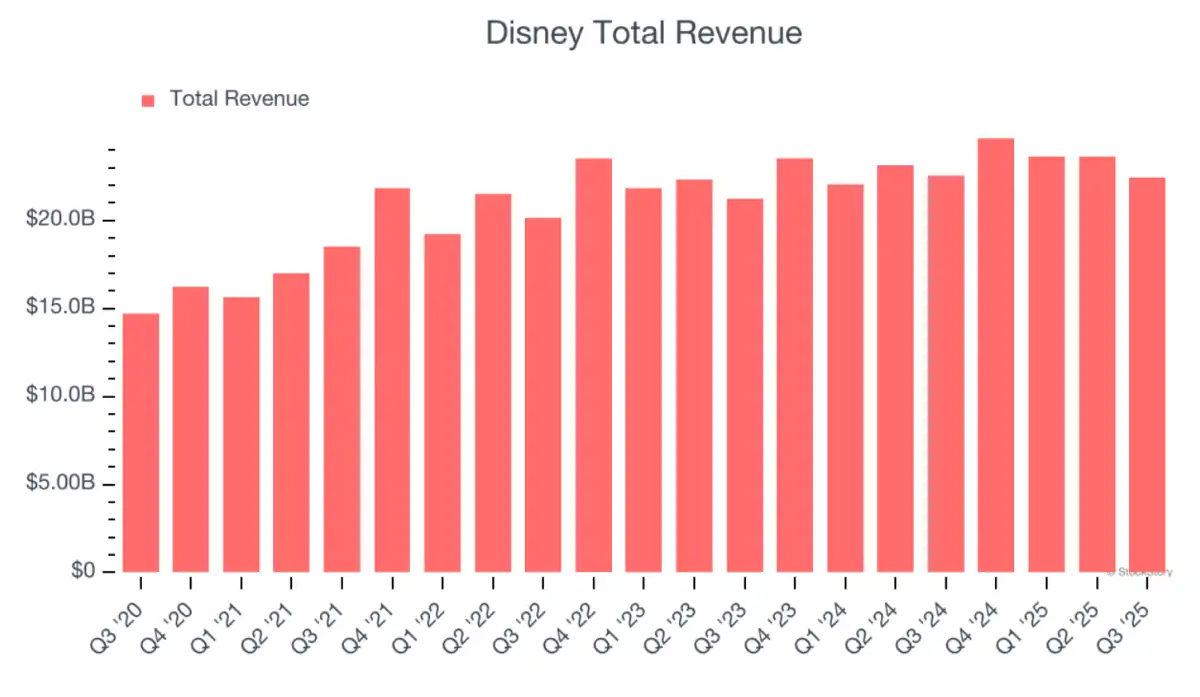

Analysts are projecting moderate revenue growth of around 5 percent to $25.93 billion year-over-year.

Key Takeaways:

-

Revenue Projection: Revenue is expected to hit $25.9 billion, but earnings per share (EPS) risks slipping to $1.56.

-

Segment Clash: Improving streaming profitability faces headwinds from cruise expansion costs and a dip in theatrical revenue.

-

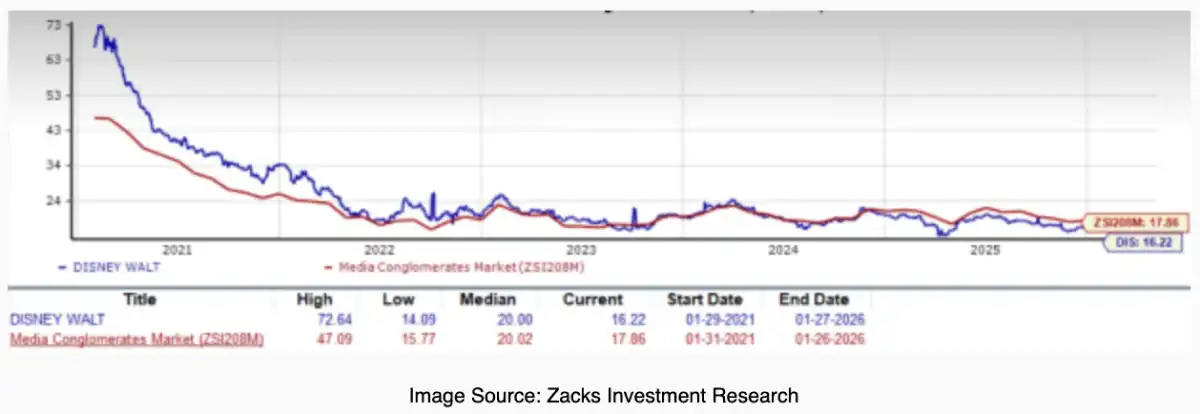

Discounted Valuation: Disney stock is trading at a P/E of 16.22x, cheaper than the media industry average.

