Key takeaways from this week’s changes in data, sentiment, and stocks.

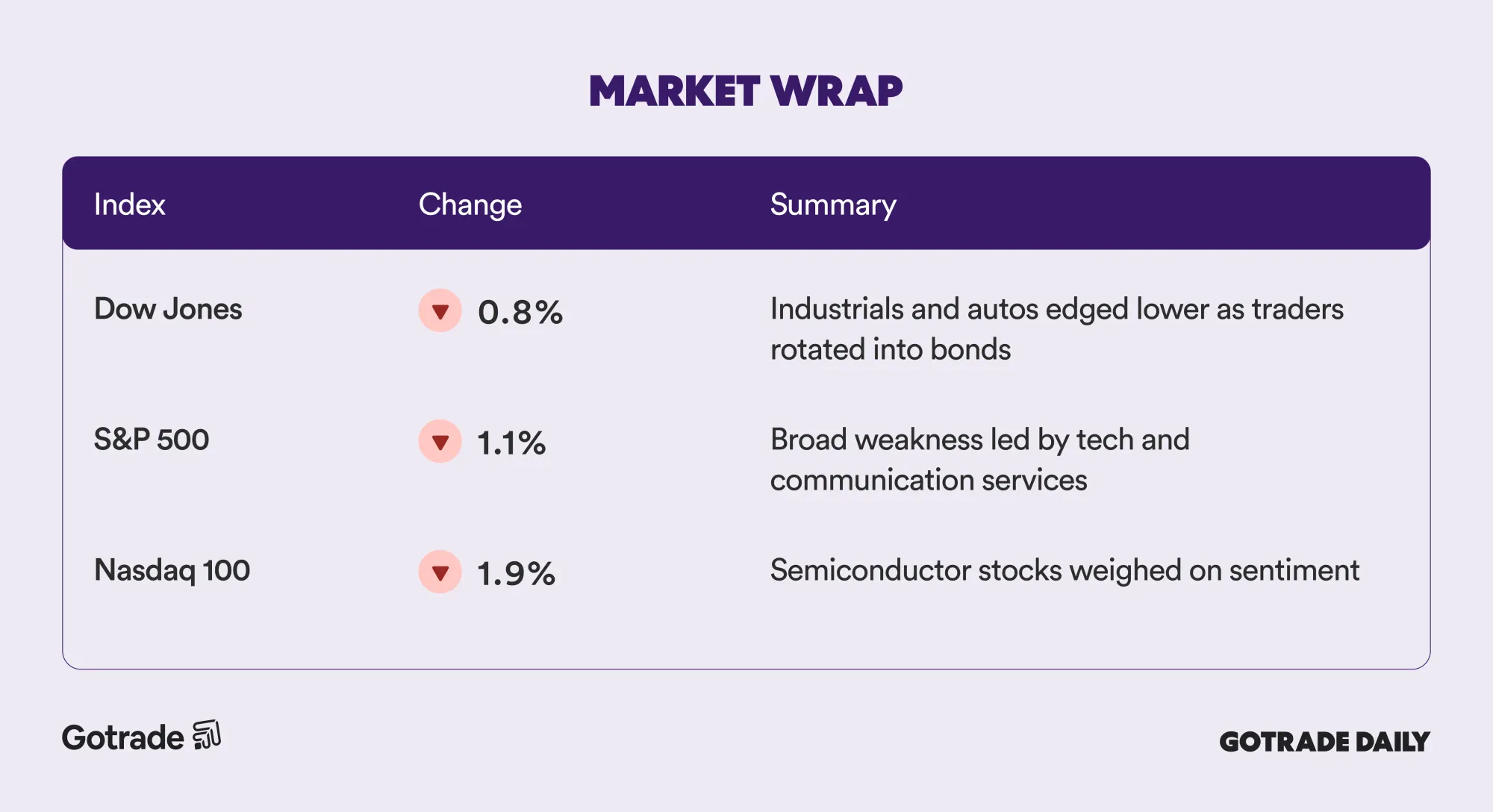

U.S. stocks moved lower on Thursday as investors weighed softer labor data and weakness across major tech names. The Nasdaq fell 1.9%, the S&P 500 dropped 1.1%, and the Dow Jones lost 0.8%.

