Markets gained as trade policy returned to the spotlight.

U.S. stocks moved higher on Wednesday as investors followed the Supreme Court’s review of former President Trump’s tariff policy.

While it may sound like a policy headline, discussions around tariffs remain a key driver of investor sentiment because they affect how companies plan, price, and compete globally.

Tariffs influence markets in three main ways.

- First, they raise production costs for companies that depend on imported materials, especially in manufacturing and technology.

- Second, they affect inflation expectations, since higher input costs can lead to higher consumer prices.

- Third, they shape global growth forecasts, as trade barriers often slow cross-border investment and supply-chain recovery.

That is why even a policy review can sway the market. On Wednesday, industrial names such as Caterpillar (+4%), Ford, and GM (+2%) climbed on hopes of trade relief, while AMD (+2.5%) and other chipmakers rebounded as optimism spread to the tech sector.

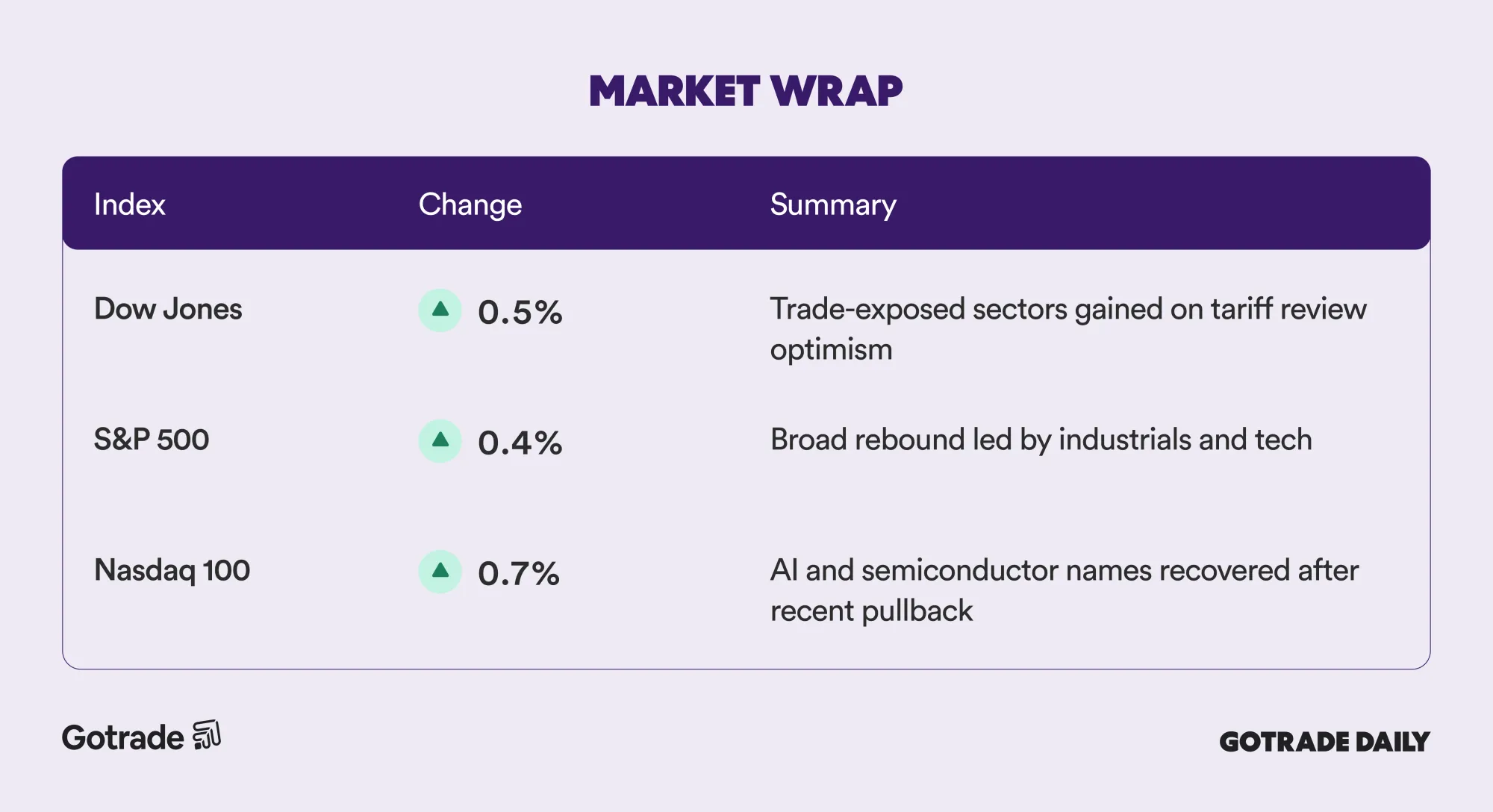

Market Wrap November 6th 2025

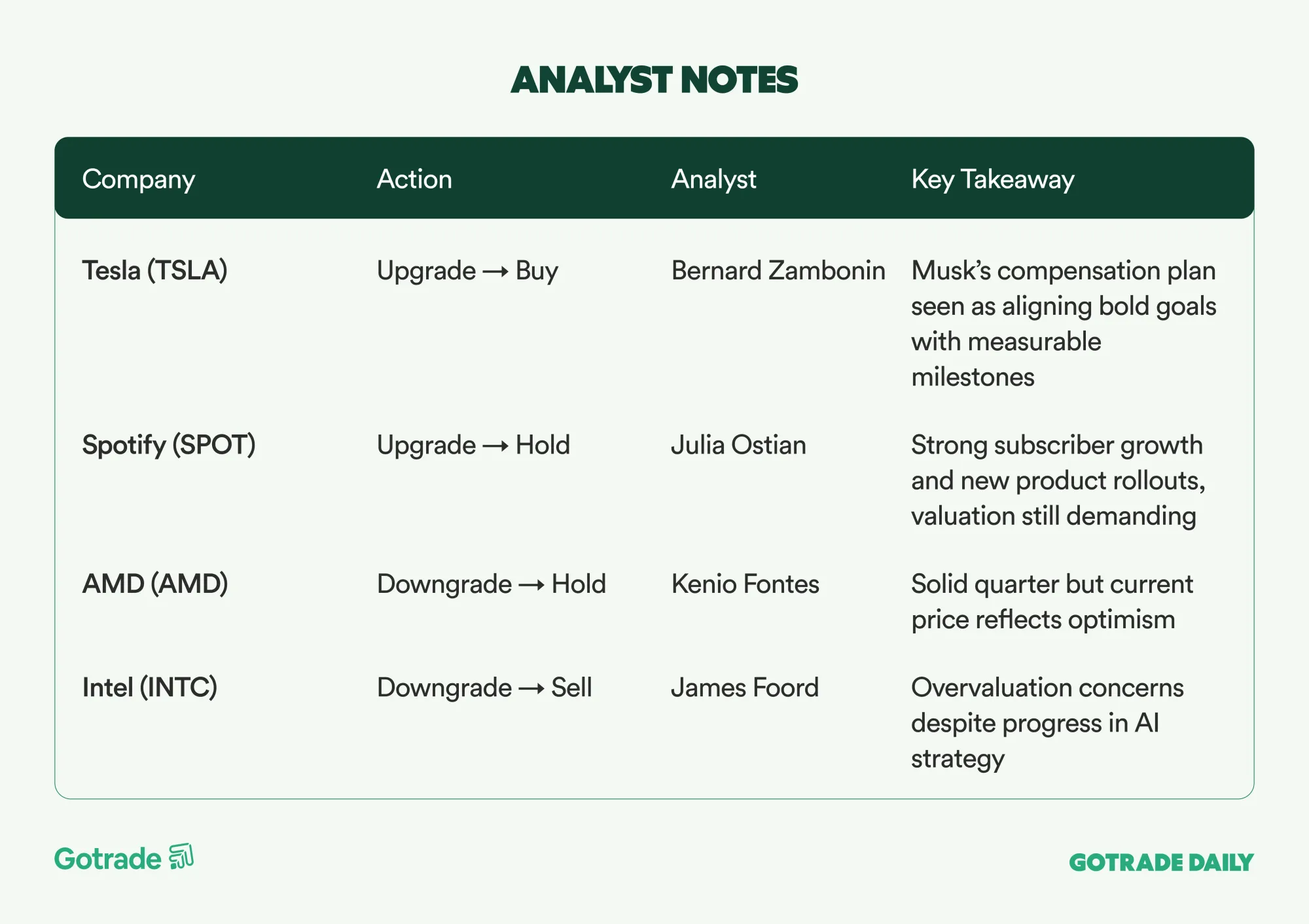

Analyst Notes

Market Highlights

Robinhood Beats on Earnings but Raises Expense Outlook

Robinhood (HOOD) reported Q3 EPS of $0.61 versus $0.54 expected and revenue of $1.27 billion, beating forecasts.

Shares slipped 1.8% after hours as the company raised its 2025 expense forecast to $2.28 billion to support new product development and expansion.

Crypto revenue surged 300% year over year, with management citing record business performance supported by strong user growth and product momentum.

McKesson (MCK) Raises 2026 Guidance After Strong Quarter

McKesson lifted its earnings outlook to $38.35–$38.85 per share after posting $103 billion in quarterly revenue.

