Jakarta, Gotrade News - Early 2026 US economic data is flashing mixed signals that investors really need to watch right now. Even though job cuts are on the rise, the Gross Domestic Product (GDP) is actually predicted to skyrocket this year

Key Takeaways

-

US unemployment could breach 6 percent due to AI efficiency and hiring freezes.

-

US GDP is projected to still grow by 5 percent as machine productivity replaces human labor.

-

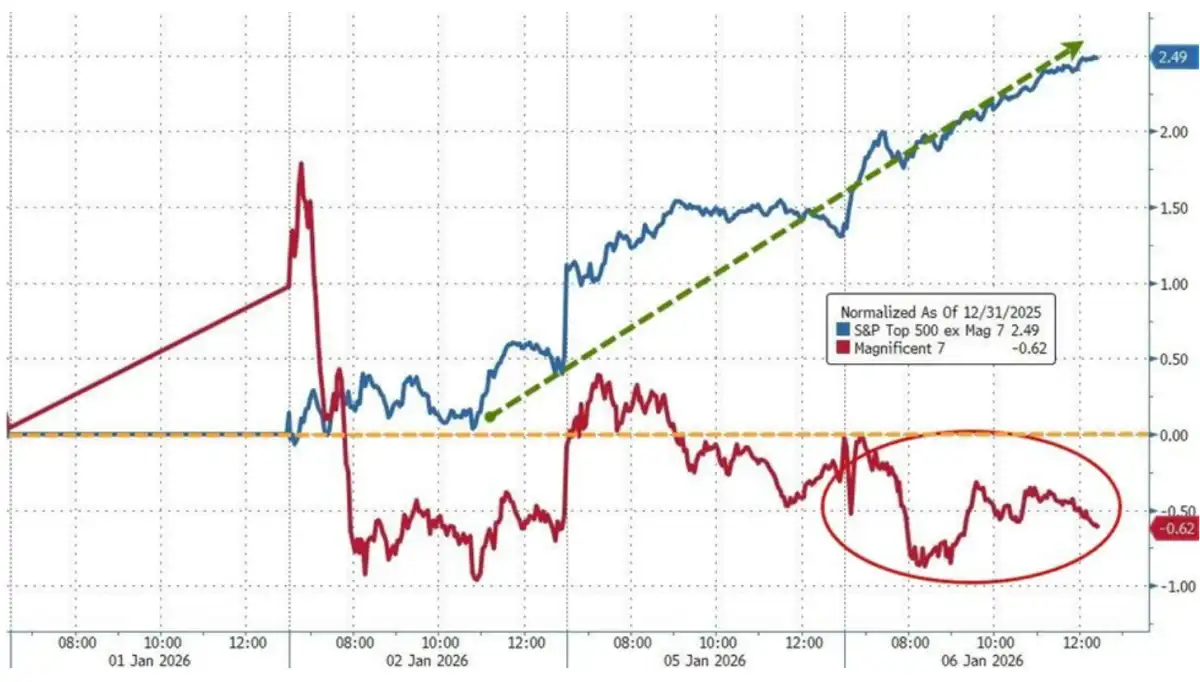

Big Tech dominance is starting to fade compared to the broader market performance.

Read also: Iran Protests Spread, Israel Holds Fire to Monitor Situation

The latest JOLTS report shows job openings dropping to 7.15 million, with hiring rates hitting their lowest point since 2013. Analysts are forecasting that the unemployment rate could hit the 6 percent level in 2026 as companies put the brakes on workforce expansion.

However, Louis Navellier predicts that US GDP will actually grow up to 5 percent this year. This surge is driven by AI efficiency, which is effectively severing the traditional correlation between human headcount and productivity output.

Shift in Stock Market Trends

This structural economic shift is creating a new phenomenon where corporate profitability remains high even as the workforce shrinks. This is having a direct impact on sector rotation in the stock market, which is starting to move away from its heavy reliance on tech giants.

The "Magnificent 7" stocks like Apple Inc., Microsoft Corporation, and NVIDIA Corporation are starting to lag behind the performance of the S&P 493. The market chatter is even shifting from "Mag 7" to "Lag 7" due to their stagnant performance at the start of the year.

The chart above confirms that stocks outside the seven tech giants are actually recording higher gains. Investors are now starting to pivot toward companies that support AI infrastructure efficiency, rather than just chasing the popular names.

Louis Navellier assesses that portfolios too concentrated in mega-cap tech stocks are at risk of stagnation this year. Growth opportunities are now shifting to a "new batch of winners" that allow the AI productivity boom to happen for real.

The "K-shaped" economy is becoming more tangible, where asset owners enjoy rising values while workers face automation risks. The investment strategy this year requires high selectivity in sectors that fundamentally benefit from AI productivity.

Read also: $400k Win on Maduro News Puts Prediction Markets in the Spotlight

Reference:

-

Investor Place, 2026: Big Job Losses AND Big GDP Growth. Accessed on January 12, 2026

-

Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.