From tariffs to rare earth exports, here’s what’s inside the new trade deal that calmed the markets.

After months of negotiations, President Donald Trump and President Xi Jinping finally reached a new trade agreement in South Korea last week.

The deal goes beyond tariffs. It’s a broader effort to stabilize global supply chains and ease economic tensions between the world’s two largest economies.

Under the agreement, China will stop the flow of fentanyl precursors into the US, lift export restrictions on key minerals such as rare earths, gallium, and graphite, and end retaliatory actions against American semiconductor companies.

In return, Washington will cut import tariffs on Chinese goods by 10 percentage points starting November 10, extend Section 301 tariff exemptions, and suspend several export control measures for one year.

China also pledged to resume imports of soybeans and US farm products, committing to buy up to 12 million tons this year and 25 million tons annually starting in 2026.

The agreement is viewed as a constructive step that helps rebuild confidence in trade relations and gives markets a brief window of calm after months of tension.

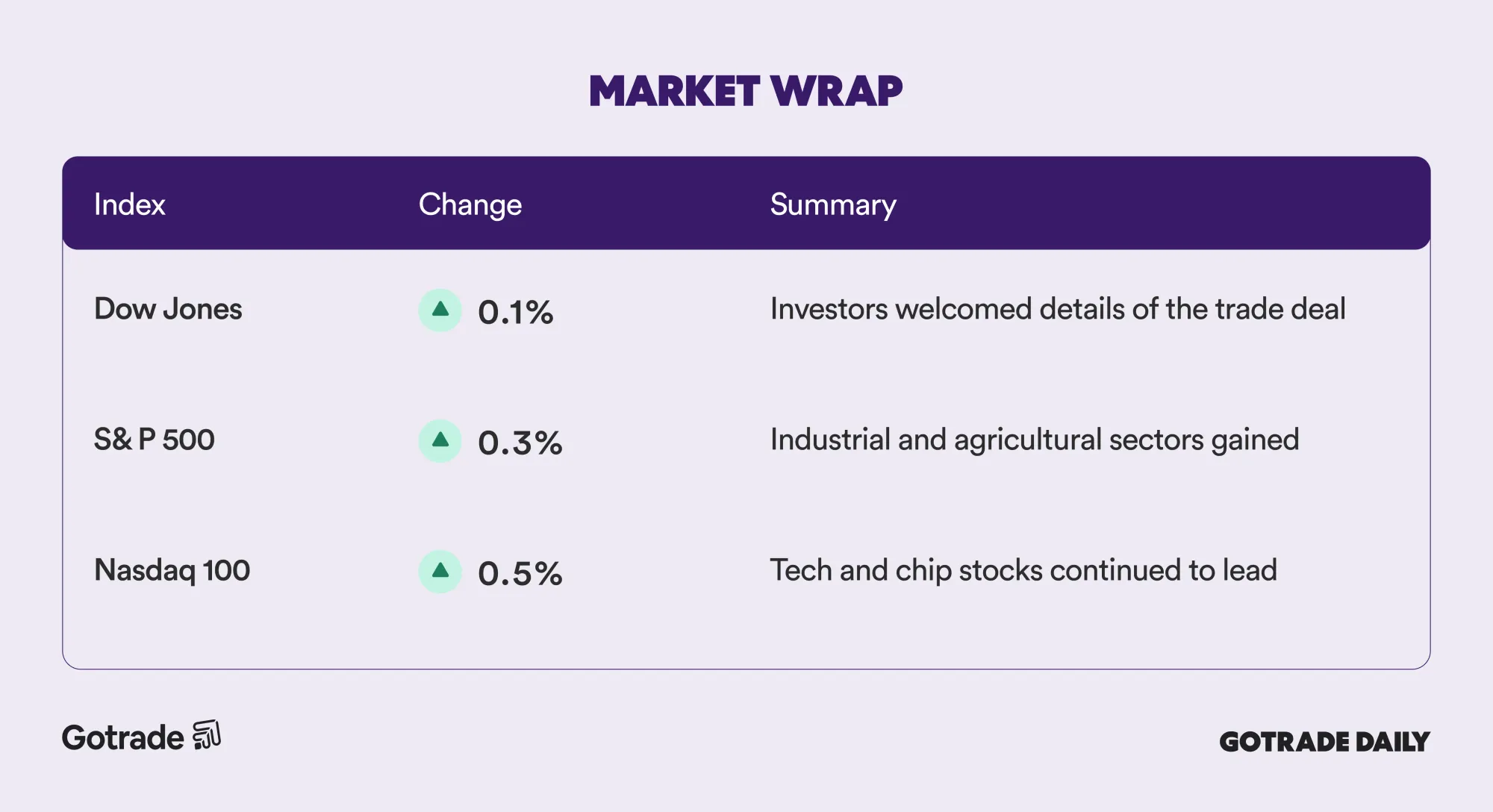

Market Wrap November 3th 2025

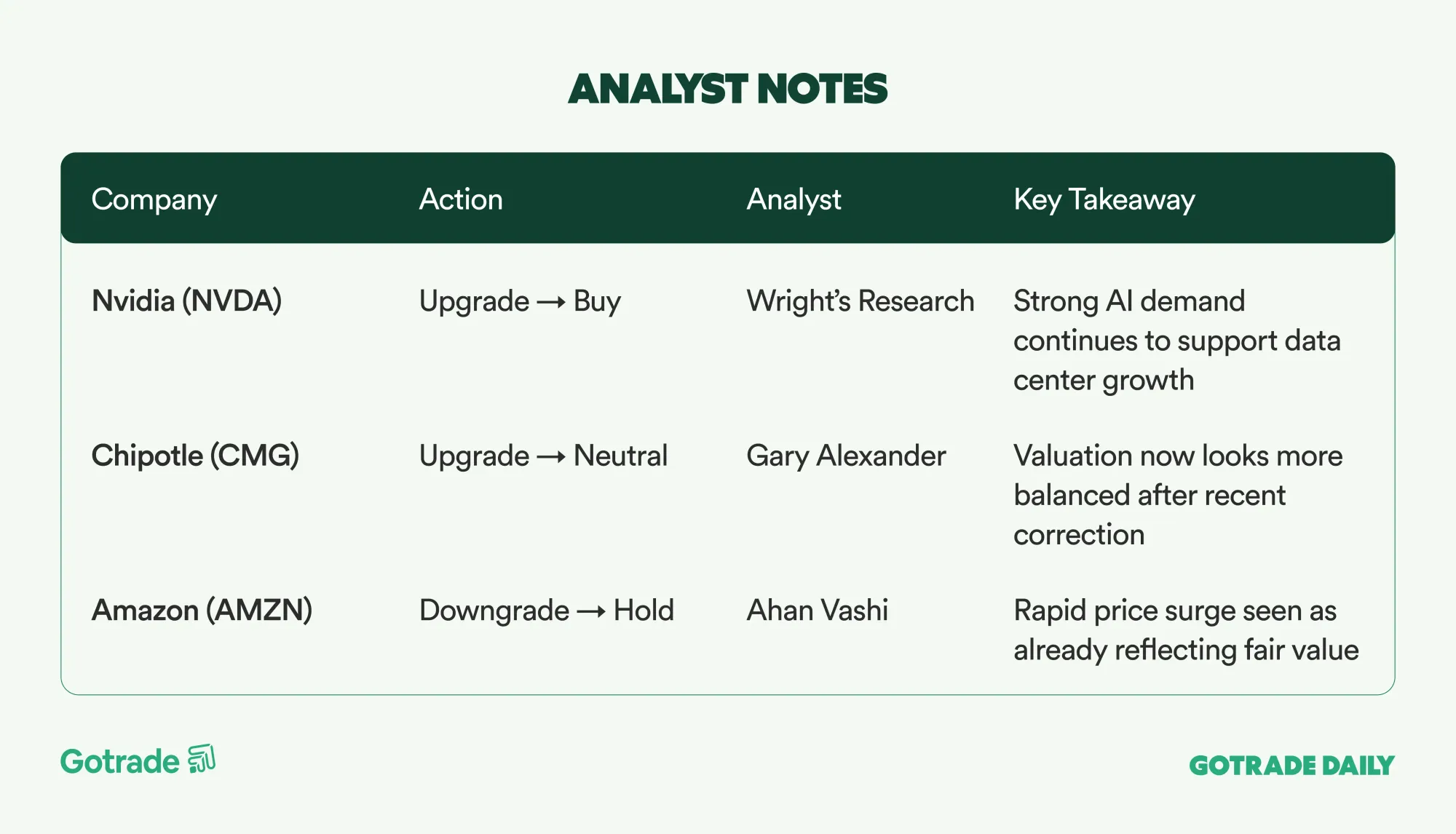

Analyst Notes

Market Highlights

Palantir Challenges the US Education System with “Meritocracy Fellowship”

Palantir Technologies (PLTR) rose 3.0% after launching its Meritocracy Fellowship, a program offering high school graduates full-time work experience without a college degree.

