Jakarta, Gotrade News - The classic portfolio diversification strategy through balanced funds has once again proved its worth following the intense market dynamics throughout 2025. Recent data highlights a resurgence in international stocks and the strongest core bond performance we’ve seen since 2020.

Key Takeaways

-

The Global 60/40 portfolio recorded a 16% return in 2025, successfully outperforming US-only portfolios.

-

Morningstar now categorizes balanced funds based on international exposure above or below the 25% threshold.

-

These instruments are highly recommended for a 6 to 10-year investment horizon to effectively dampen stock market volatility.

Read also: 2026 Crypto Outlook: ETF Boom & Big Bank Adoption

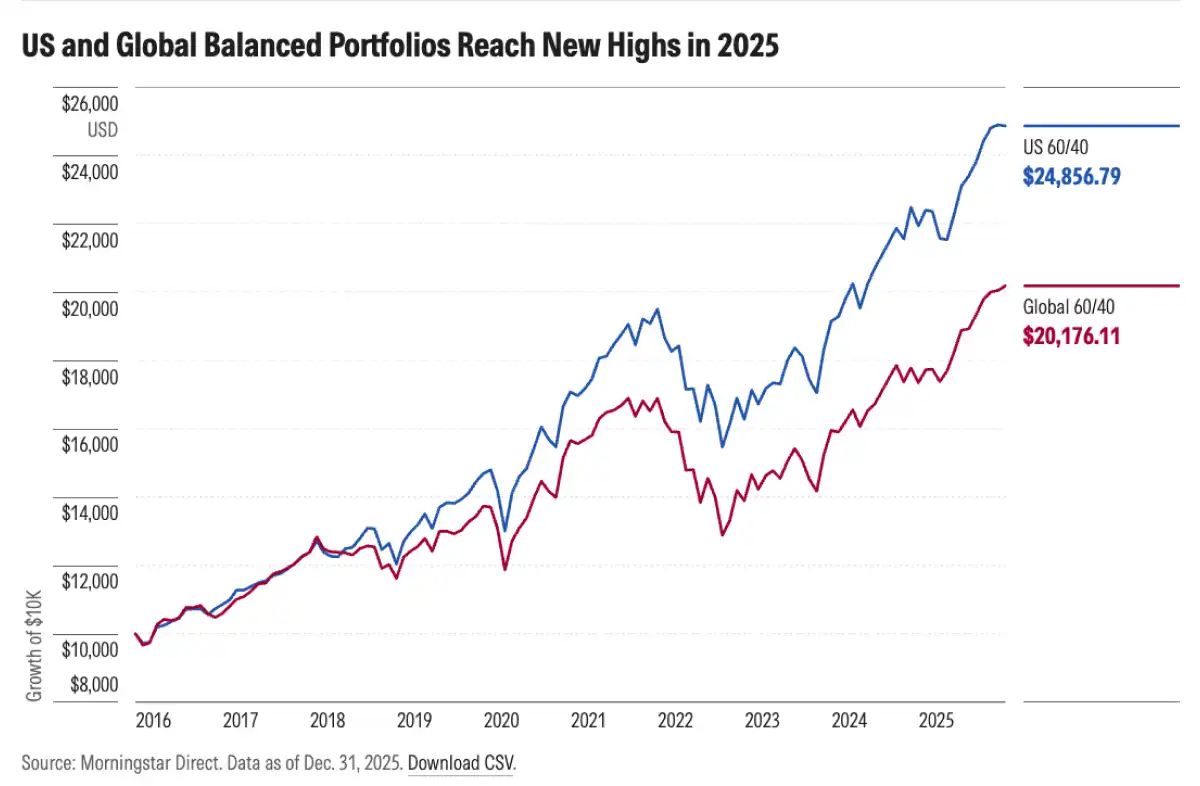

According to a report from Morningstar, the Global 60/40 portfolio managed to score a 16% gain, hitting a new all-time high by the end of 2025. This figure comfortably outpaced US-focused portfolios, which grew by 13% during the same period.

