Amazon and OpenAI team up to power the next wave of AI.

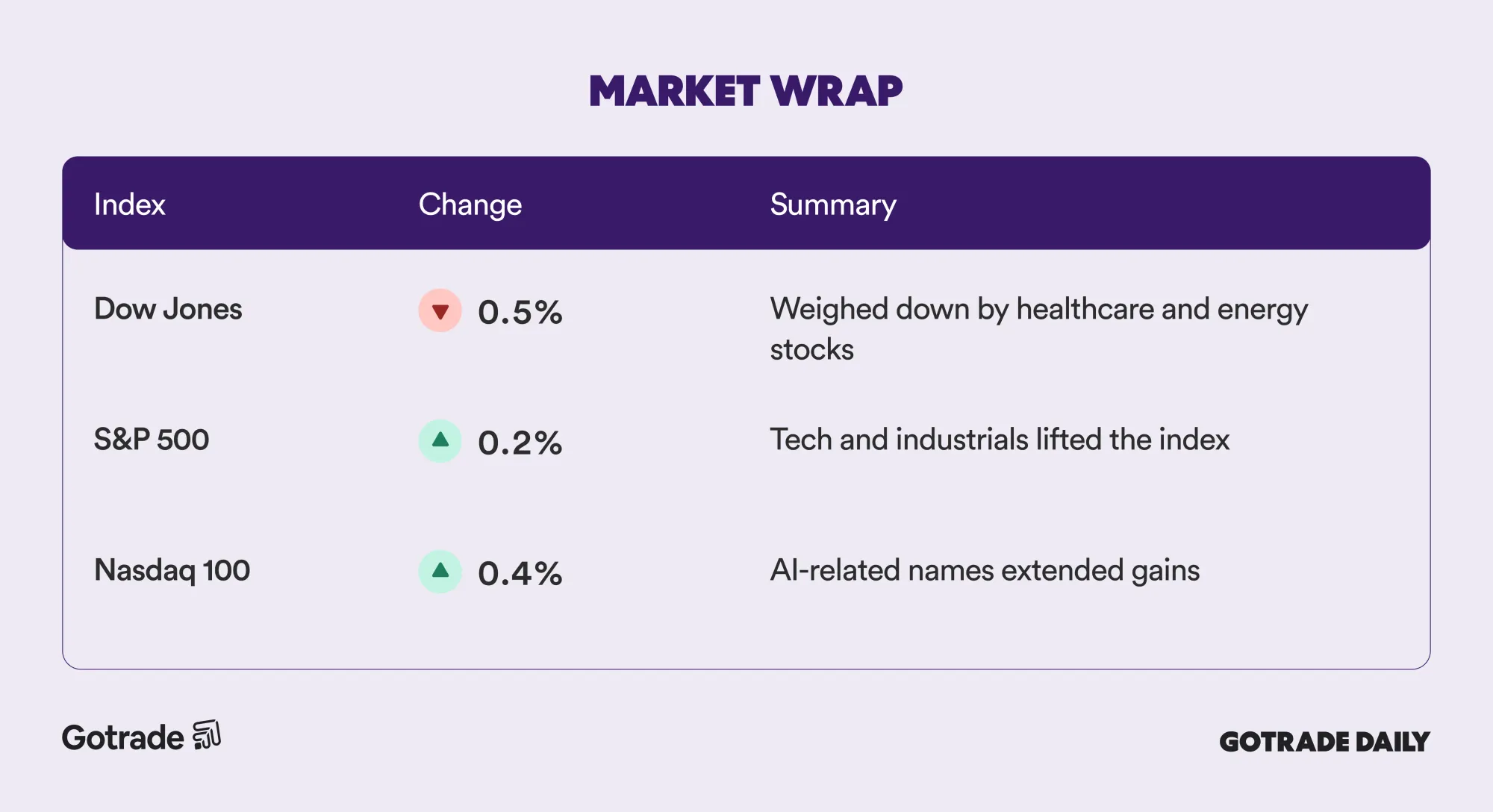

Tech giants pushed the S&P 500 and Nasdaq higher while the Dow slipped, showing how fast-growing tech companies continue to outpace slower sectors such as healthcare.

Amid that momentum, Amazon Web Services (AWS) and OpenAI announced a $38 billion partnership to expand global AI computing capacity. The deal gives OpenAI access to AWS data centers powered by Nvidia GPUs, helping it train and scale future AI models more efficiently.

For Amazon, this move strengthens its position in the global AI-infrastructure race alongside Microsoft and Google. It also shows how control over computing power is becoming just as important as breakthroughs in software.

What does this mean?

AI is entering a new phase, one defined less by apps and more by the hardware that makes them possible. Companies that build the infrastructure behind AI are increasingly shaping how the entire market grows.

This deal could deepen the divide between Big Tech and the rest of the market, as investors shift focus to the players powering the world’s largest AI systems.