A report showing the highest October job cuts since 2003 briefly pushed bond yields lower as traders looked for stability.

With mixed signals coming from earnings, jobs data, and policy updates, many traders are focusing on the bigger picture instead of reacting to daily price swings.

They are paying closer attention to whether gains are supported by earnings strength, how steady trading volumes remain, and if volatility is beginning to pick up. These patterns can help reveal where confidence is holding and where momentum might be slowing.

Adjusting for Portfolio Resilience

Periods like this often prompt investors to review how their portfolios are positioned. Michael Sansoterra, Chief Investment Officer at Silvant Capital Management, told MarketWatch that it is a good time to reassess exposure to high-growth sectors and ensure it still aligns with personal risk tolerance.

For some, that may mean taking profits from positions that have performed well or balancing them with industries that tend to show steadier growth such as energy, infrastructure, or aerospace.

Sansoterra added that uncertain moments often remind investors to focus on companies with strong fundamentals, consistent cash flow, and sustainable performance instead of chasing short-term trends.

According to Charley Blaine of TheStreet, understanding market shifts is less about predicting what comes next and more about recognizing patterns that support smarter and steadier decisions.

Market Wrap November 7th 2025

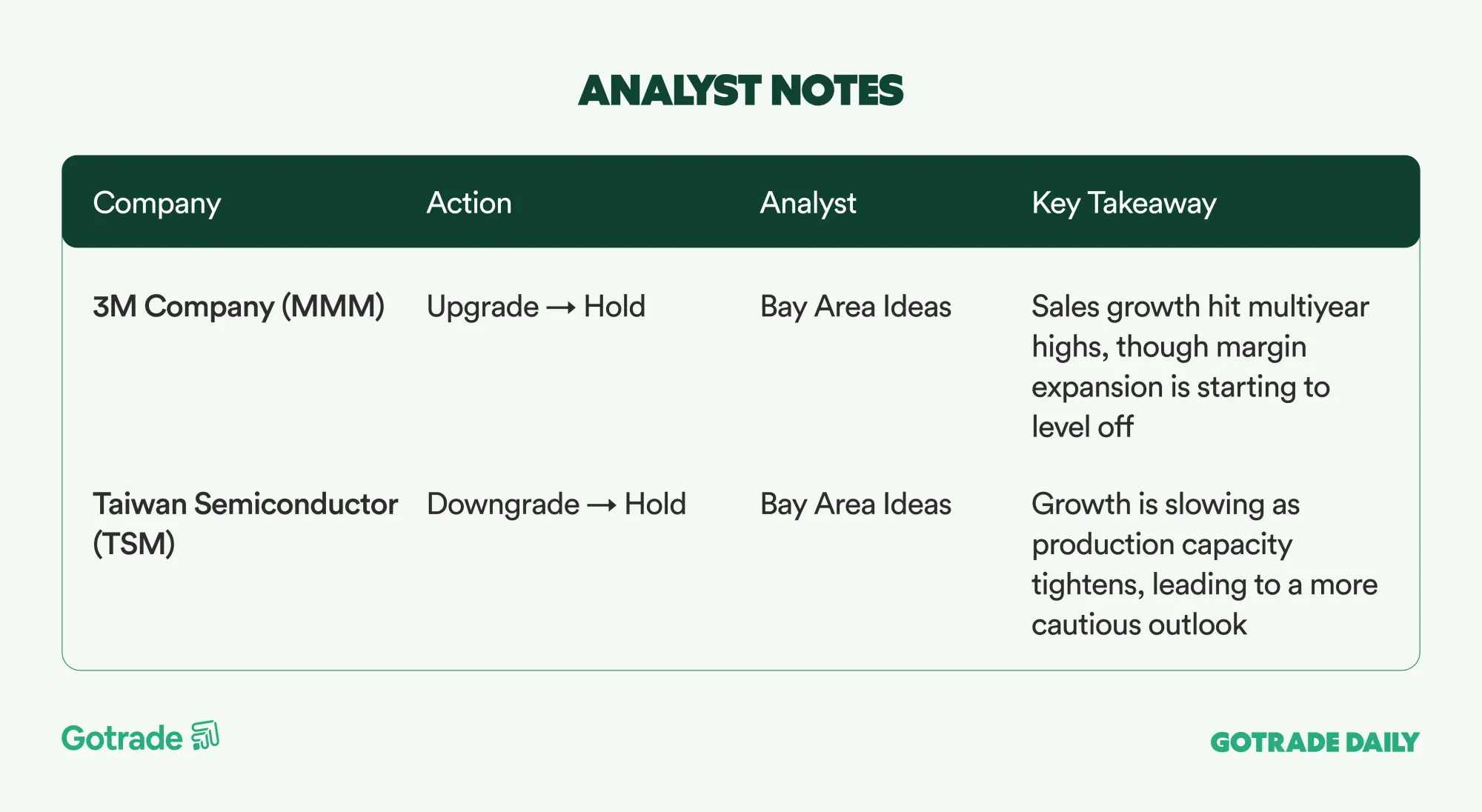

Analyst Notes

Market Highlights

Celsius Slumps Despite 173% Revenue Surge

Celsius Holdings (CELH) fell 24.8% even after posting third-quarter revenue of US$725 million, up 173% YoY, with gross margin rising to 51.3% from 46%.

CEO John Fieldly called 2025 a “transformational year,” marked by the Rockstar Energy acquisition, an expanded PepsiCo partnership, and the launch of the Alani Nu integration strategy.