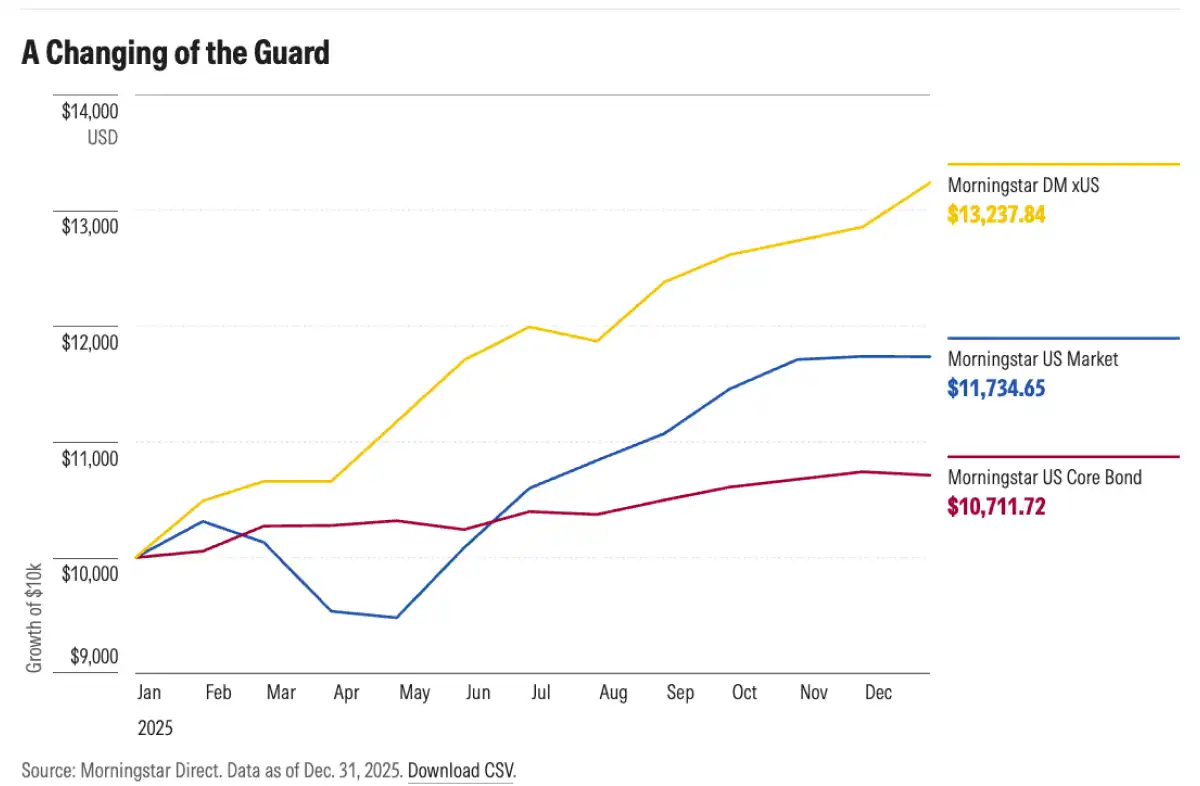

This phenomenon marks a potential "changing of the guard," where the long-standing dominance of US domestic assets might be shifting toward global assets. This is a major "heads up" for investors looking to trim volatility risk without missing out on growth momentum from various geographic regions.

