Jakarta, Gotrade News - Throughout 2025, President Donald Trump’s protectionist moves have drastically reshaped the global economic landscape through aggressive import tariffs.

This move hasn't just triggered market volatility affecting the SPDR S&P 500 ETF Trust, but it’s also put a serious strain on cost structures for consumers and businesses in the US.

Key Takeaways:

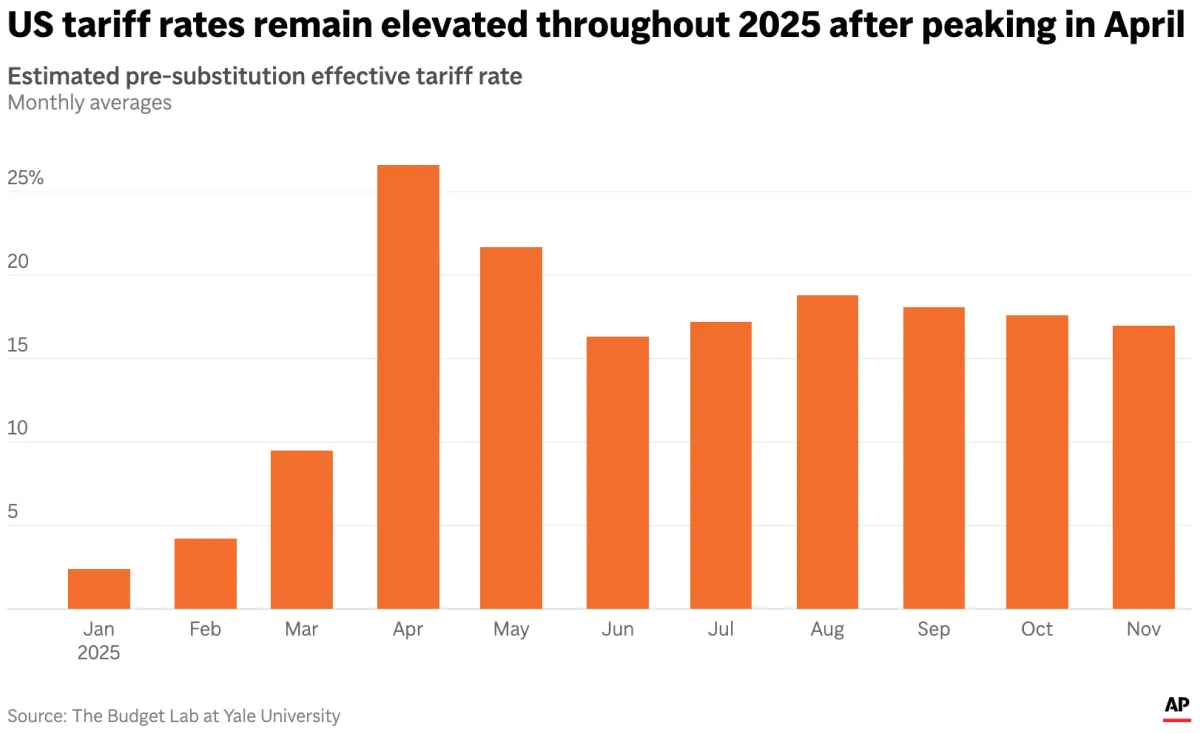

- The average US import tariff hit nearly 17% in November, the highest level since 1935.

- Despite tariff revenue hitting US$236 billion, the year-to-date trade deficit is up 17% compared to 2024.

