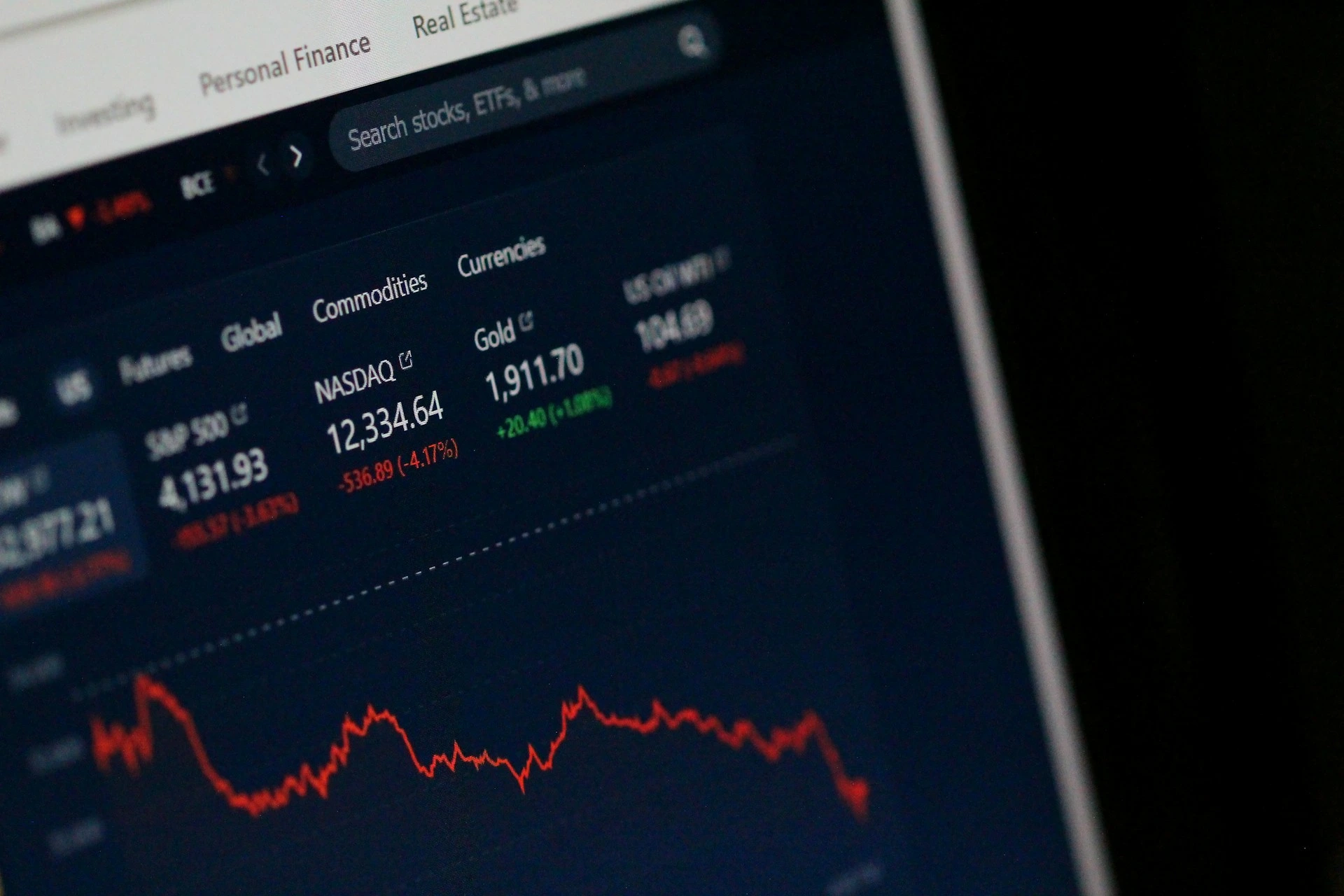

A downtrend refers to a market condition where prices move lower over time. This downward movement reflects sustained selling pressure and weakening confidence among market participants. Downtrends are a core concept in market analysis and are commonly used to describe unfavorable price behavior across different assets.

Understanding what a downtrend is helps investors and traders interpret market direction more clearly. Rather than reacting to individual price drops, a downtrend highlights the broader pattern that shapes price movement over time.