Market Expectations & Earnings Challenges

Despite the projected revenue bump, the analyst consensus sees earnings per share (EPS) dipping 11.36 percent to $1.56. This drop reflects the operational cost challenges the company is facing in the short term.

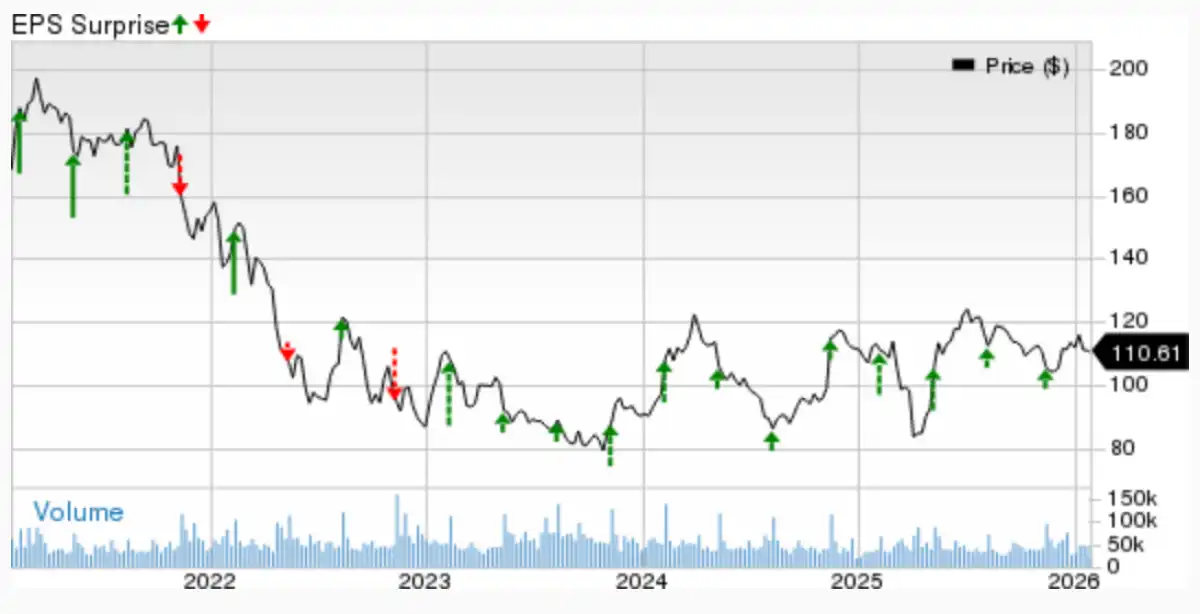

Investors need to keep an eye on management’s guidance for the second half of fiscal 2026, which is expected to see double-digit growth. Disney’s consistency in beating earnings expectations over the last four quarters remains a solid positive note.

The entertainment segment is facing a mixed bag with projected revenue of $11.6 billion, up 6.8 percent annually. The Direct-to-Consumer (streaming) business is expected to post an operating profit of $375 million, thanks to premium content drops like the Taylor Swift documentary.

However, the theatrical business faces a tough uphill battle with a potential negative impact of $400 million compared to last year. This is largely due to the difficulty of matching the success of previous blockbusters like Moana 2.

Expansion Costs & Competition

On the flip side, the Experiences (Parks & Products) segment is shouldering $90 million in pre-opening costs for the Disney Destiny and Disney Adventure cruise ships. These costs are squeezing short-term margins, even though domestic park demand remained steady during the holidays.