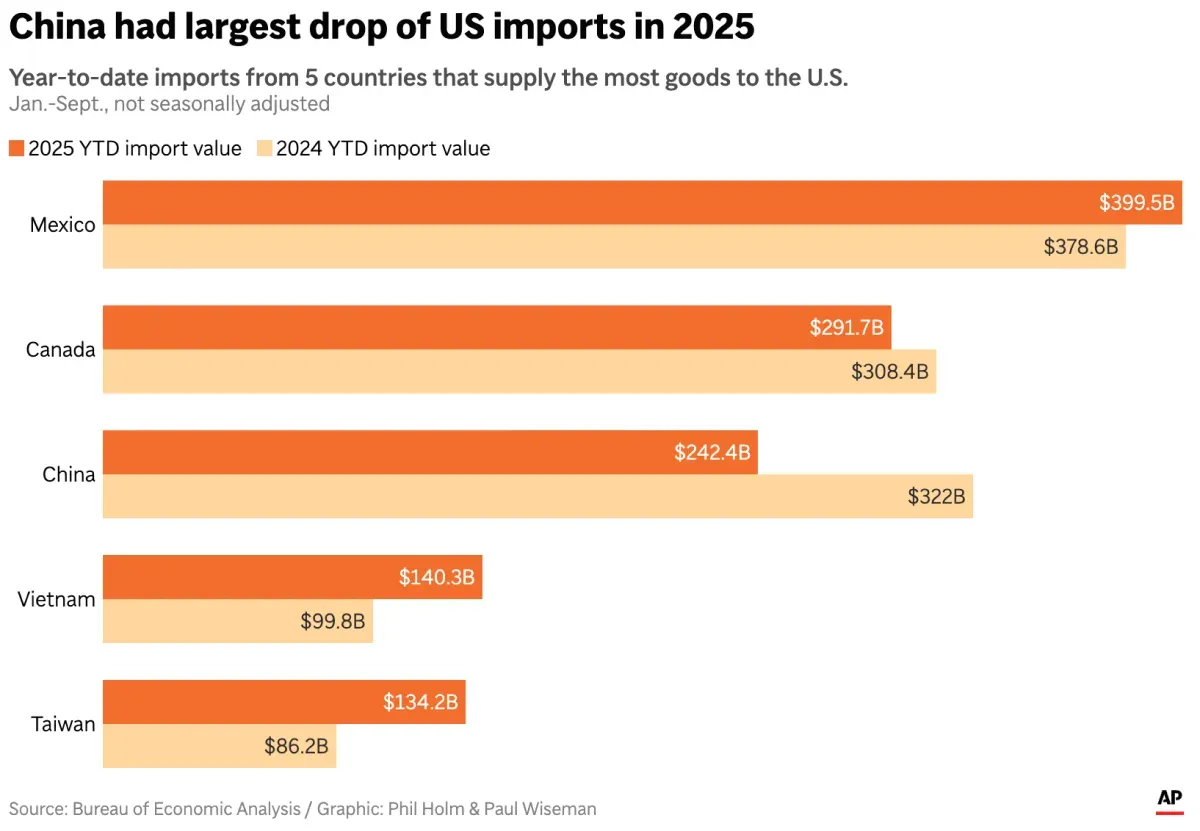

- Imports from China tanked by 25%, while Mexico and Vietnam are stepping up to grab market share.

Latest data from the Yale Budget Lab shows the effective US tariff rate hitting its highest level in nearly a century, averaging close to 17% in November 2025. This figure has skyrocketed sevenfold compared to the January average, signaling that the burden of import costs has now fully shifted to US businesses and households.

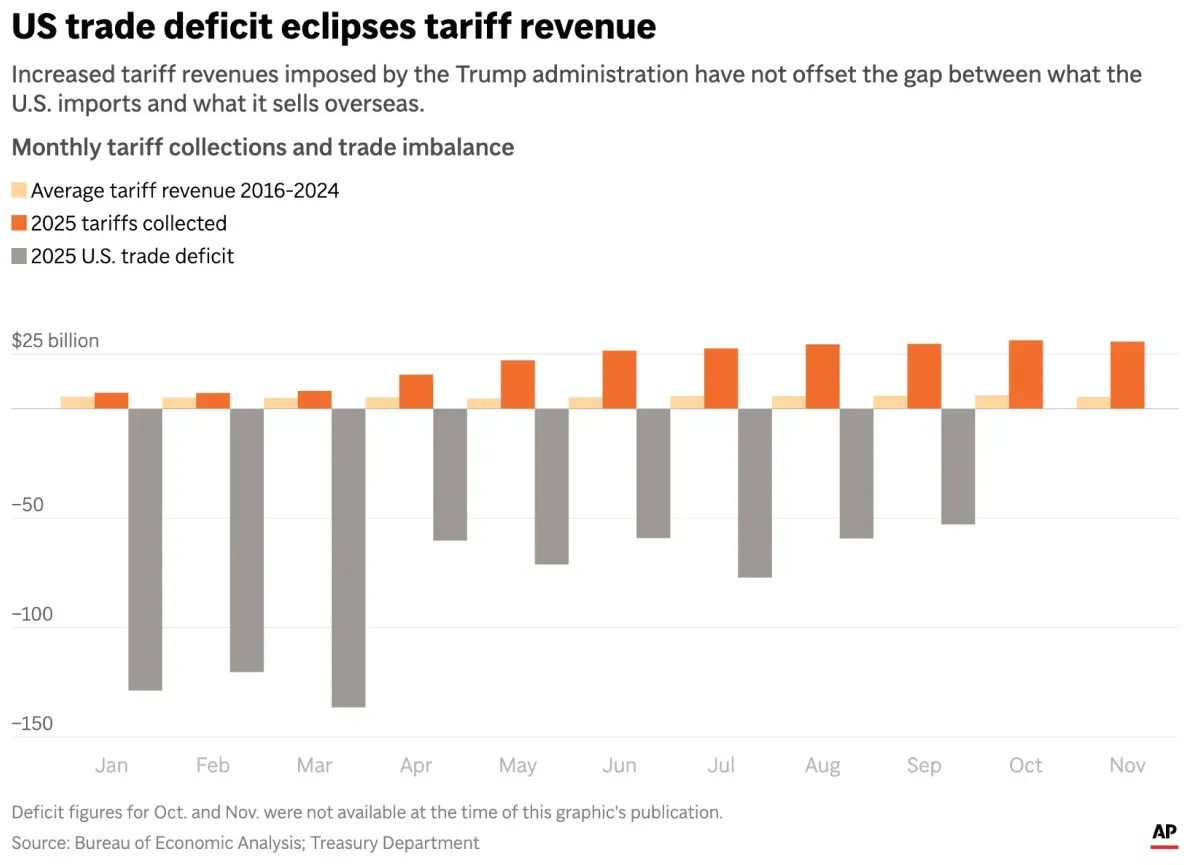

On the fiscal side, this policy did manage to rake in over US$236 billion for the state coffers by November 2025, far outpacing previous years. However, the data shows this revenue is still just a drop in the bucket compared to what’s needed to replace federal income taxes or plug the trade deficit gap as promised.