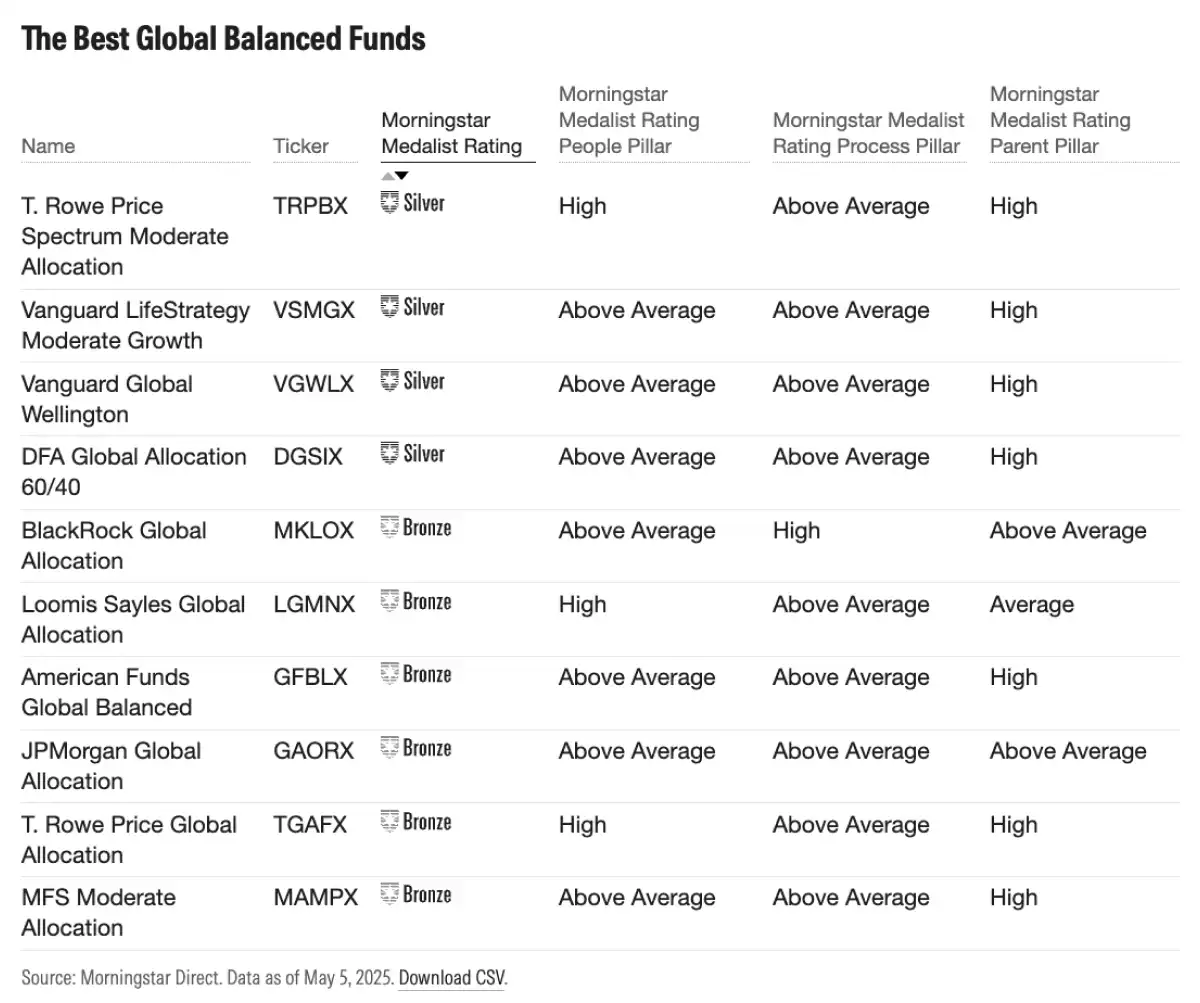

To help investors navigate these options, Morningstar has split balanced funds into two main categories to make picking a strategy easier. The "global moderate-allocation" category is now required to consistently maintain at least 25% of its investment portion outside of the United States.

