The VanEck Gold Miners ETF (GDX ETF) is one of the most widely used instruments for gaining exposure to gold mining companies rather than gold itself. While it is often grouped together with Gold ETFs, GDX behaves very differently from physically backed gold products such as GLD.

Understanding GDX requires a shift in mindset. GDX is not designed to track gold prices directly. Instead, it reflects the performance of companies whose revenues and profits are linked to gold production. This distinction shapes its risk profile, volatility, and role within a portfolio.

What GDX Is and What It Represents

GDX is an equity ETF that holds shares of large and mid-sized gold mining companies listed globally. These companies are involved in the exploration, mining, and production of gold.

Unlike GLD or other physically backed Gold ETFs, GDX does not hold gold bullion. Investors in GDX are effectively investing in gold-related businesses, not the metal itself.

Because GDX represents operating companies, its performance depends on a combination of factors:

-

Gold prices

-

Production volumes and costs

-

Management execution

-

Broader equity market conditions

This makes GDX a business exposure with commodity sensitivity, rather than a pure commodity exposure.

If you want to see how gold mining stocks respond differently from gold prices, comparing GDX with spot gold across market cycles can help clarify the distinction. Access GDX via Gotrade, now!

How GDX Works as a Gold Mining ETF

GDX tracks an index composed of major global gold mining companies. The ETF is market-cap weighted, meaning larger companies have a greater influence on performance.

Because GDX holds stocks, it trades like any other equity ETF during market hours. Its price reflects investor expectations about future profitability, costs, and growth prospects of gold miners, not just current gold prices.

Gold mining companies often experience operating leverage. When gold prices rise, revenues can increase faster than costs, boosting margins. When gold prices fall, fixed costs can pressure profitability, amplifying downside.

This operating leverage is central to how GDX behaves.

GDX’s Prospects as a Gold-Linked Investment

GDX tends to perform best during periods when gold prices are rising and investor confidence in the mining sector is improving.

Rising gold prices can expand profit margins, especially if production costs remain stable. In these environments, GDX may outperform gold itself due to earnings leverage.

However, GDX’s prospects are not solely tied to gold prices. Cost inflation, energy prices, labor expenses, and regulatory pressures can all affect miners’ profitability.

In addition, because GDX is an equity ETF, broader stock market sentiment plays a role. During equity market stress, GDX can decline even if gold prices are stable or rising.

Risks of Investing in GDX

Equity market risk

GDX is fully exposed to equity market volatility. During market-wide selloffs, gold mining stocks often fall alongside other equities.

This risk does not exist in physically backed Gold ETFs.

Operational and cost risks

Gold mining is capital-intensive. Rising energy costs, labor shortages, and environmental regulations can compress margins.

Company-level issues can negatively impact GDX even in favorable gold price environments.

Gold price dependency

While GDX does not track gold directly, gold prices remain a key driver. Falling gold prices can quickly erode profitability across the sector.

This creates downside risk during unfavorable commodity cycles.