Downtrend Definition

A downtrend is defined by a pattern of lower highs and lower lows. This structure indicates that sellers are consistently willing to accept lower prices, pushing the market downward.

Key features of a downtrend include:

-

Successively lower price peaks

-

Successively lower price pullbacks

-

Sustained downward direction over time

A downtrend market does not move downward in a straight line. Temporary rebounds and pauses occur, but the overall direction remains negative.

How a Downtrend Forms

Persistent selling pressure

Downtrends develop when selling pressure outweighs buying demand. Sellers dominate price action, forcing prices lower over time.

This pressure often reflects declining confidence in economic conditions, earnings outlooks, or asset-specific fundamentals.

Negative expectations and sentiment

Downtrends are reinforced by negative expectations. As prices fall, pessimism increases and discourages buying interest.

This feedback loop can sustain downward momentum as long as sentiment remains weak.

Deteriorating market conditions

Broader conditions often contribute to downtrends. Economic slowdowns, tighter financial conditions, or unfavorable policy changes can weaken demand for risk assets.

These factors provide a backdrop for sustained price declines.

Key Characteristics of a Downtrend Market

Lower highs and lower lows

The defining characteristic of a downtrend market is its price structure. Each rebound fails below the previous high, and each decline reaches a new low.

This structure reflects strong supply and limited buying support.

Counter-trend rallies

Downtrends include counter-trend rallies. These temporary upward moves occur as prices rebound from oversold conditions.

Such rallies do not necessarily signal recovery. They are often short-lived unless supported by broader changes.

Weak momentum and participation

Downtrends are often accompanied by declining participation on rallies. Buying interest fades quickly, while selling resumes with ease.

Momentum favors sellers until conditions shift.

Downtrend vs Uptrend and Sideways Market

Directional comparison

A downtrend moves downward over time. An uptrend moves upward, while a sideways market lacks clear direction.

Recognizing these distinctions helps align expectations with prevailing conditions.

Risk and opportunity profile

Downtrend markets emphasize capital preservation and risk control. Opportunities exist, but volatility and uncertainty are elevated.

Uptrends and sideways markets present different risk-return dynamics.

Transition between market phases

Markets move between uptrend, downtrend, and sideways phases. These transitions are rarely obvious in real time.

Understanding context helps avoid misinterpreting short-term movements.

Downtrend in Trading and Investing

Trend-following perspective

Downtrends are central to bearish or defensive trading approaches. Participants often focus on managing downside risk rather than seeking growth.

However, timing remains challenging. False recoveries are common.

Long-term investing considerations

For long-term investors, downtrends are difficult but expected phases of market cycles. Sharp declines can test discipline and patience.

Maintaining a long-term perspective helps avoid decisions driven solely by fear.

Risk management importance

Risk management becomes critical during downtrend markets. Drawdowns can accelerate quickly if exposure is unmanaged.

Diversification and position sizing help reduce downside impact.

Limitations of Downtrend Analysis

False breakdowns

Not every downward move leads to a sustained downtrend. Prices may recover quickly after brief declines.

Confirmation over time is necessary to distinguish trends from noise.

End of a downtrend

Downtrends eventually end as conditions change. Stabilization and improving expectations often precede recovery.

These turning points are typically recognized in hindsight.

Emotional bias risk

Downtrends can amplify fear and pessimism. Emotional responses may lead to rushed decisions.

Awareness of bias helps maintain discipline.

Conclusion

A downtrend is a market condition characterized by lower highs and lower lows over time. Understanding what a downtrend is helps investors and traders recognize unfavorable market direction and avoid focusing solely on isolated price movements.

While downtrend markets emphasize caution and risk control, they are a natural part of market cycles. Observing how downtrends form, develop, and eventually end improves understanding of market dynamics.

Platforms that allow investors to monitor price trends and market behavior across assets, such as the Gotrade app, can support more informed and disciplined decision-making during downtrend markets.

FAQ

What is a downtrend?

A downtrend is a price movement defined by lower highs and lower lows.

Does a downtrend mean prices always fall?

No. Downtrends include temporary rebounds and pauses.

How long can a downtrend last?

Downtrends can last from weeks to years depending on conditions.

Can downtrends occur in all markets?

Yes. Downtrends can occur in stocks, bonds, commodities, and currencies.

References

- Investopedia, Downtrend Definition, 2026.

- Corporate Finance Institute, Downtrend, 2026.