CFO Jarrod Langhans cautioned that Q4 could be a “noisy quarter” due to logistics, promotions, and import-tariff costs, though management expects full synergy from the Pepsi and Rockstar integrations starting Q1 2026.

The company also cut US$200 million in debt after the quarter to strengthen its balance sheet amid continued expansion.

UnitedHealth Falls for Seventh Straight Day as Cost Pressures Mount

UnitedHealth Group (UNH) slipped 1.9% to US$321.66, marking seven consecutive days of decline and a 34.7% YTDdrop, a sharp contrast to the S&P 500’s 15.5% gain.

Despite beating Q3 earnings expectations and raising full-year profit guidance, shares remain under pressure from rising health-care costs and shrinking margins.

Analysts note that UnitedHealth’s strategy to absorb higher costs without increasing premiums supports customer growth but limits short-term profitability.

The stock maintains a “Hold” Quant Score of 3.2/5, with A+ for profitability but F for growth, and some see the weakness as a long-term accumulation opportunity.

Opendoor Overhauls Strategy, Targets AI-Driven Profitability by 2026

Opendoor Technologies (OPEN) dropped 16% after-hours after Q3 results missed expectations and management unveiled a “re-founding strategy” to transform the company into a software and AI-focused business.

New CEO Kaz Nejatian said the company is moving away from external consultants to build in-house technology aimed at streamlining home-buying and selling.

Q3 revenue came in at US$915 million, down from US$1.57 billion in Q2, with EPS -US$0.12 and EBITDA -US$33 million. Despite wider losses, Opendoor expects to reach net-income break-even by end-2026 through cost efficiency and higher transaction volumes.

Management guided Q4 revenue down 35% QoQ to around US$595 million, slightly above consensus, signaling early progress in the strategic shift.

