Analysts share what’s fueling markets after months of AI-driven gains.

After months of steady gains powered by artificial intelligence optimism, U.S. markets are back in focus.

Executives from Morgan Stanley, Goldman Sachs, and JPMorgan recently shared their perspectives on what’s keeping the rally alive and how investors are positioning for what comes next.

While some say valuations are stretching beyond historical averages, others argue that today’s tech leaders stand on stronger ground, with solid balance sheets, consistent cash flow, and products driving real demand.

Some analysts have drawn comparisons to the dot-com boom of the late 1990s, but the tone this time is different. Rather than a speculative frenzy, the rise of AI represents a structural shift that is reshaping how investors think about growth, innovation, and sector leadership across the S&P 500.

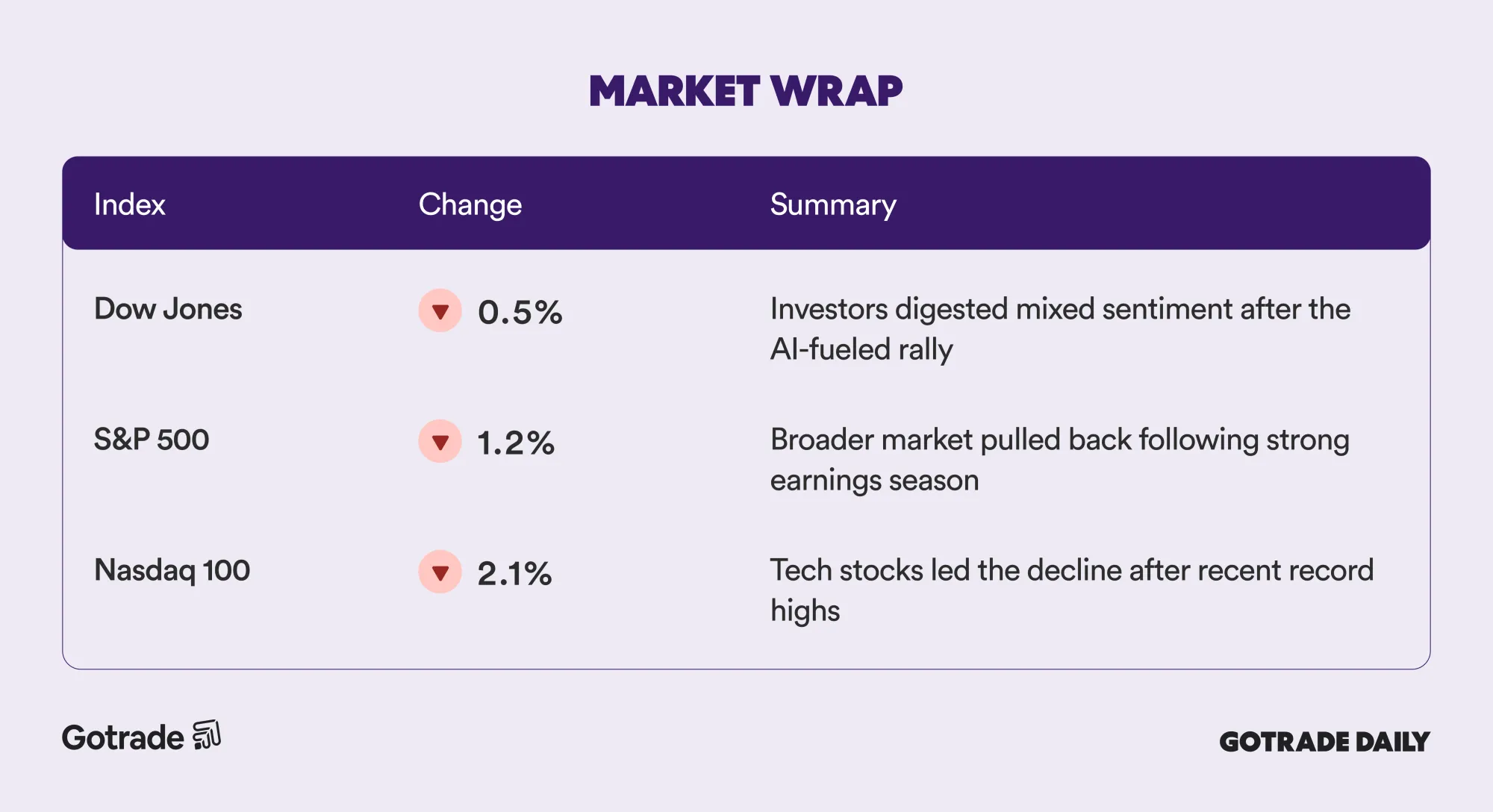

Market Wrap November 5th 2025

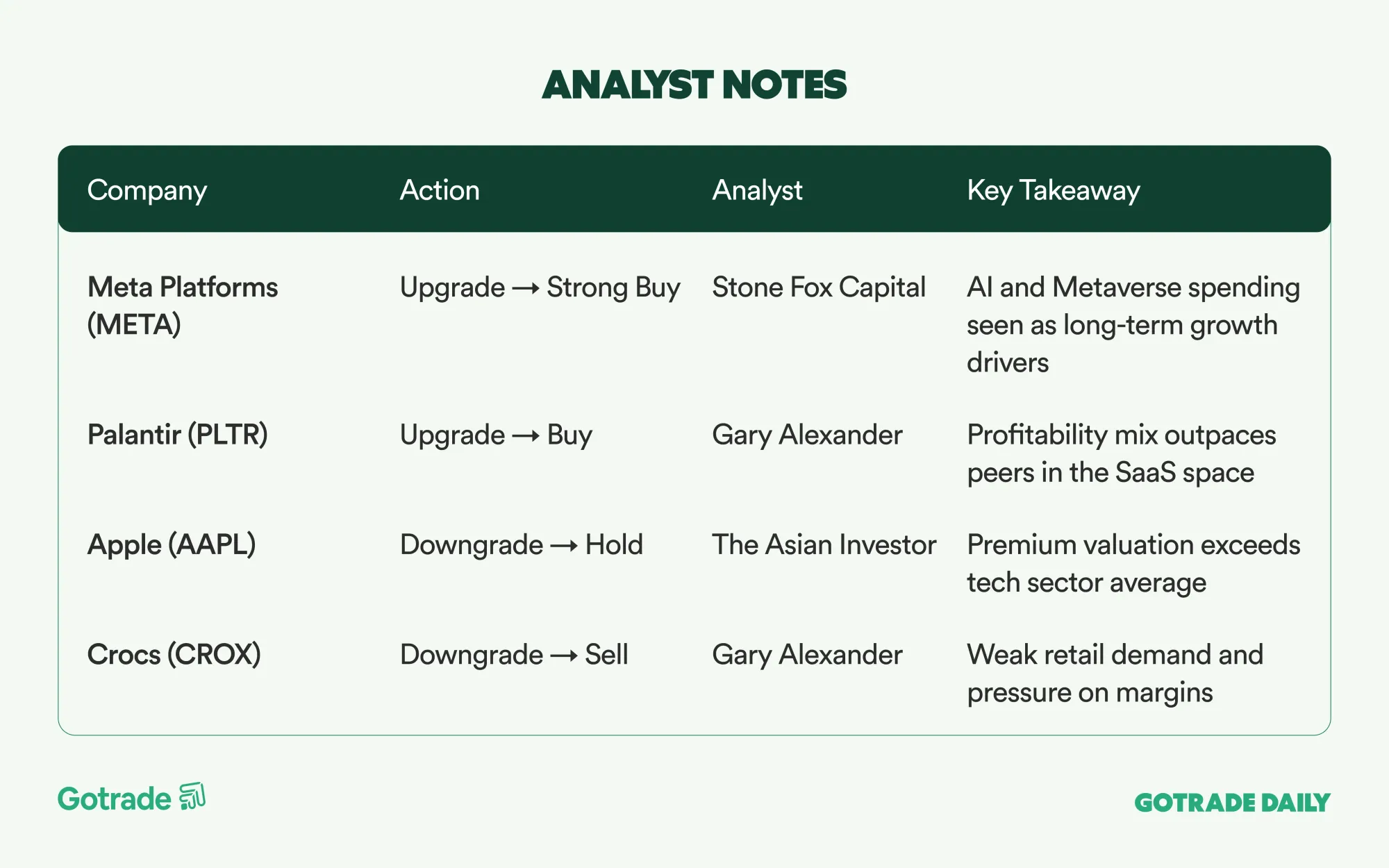

Analyst Notes

Market Highlights

Uber Reports Double-Digit Growth and Expands Autonomous Strategy

Uber Technologies (UBER) fell 5.1% despite reporting a 21% YoY jump in gross bookings, driven by strong rides and delivery volumes. CEO Dara Khosrowshahi called the quarter “one of the best ever,” with record EBITDA and free cash flow.

The company announced partnerships with Nvidia (NVDA) and Stellantis to integrate autonomous vehicles, starting with 5,000 units. Uber also launched Uber AI Solutions, designed to improve driver efficiency and earnings.