Market Wrap November 4th 2025

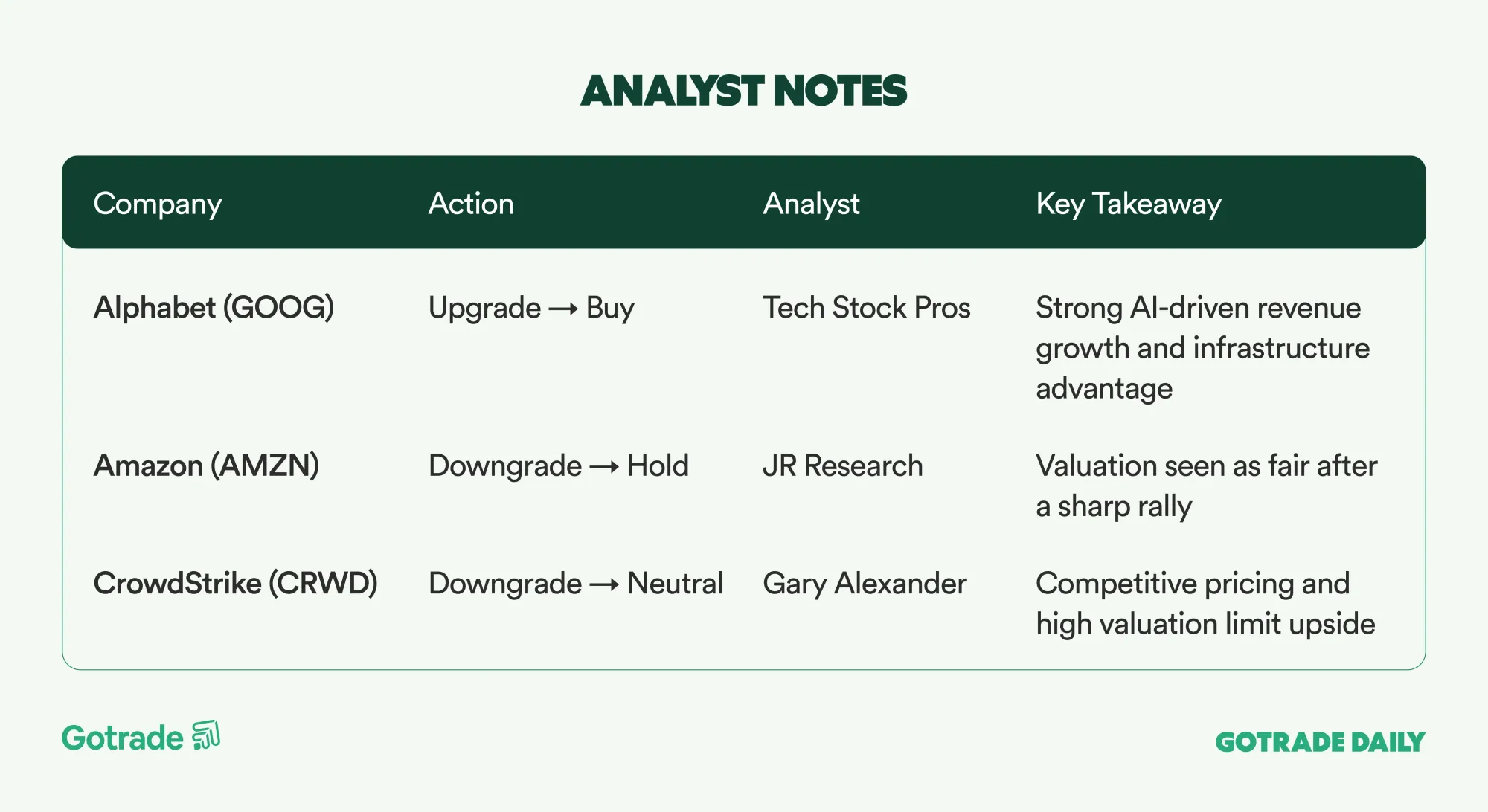

Analyst Notes

Market Highlights

Realty Income Raises 2025 Investment Guidance to $5.5 Billion, Expands in Europe

Realty Income (O) rose 0.4 % after lifting its 2025 investment guidance from $5 billion to $5.5 billion, supported by faster acquisition activity in Europe that now accounts for 72 % of total Q3 investments.

CEO Sumit Roy highlighted the launch of a perpetual life fund to boost liquidity and support global expansion. The company reaffirmed its use of AI-based predictive analytics to enhance acquisition and asset management efficiency.

In Q3, Realty Income invested $1.4 billion with an average yield of 7.7 %, maintaining a 98.7 % occupancy rate and a rent recapture rate of 103.5 %. Guidance for AFFO per share was also raised to $4.25–$4.27, signaling confidence in stable earnings amid tight competition.

OpenAI Partners with Amazon to Secure $38 Billion in Nvidia GPU Capacity

Amazon (AMZN) climbed 4 % after OpenAI signed a landmark deal worth $38 billion to run AI workloads on AWS infrastructure equipped with Nvidia (NVDA) GPUs.

Under the agreement, OpenAI will gain dedicated access to AWS computing power, with expansion plans already underway to meet surging AI demand. AWS stated that the capacity is separate from its general pool and partially ready for immediate use.

The deal deepens Amazon’s exposure to global AI-infrastructure spending and positions AWS as a key backbone for generative AI outside Microsoft’s long-standing partnership with OpenAI. Meanwhile, Microsoft (MSFT) remains a major investor in OpenAI, signaling fresh competitive dynamics in the cloud AI landscape.

Verizon Builds New Fiber Network to Connect Amazon Data Centers

Verizon Communications (VZ) slipped 0.7 % despite announcing a strategic partnership with Amazon Web Services (AMZN) to construct a high-capacity fiber network linking AWS data centers across the United States.

Through its Verizon Business unit, the company will deliver low-latency infrastructure optimized for generative AI workloads under a new solution called Verizon AI Connect.

Amazon said the collaboration marks a key step in expanding industry-scale AI capabilities by combining AWS cloud systems with Verizon’s network performance. Though the contract value wasn’t disclosed, the move underscores Verizon’s shift from telecom operator to strategic digital-infrastructure provider.

Earnings Calendar

The new deal between Amazon and OpenAI shows that the future of AI isn’t just about the apps we use, but the infrastructure behind them.

This move could help Big Tech regain momentum and drive market sentiment in the days ahead.

Do you already know which stocks are catching traders’ eyes today?

👉 See what traders are following today

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.