Written by Aries Yuangga

Summary

PayPal (NASDAQ: PYPL) continues to deliver clean, steady execution, but the stock trades like a distressed fintech because the market is fearful about macro and consumer spending.

The reality:

- Q3 beat on transaction margin (+6% YoY) and EPS (+12% YoY).

- Unbranded processing (Braintree) is re-accelerating for the third straight quarter.

- PYPL holds US$14.4B in cash vs US$11.4B debt → net cash balance sheet.

- Share repurchases are massive: US$5.7B in last 12 months, > GAAP net income.

- New catalyst: agentic commerce + OpenAI partnership to power payments for ChatGPT.

- Valuation is absurdly cheap at < 11× forward earnings, pricing PYPL like a cyclical bank, not a high-margin global payments processor.

Thesis: PYPL is a mispriced fintech compounder with AI optionality.Despite temporary macro weakness, fundamentals are improving and buybacks are aggressively shrinking the float.

Rating: STRONG BUY. Accumulate dips, especially inside the structural demand zone.

Technical Analysis

(based on the weekly chart you provided)

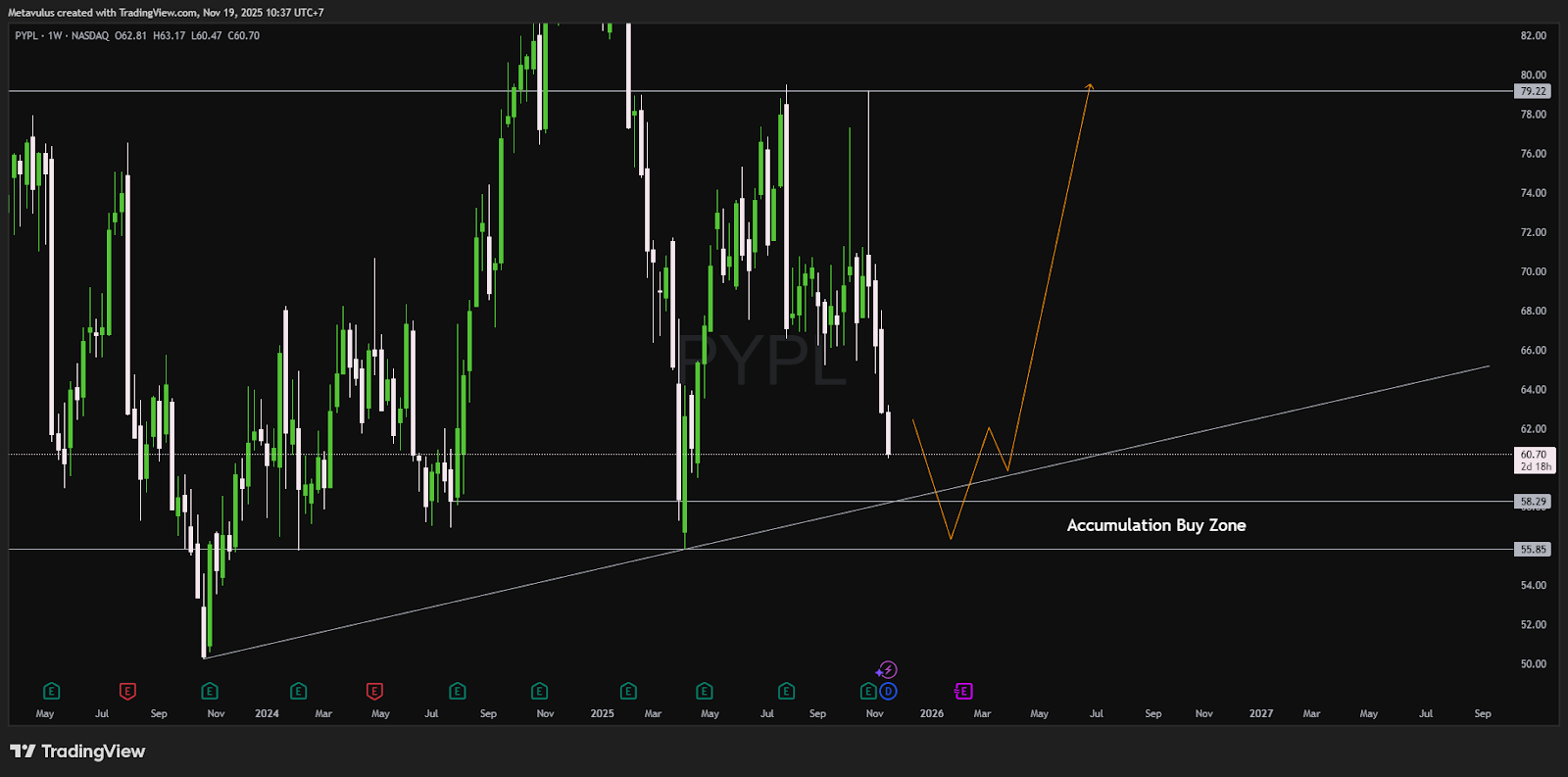

Current Price: ~US$60.70

Key Levels

Resistance

- US$79.22 → major long-term resistance

- A breakout above this would signal the start of a full re-rating cycle

Accumulation Buy Zone

From the chart:

- US$58.29 → upper bound of demand zone

- US$55.85 → bottom of accumulation zone (strong support + trendline confluence)

This is where buyers have historically stepped in hard.