The initiative selected 22 participants from over 500 applicants for a four-month intensive program combining political philosophy, communication training, and hands-on engineering experience in defense, healthcare, and insurance.

CEO Alex Karp said the program aims to find “independent thinkers who can solve problems,” arguing that many universities “no longer teach real critical thinking.”

ExxonMobil Hits Production Record, Targets $3 Billion Profit Boost in 2025

ExxonMobil (XOM) gained 0.5% after reporting record oil production in Guyana and the Permian Basin.

CEO Darren Woods said ten new projects launched this year could add over $3 billion in profit by 2025, with the Yellowtail project in Guyana starting operations four months ahead of schedule.

Despite its expansion, Exxon plans to keep 2025 capital spending below its $27–29 billion guidance range while advancing low-carbon projects.

Tesla Faces New US Regulatory Pressure Over Locked Door Cases

Tesla (TSLA) climbed 3.7% even as the NHTSA expanded its investigation into Model Y doors that failed to open after power loss.

Tesla has until December 10 to respond. The case adds legal pressure amid competition and ongoing debate over the safety of its fully electric door systems.

Earnings Watch

Diplomatic and policy updates gave markets a brief pause, while stories from Palantir, ExxonMobil, and Tesla show how innovation and regulation continue to shape global momentum.

The market never stands still, and every headline tells a new story worth watching

👉 See what traders are following today!

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.