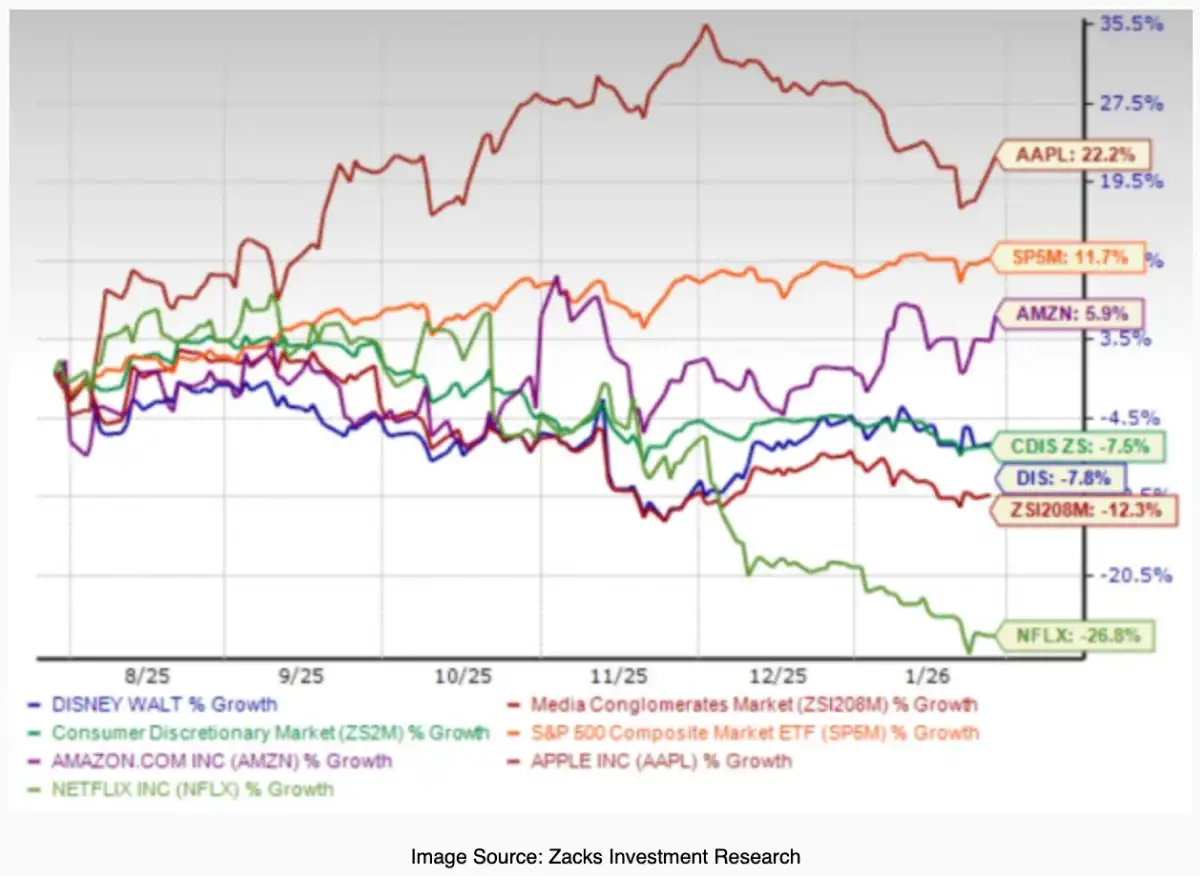

Competition in the streaming space is also heating up against heavyweights like Netflix and Amazon Prime Video. Disney stock is down 7.8 percent over the last six months, lagging behind the broader sector performance.

Right now, Disney is trading at a forward P/E ratio of 16.22x, which is a discount compared to the industry average of 17.86x. This valuation might look tempting to long-term investors who believe in the company’s turnaround execution.

However, short-term uncertainty has many analysts recommending a wait and see approach. It might be wise to wait for clearer execution signals from management in the second half of the year before taking a big position.

Own The Walt Disney Company Stock

Is this discounted valuation the right moment to get into the global entertainment giant?

You can start collecting Disney (DIS) shares without buying a whole expensive share. On Gotrade, access to the US stock market is wide open and affordable.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

StockStory, Earnings To Watch: Disney (DIS) Reports Q4 Results Tomorrow. Accessed on February 2, 2026

-

Zacks, Disney Stock Before Q1 Earnings: Buy Now or Wait for Results?. Accessed on February 2, 2026

-

Featured Image: Shutterstock