Management expects gross bookings to grow in the high teens and EBITDA to rise 30–35% YoY in Q4.

Arista Networks Drops Despite Record Revenue

Arista Networks (ANET) plunged 10% in after-hours trading despite reporting Q3 revenue of US$2.31 billion (+27% YoY) and EPS of US$0.75, both above estimates. The selloff followed softer-than-expected margin guidance for Q4.

CEO Jayshree Ullal reaffirmed focus on the “centers of data” strategy, emphasizing Arista’s role in cloud and AI infrastructure for major hyperscalers. Despite the dip, the company’s fundamentals remain strong after nearly 40% YTD gains.

Rivian Maintains 2025 Delivery Targets, Focuses on R2 SUV

Rivian Automotive (RIVN) dropped 5.2% after posting Q3 revenue of US$1.6 billion while keeping its 2025 delivery guidance at 41,500–43,500 units.

CEO Robert Scaringe reaffirmed confidence in the upcoming R2 SUV, calling it Rivian’s most important product yet.

CFO Claire McDonough confirmed adjusted EBITDA loss of US$602 million and reiterated expectations to achieve break-even gross profit by late 2025, supported by US$7.1 billion in cash reserves.

Earnings Watch

Momentum may be shifting, but opportunities for growth continue to emerge across key sectors.

Stories like Uber’s AI expansion, Arista’s cloud shift, and Rivian’s next-generation EVs highlight how innovation keeps shaping the market’s direction.

Curious which names are driving today’s moves?

👉 See what traders are following today!

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.