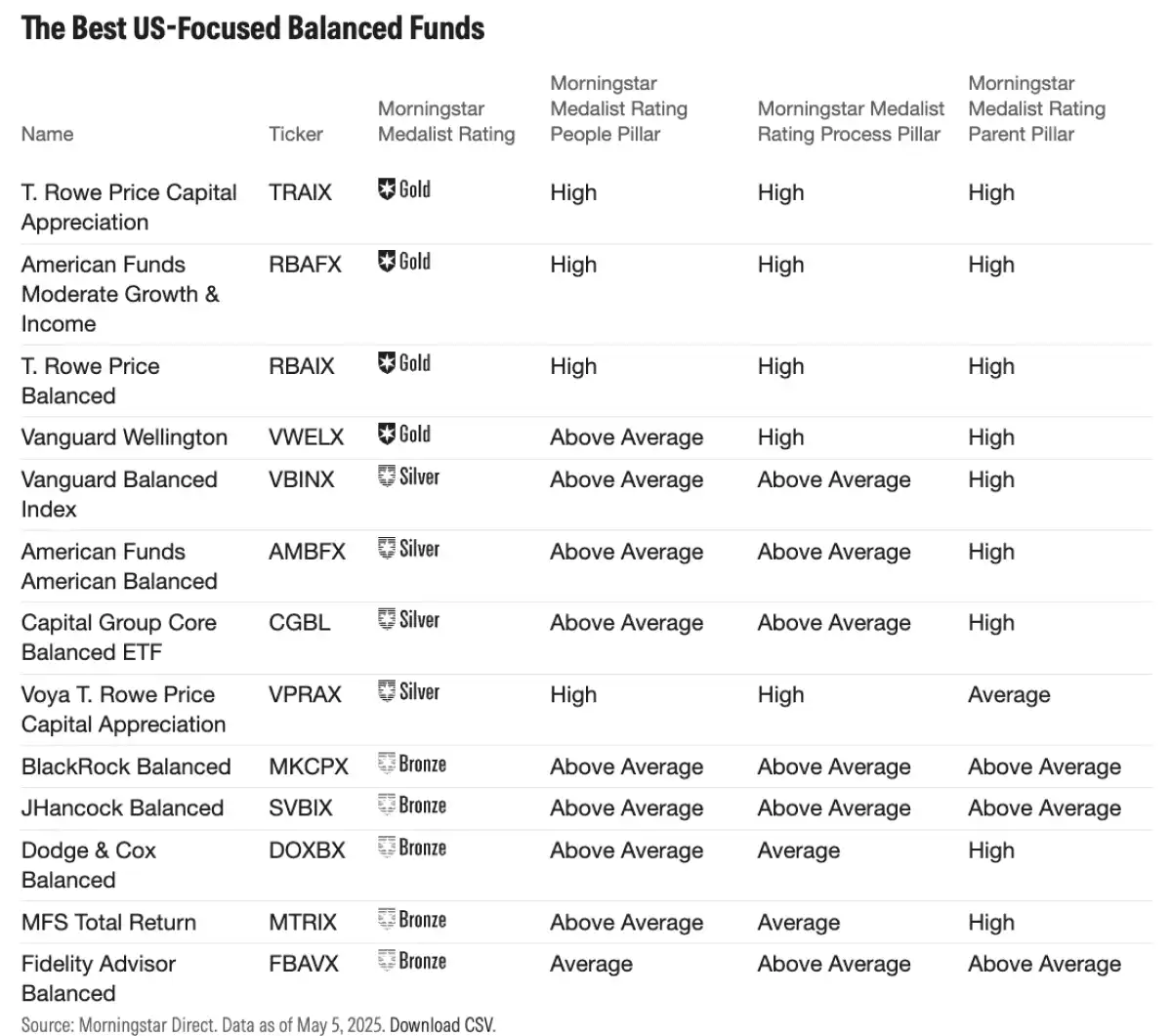

For investors looking for efficiency, big-name asset managers like Vanguard and BlackRock offer highly-rated balanced fund options. Mainstays like Vanguard Wellington (VWELX) and T. Rowe Price Balanced (RBAIX) remain top-tier picks with Gold Medalist Ratings.