Growth in its oncology and prescription-tech divisions continues to drive consistent returns. Analysts noted that McKesson’s shift toward automation and specialty healthcare is positioning it well for long-term stability.

Williams (WMB) Pipeline Could Save New England $11 Billion

Williams (WMB) rose 1.8% after a new analysis by S&P Global Commodity Insights found that reviving the Constitution Pipeline could save New England up to $11.6 billion in energy costs and support 2,000 jobs annually over 15 years.

The 125-mile project, canceled in 2020, is being reconsidered as energy companies and policymakers look for ways to stabilize supply and reduce price spikes in peak-demand seasons.

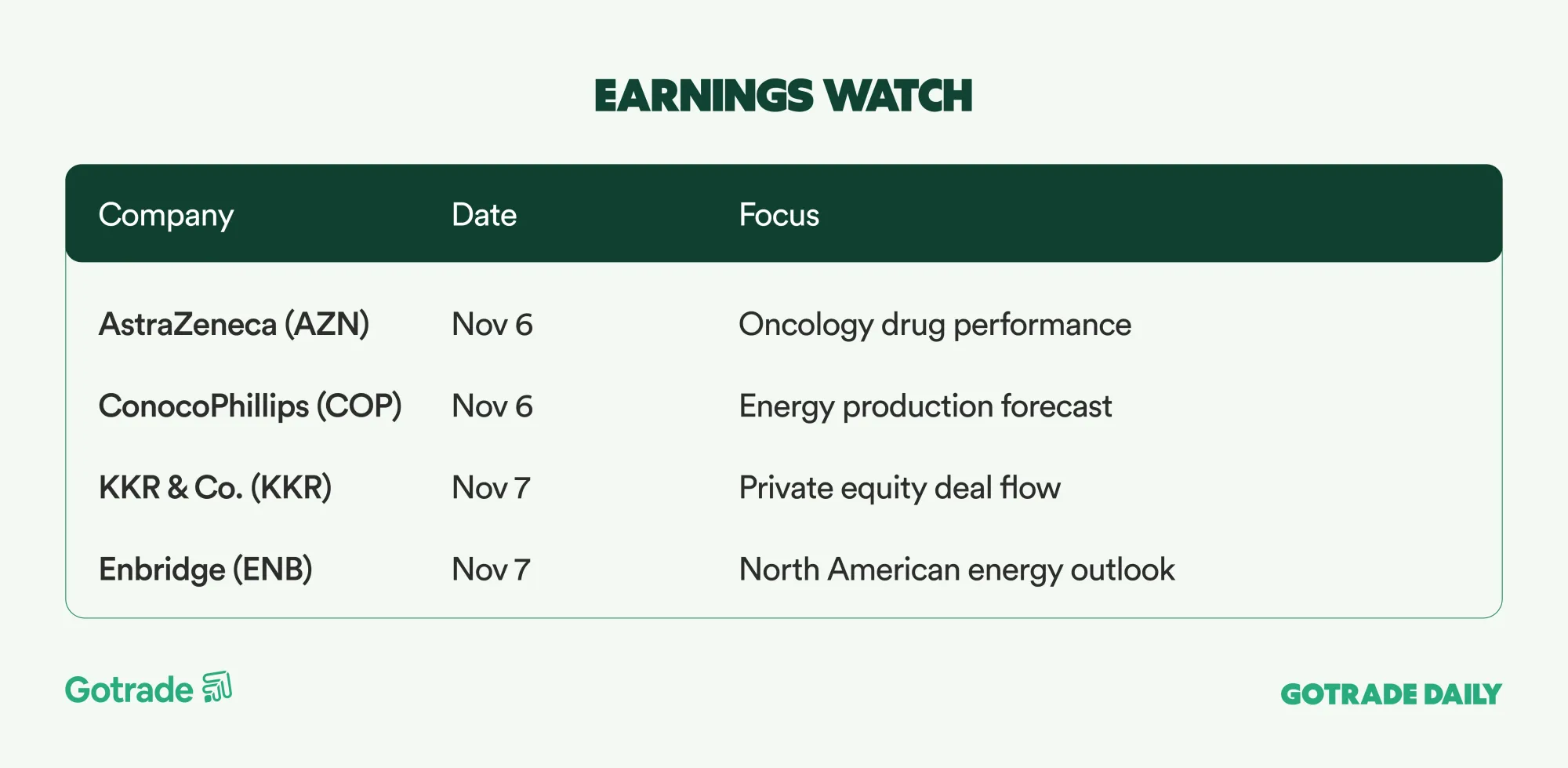

Earnings Watch

Markets showed how quickly sentiment can shift when optimism returns.

With earnings and policy updates ahead, traders have plenty to watch and even more to learn from every move.

Ready to see where the next momentum builds?

👉 See what traders are following today!

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.