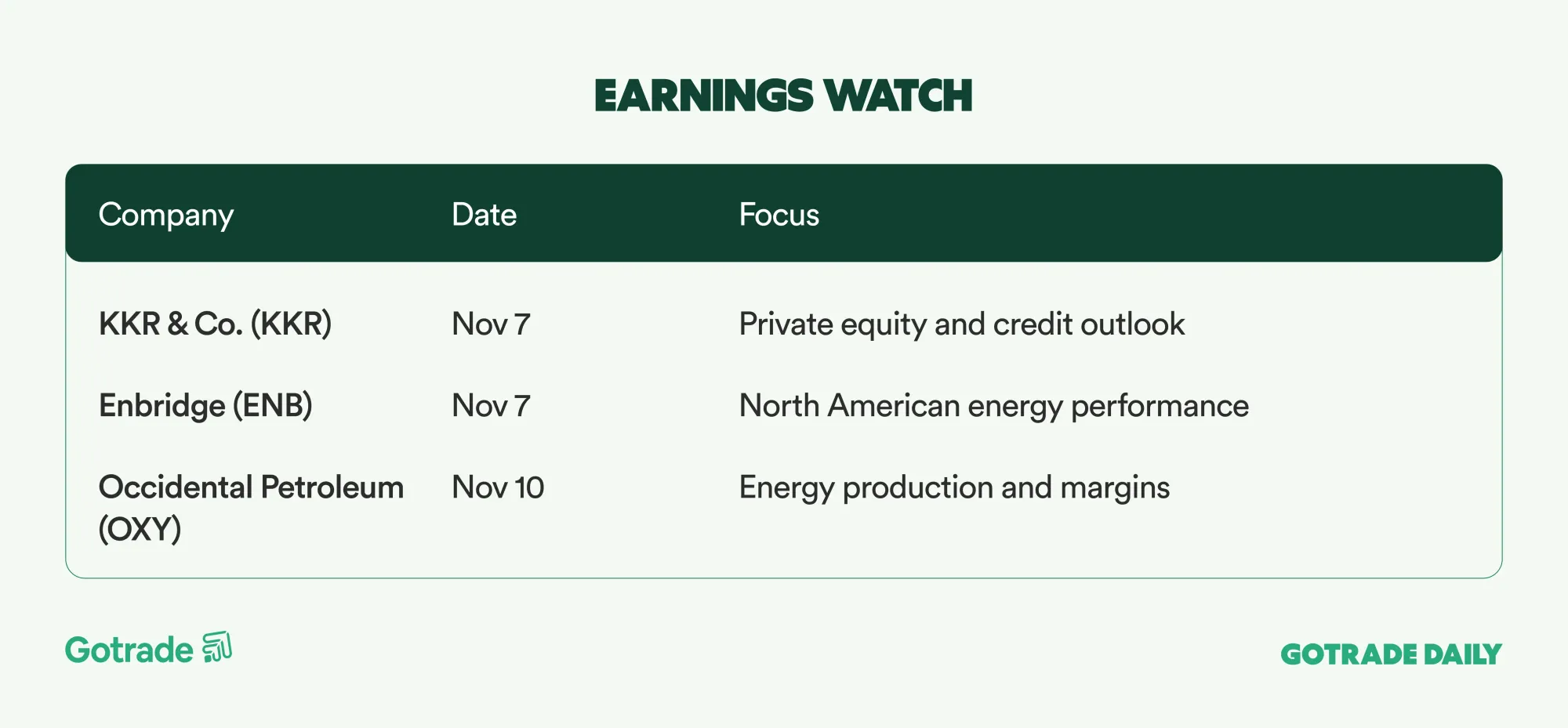

Earnings Watch

Markets often move in phases, and this week’s activity shows traders taking a step back to reassess.

Cooling tech sentiment, lower bond yields, and sector rotation suggest that capital is finding a new balance rather than exiting entirely.

By focusing on data, fundamentals, and broader market behavior, traders can stay grounded and prepare for what comes next.

👉 See what traders are following today.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.