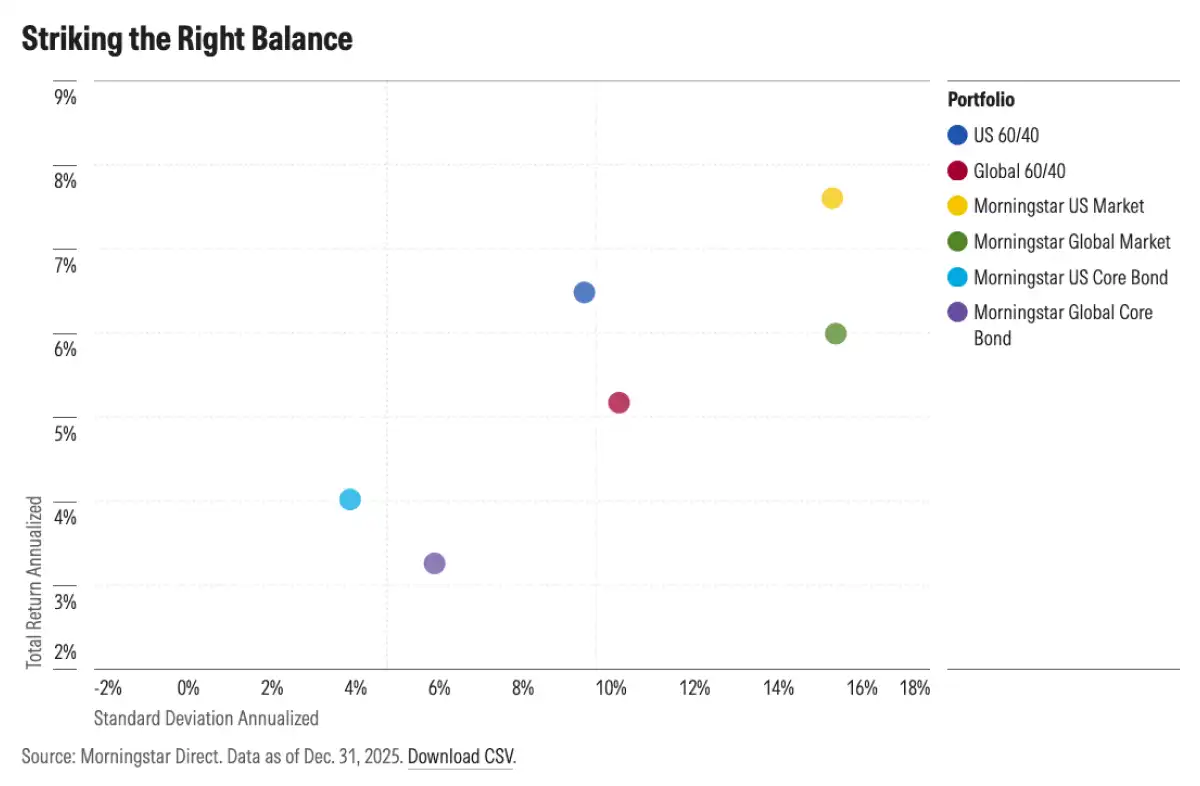

Even though they offer more stability, balanced funds with a 50% to 70% stock composition still carry significant drawdown risks. Morningstar points out that during the 2008 financial crisis, the US moderate target allocation index actually corrected by as much as 31%.

Because of this, these instruments aren't exactly the best fit for short-term "emergency funds" or savings you'll need soon. Investors are better off having a 6 to 10-year investment horizon when using a balanced fund as their portfolio’s core.

Read also: Gold to $5,000? Top 2026 Gold ETF Picks for You

Flexibility remains the name of the game, as every fund has its own DNA, ranging from fully active management to entirely passive setups. You can tailor your choice based on your fee preferences and how comfortable you are with the strengthening international market exposure.

Reference:

-

Morning Star, The Best Balanced Funds and ETFs. Accessed on January 14, 2026

-

Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.