Markets do not move randomly. Many of the largest and fastest price moves happen around specific events. Earnings releases, economic data, central bank decisions, and corporate actions can all reshape expectations in minutes. Event-driven trading is built around this reality.

Event-driven trading focuses on how markets react to new information, not on predicting price patterns alone.

This guide explains what event-driven trading is, how an event-driven trading strategy works, and the risks traders need to understand.

Understanding Event-Driven Trading

Event-driven trading is a strategy that seeks to profit from price movements caused by specific events. Event-driven trading is centered on identifiable market catalysts.

Instead of trading continuously, traders wait for defined events that can shift supply, demand, or expectations.

The event creates volatility. The strategy focuses on managing that volatility.

What qualifies as a market event?

Common events include:

-

Earnings announcements

-

Economic data releases

-

Central bank decisions

-

Mergers and acquisitions

-

Corporate guidance changes

-

Regulatory or geopolitical news

Not all events matter equally. The market reaction matters more than the headline itself.

How an Event-Driven Trading Strategy Works?

Event-driven strategies vary widely depending on the event type.

Pre-event positioning vs post-event reaction

Some traders position before an event, expecting volatility.

Others wait for the event to occur and trade the market’s reaction instead.

- Pre-event trading involves more uncertainty.

- Post-event trading focuses on confirmation but may miss the first move.

Trading expectations, not news

Markets price expectations, not facts.

An event-driven trading strategy focuses on whether outcomes are:

-

Better than expected

-

Worse than expected

-

In line with expectations

Price can fall on good news or rise on bad news if expectations differ.

Volatility and liquidity considerations

Events often cause:

-

Sudden volatility expansion

-

Wider bid ask spreads

-

Temporary liquidity gaps

Execution quality becomes more important than precision.

Common Types of Event-Driven Trading

Event-driven trading can be applied in different ways.

Earnings-driven trading

Earnings reports are among the most traded events.

Price moves depend on:

-

Earnings relative to expectations

-

Forward guidance

-

Market positioning before the release

Large gaps and fast moves are common.

Macro and economic data events

Economic releases such as inflation data or employment reports can move entire markets.

These events often affect:

-

Interest rate expectations

-

Currency markets

-

Equity index direction

Reactions may be brief or trend forming.

Corporate actions and special situations

Mergers, buybacks, and restructurings can change valuation assumptions.

These events are often less frequent but can create sustained repricing.

Strengths and Limitations of Event-Driven Trading

Event-driven trading offers opportunity, but also complexity.

Strengths of event-driven trading

Event-driven strategies:

-

Focus on high impact moments

-

Avoid constant screen time

-

Align with fundamental catalysts

-

Can produce large moves quickly

They are especially attractive to traders who prefer selectivity.

Risks and challenges

Event-driven trading involves:

-

Sharp price gaps

-

Slippage and execution risk

-

Unpredictable reactions

-

Emotional volatility

Stops may not protect against overnight moves.

Information asymmetry risk

Professional participants often have better tools, faster data, and deeper context.

Retail traders must accept that they are reacting, not leading.

Event-Driven Trading vs Event-Driven Investing

Event-driven trading and event-driven investing are related but different.

- Trading focuses on short term price reaction.

- Investing focuses on longer term value changes after events.

Event-driven investing may involve holding positions through volatility, while trading focuses on managing immediate risk.

Understanding this distinction prevents mismatched expectations.

When Event-Driven Trading Works Best?

Event-driven trading works best when:

-

The event is clearly defined

-

Market expectations are known

-

Liquidity is sufficient

-

Risk is controlled tightly

It struggles when:

-

Outcomes are ambiguous

-

Multiple events overlap

-

Markets are already unstable

Selectivity matters more than frequency.

Conclusion

Event-driven trading is built around moments when markets receive new information. By focusing on how expectations shift and how price reacts, traders aim to capture volatility created by events rather than routine market noise.

Understanding how an event-driven trading strategy works, and respecting its risks, helps traders approach these setups with discipline instead of emotion.

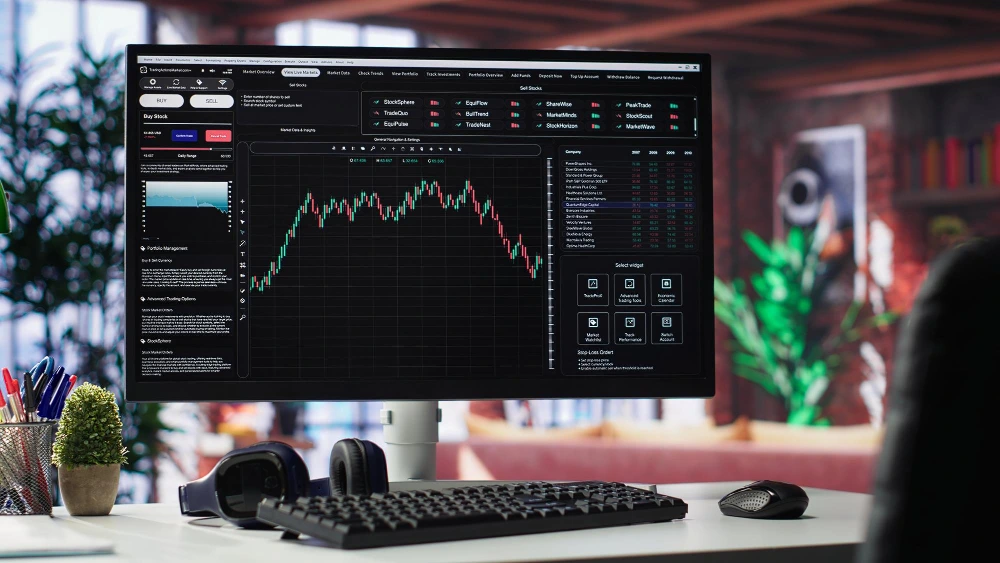

If you want to observe how events impact US stocks in real market conditions, you can use the Gotrade app. Charting and execution tools make it easier to study event-driven price behavior while managing position size responsibly.

FAQ

What is event-driven trading?

It is trading strategies focused on price movements caused by specific events.

Is event-driven trading risky?

Yes. Volatility, gaps, and slippage are common.

Do all events move markets?

No. Only events that change expectations significantly tend to matter.

Can beginners use event-driven trading?

It can be challenging and requires strong risk management.

Reference:

-

Investopedia, Event-Driven Trading, 2026.

-

The Hedge Fund, Event-Driven Strategies, 2026.