Invalidation

- Weekly close < US$55 = structure breaks → wait for a new base to form

Read

Price is in a deep pullback into multi-year trendline support.The sequence illustrated in your chart shows a W-shaped bottom inside the demand zone followed by a rally toward US$79.

As long as price stays above ~US$58, the long-term bullish structure remains intact.

Trading Setup

DCA Plan (Long-Term Investors)

- 40% size: US$60–58

- 40% size: US$58–56 (primary accumulation zone)

- 20% size: US$56–55 (aggressive bid near trendline)

→ Full-fill cost basis ≈ US$57–59

Risk Management

For Swing Traders / Leverage Users

- Reduce or cut position if:

- Daily close < US$58, or

- Weekly close < US$55 (structural break)

For Long-Term Investors (2–5 years+)

Use fundamental stops, not price stops.Thesis breaks only if:

- Unbranded processing fails to recover

- EPS growth collapses for multiple quarters

- Agentic commerce & AI integrations show no real traction

- Management slows buybacks materially

- PYPL weakens balance sheet (net debt)

Take Profit Levels

- TP1: US$70–72 → take 15–25% to derisk

- TP2: US$78–80 → major resistance, expect sellers

- Stretch Target: US$90–95 → if re-rating pushes valuation to 15–18× earnings

Options / Income Ideas (Optional)

- Sell CSPs at US$57 / US$55 (30–45 DTE) → paid to enter the buy zone

- If assigned → sell covered calls at US$75–85 to monetize volatility

Why The Thesis Works (Pillars)

1️⃣ Agentic Commerce = PYPL’s Hidden “AI Call Option”

OpenAI partnership → PayPal powers checkout for ChatGPT & future AI agents.

As agentic commerce becomes mainstream, AI agents will:

- compare prices

- auto-initiate purchases

- execute payments

PayPal is positioning itself as the default financial rails for the next generation of e-commerce.

This is a potential multi-year TAM expansion Wall Street hasn’t priced in.

2️⃣ Unbranded Processing Recovery Strengthens the Core

Braintree growing +6% YoY for 3 consecutive quarters. This is crucial:

- Drives TPV growth

- Brings back lost volume without subsidizing unprofitable merchants

- Improves stability in revenue mix

Market fears were about Braintree slowing; now it’s recovering.

3️⃣ Fortress Balance Sheet + Aggressive Buybacks

- US$14.4B cash

- Net cash position

- US$5.7B buybacks in 12 months

When a company retires shares at 10× forward earnings, long-term returns compound heavily.

This is arguably PYPL’s biggest bull thesis.

4️⃣ Valuation Is Irrationally Cheap

At ~11× forward earnings, PYPL trades like:

- A cyclical bank

- Not a global payments infrastructure player

- Not an AI-enabled commerce platform with net cash

Fair multiple should be 15×–18× given durable EPS growth and massive buybacks.

5️⃣ PYPL Is Structurally Less Leveraged Than Traditional Financials

The market treats PYPL like a bank. It is NOT a bank.

- Lower leverage

- Higher liquidity

- Higher quality earnings

- Safer in downturns due to fee-based business model

This gap between perception vs. reality is the opportunity.

Valuation & Scenarios

Base Case (12–18 months)

- Modest TPV growth

- Continued recovery in unbranded

- Share count keeps shrinking

Fair Value: US$75–80 (15× earnings)

→ ~30–40% upside

Bull Case

- AI & agentic commerce drive new payment volume

- EPS growth >15% YoY

- Multi-year re-rating occurs

Fair Value: US$90–95 (17–18× earnings)

→ ~50%+ upside

Bear Case

- Recession hits consumer spending

- TPV softens

- EPS stagnates

- Market stuck at 10–11× earnings

Price Range: US$50–55 → still buffered by buybacks + net cash

Risks

- Macro slowdown → smaller basket sizes

- Heavy competition at checkout (Apple Pay / Google Pay / Shopify / Stripe)

- BNPL credit risk

- Failure to execute agentic commerce strategy

- Recession that weakens TPV growth

None of these are thesis-killers, but they may cause volatility.

Conclusion

PayPal is being priced like a broken fintech, but fundamentally:

- EPS growing

- TPV improving

- Braintree recovering

- Net cash balance sheet

- Massive buybacks

- AI agent commerce catalyst emerging

This is a classic value + growth re-rating setup.Market sentiment is far more bearish than the actual fundamentals.

Verdict: STRONG BUY.

Accumulate US$58–56,Target US$70–80,Stretch US$90+ on a re-rating and AI tailwinds.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.