The US trade deficit actually recorded a 17% year-to-date increase compared to the same period in 2024, despite narrowing slightly in September. The biggest spike in the deficit happened in March, as businesses scrambled to panic-buy and stockpile goods before the new tariffs kicked in.

The most significant structural impact is visible in the global supply chain shift, where the value of US imports from China plunged nearly 25% due to tariffs hitting 47.5%. China’s position as the top trading partner has been dethroned, while import volumes from alternative hubs like Mexico, Vietnam, and Taiwan have seen substantial growth.

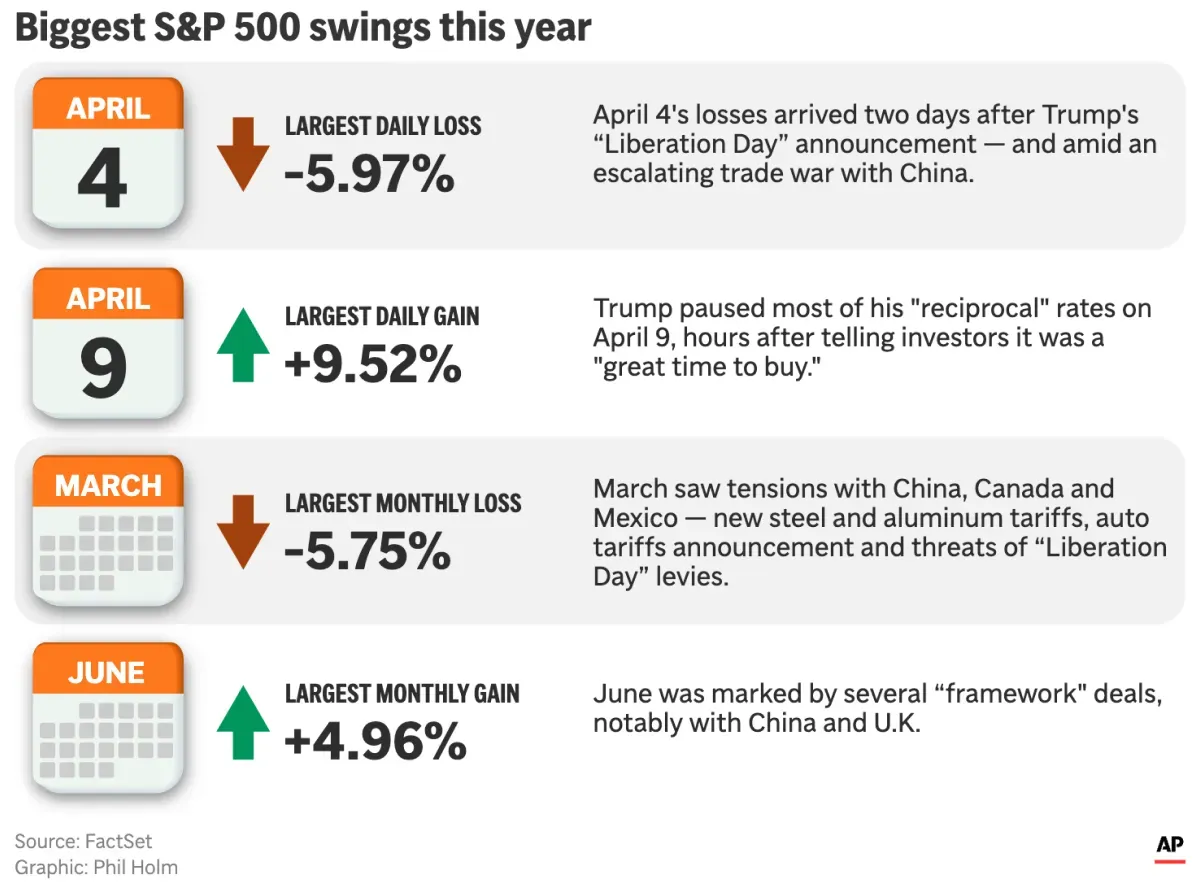

This policy uncertainty has also been the main driver for stock market jitters, with the SPDR S&P 500 ETF Trust seeing its wildest daily and weekly swings back in April. This pattern confirms that for investors, trade policy risk is now a fundamental factor just as critical as earnings reports.

So, what’s next for you? Keep a close eye on the upcoming US inflation reports, because with effective tariffs staying elevated through the end of the year, consumer prices might stay higher for longer than expected.

Reference:

- AP News, Trump overturned decades of US trade policy in 2025. See the impact of his tariffs, in four charts. Accessed on December 30, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.