Jakarta, Gotrade News - The market is gearing up for Netflix, Inc. to drop its Q4 2025 earnings this coming January 20. According to data from Finbold, analysts are eyeing revenue of around $11.97 billion with earnings per share (EPS) at roughly $0.55.

Key Takeaways

-

Netflix’s Q4 2025 earnings drop on January 20, with a $11.97 billion revenue target.

-

The Warner Bros. acquisition remains a major "wildcard" causing stock volatility.

-

AI predictions point to a $90–$102 trading range in the short term post-release.

Market sentiment is currently a bit mixed, caught between strong international subscriber growth and the "noise" surrounding the Warner Bros. acquisition. Issues with funding structures and regulatory hurdles have been the main culprits behind the recent stock volatility.

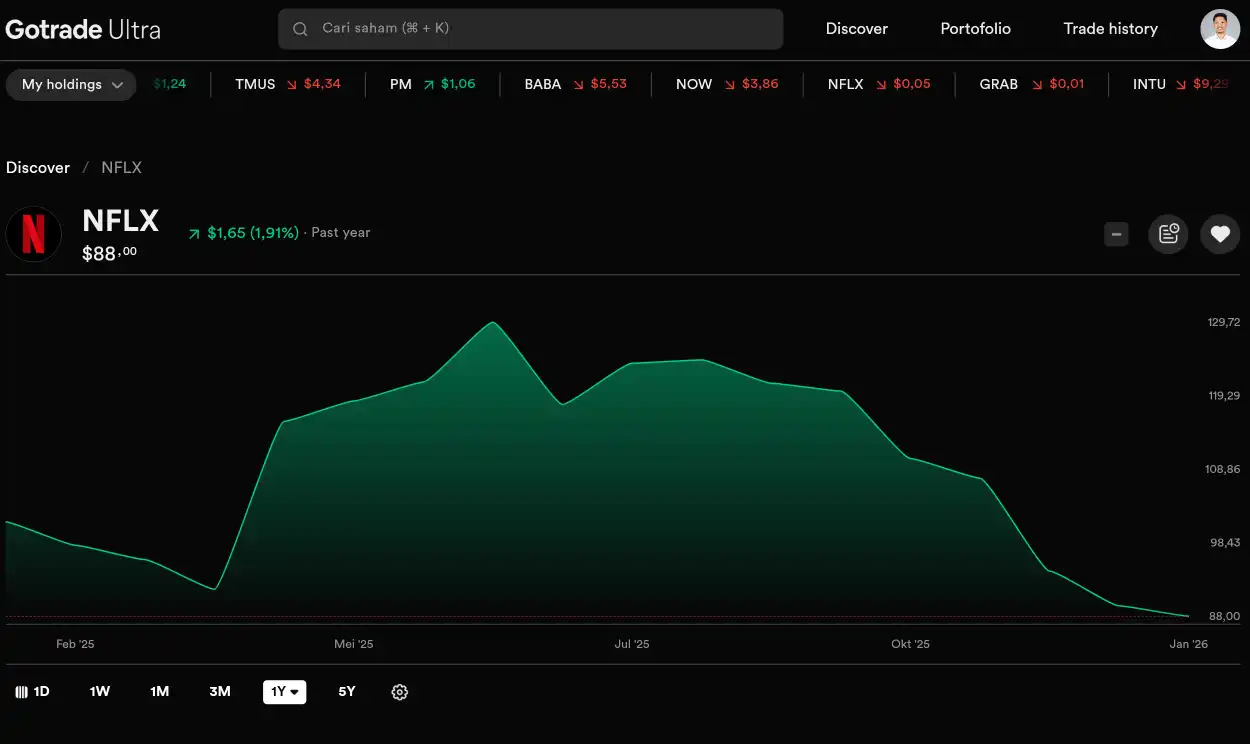

Gotrade notes that NFLX is currently sitting at the $88 level, showing a modest 2.5% gain over the past year. To get a better look at the potential move, ChatGPT weighed in with three post-earnings price scenarios.

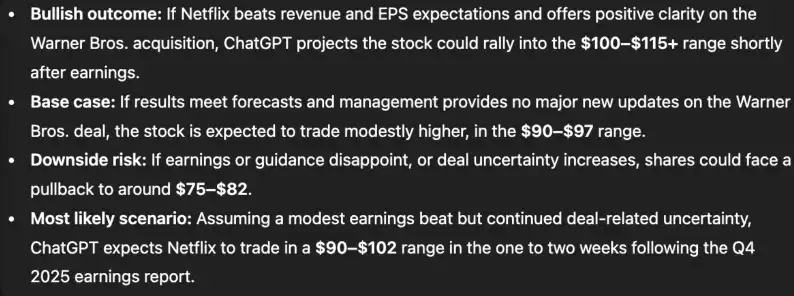

In a bullish scenario, NFLX could pull off a solid rally into the $100 to $115 range if they beat expectations across the board. For this to happen, management needs to give a positive "green light" or clarity regarding the Warner Bros. deal to boost investor confidence.

The base case projects the price to hover between $90 and $97 if the results land right on target. In this situation, it’s assumed that management won't be dropping any major bombs or updates regarding the ongoing acquisition.

On the flip side, there is still a downside risk to the $75–$82 level if their forward guidance ends up being a letdown. Any increased uncertainty about the big merger could easily trigger a sell-off from cautious investors.

Key Factors for the Next Move

ChatGPT’s "most likely" forecast puts Netflix stock in a $90 to $102 range shortly after the report hits. This assumes a slight earnings beat, though the acquisition drama might still act as a "drag" on the stock’s momentum.

Investors are also keeping a close eye on ad-revenue growth, which is still in its early days. While the ad tier is scaling up, it’s not yet big enough to fully offset the volatility coming from merger headlines.

It is worth watching management’s tone during the Q&A session regarding the Warner Bros. financing strategy. Clearer commentary is expected to be the main catalyst for where Netflix’s price action heads next.

The Finbold report emphasizes that while fundamentals are solid, they are being tested by massive expansion plans. Getting that regulatory "all clear" will be the ultimate key for a long-term price recovery.

Reference:

-

Finbold, AI predicts Netflix stock price after Q4 earnings report. Accessed on January 19, 2026

-

Featured Image: Shutterstock