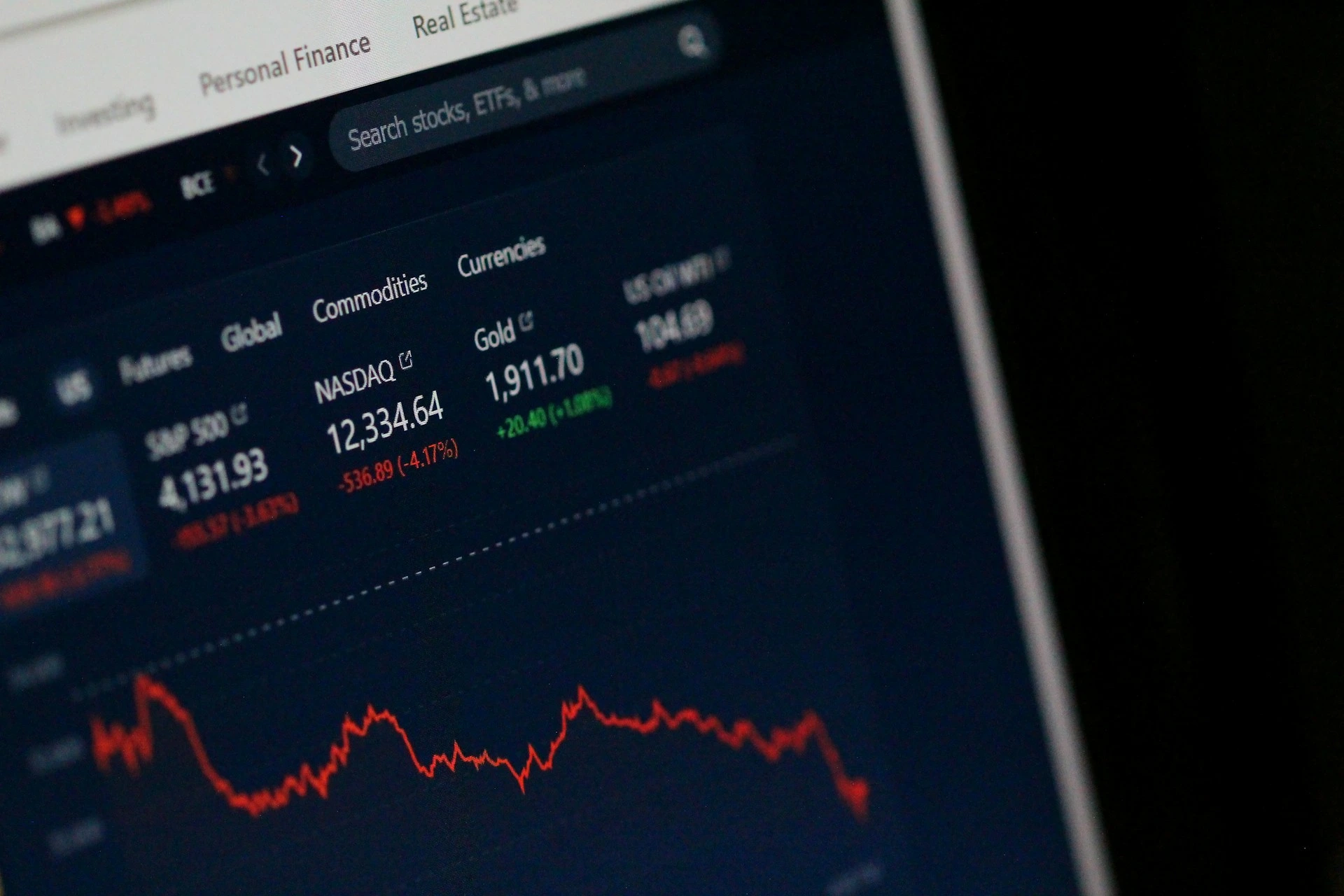

Higher volatility than Gold ETFs

GDX is typically more volatile than GLD. Price swings can be larger and more abrupt.

This volatility increases both opportunity and drawdown risk.

How GDX Fits Into Portfolio Strategy

GDX is commonly used as a satellite position rather than a core holding. Its higher volatility and equity exposure make careful position sizing essential.

For many investors, GDX works best when:

-

Used tactically during favorable gold cycles

-

Combined with more stable gold exposure such as GLD

-

Sized smaller than broad equity holdings

GDX is not a substitute for physical gold exposure. It serves a different function, focused on potential upside rather than stability.

Conclusion

GDX is a gold mining ETF that provides equity-based exposure to gold-related businesses rather than physical gold. Its performance reflects a combination of gold prices, operational efficiency, and equity market conditions.

Understanding how GDX works, its prospects, and its risks helps investors use it intentionally rather than assuming it behaves like a traditional Gold ETF. When aligned with the right risk tolerance and portfolio role, GDX can complement gold exposure, but it requires disciplined sizing and realistic expectations.

If you want to explore GDX alongside other Gold ETFs and understand how mining stocks behave across different gold price environments, the Gotrade app allows you to compare gold-related exposures and build positions thoughtfully.

FAQ

What is GDX ETF?

GDX is an equity ETF that holds shares of global gold mining companies.

Does GDX track gold prices directly?

No. GDX tracks mining stocks, not physical gold.

Is GDX riskier than Gold ETFs like GLD?

Yes. GDX carries equity and operational risks in addition to gold price sensitivity.

Does GDX pay dividends?

Some mining companies pay dividends, but payouts vary and are not guaranteed.

References

- VanEck, GDX Fund Overview, 2026.

- ETF.com, Gold Miners ETFs Explained, 2026.